Qs Laptop

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2018

- Messages

- 3,532

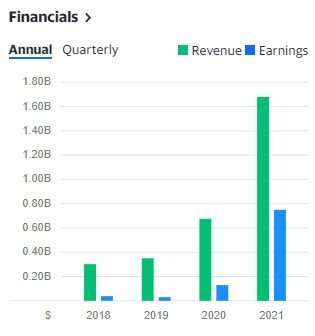

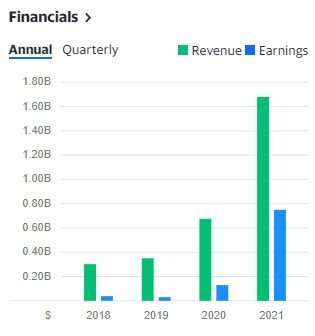

Take a look at the numbers for this "mystery" stock. This stock is on the NYSE.

It has a PE ratio of 1.73.

It's beta is 0.33.

Market cap is $2.82B

EPS of 21.56

Avg. volume is 1.25M

52 Week Range 32.20 - 77.18

Currently trading at 37.50

It does not pay a dividend.

It has zero debt.

This is a China-based company.

I can't think of a reason not to buy this stock. I already have a small position in one of my IRA's at $56.75. Would you buy this stock?

It has a PE ratio of 1.73.

It's beta is 0.33.

Market cap is $2.82B

EPS of 21.56

Avg. volume is 1.25M

52 Week Range 32.20 - 77.18

Currently trading at 37.50

It does not pay a dividend.

It has zero debt.

This is a China-based company.

I can't think of a reason not to buy this stock. I already have a small position in one of my IRA's at $56.75. Would you buy this stock?