I came across this article this am and found it interesting...

https://apple.news/AuryF6Y1KPwqvFHzGcDZl3Q

Key quote: "I want to start out by stating that I am confident that the strategy I’m about to share will outperform the market (S&P 500) over the long run on a total return basis. However, I do not necessarily believe that it will outperform the S&P 500 over the shorter run, although it is possible that it would."

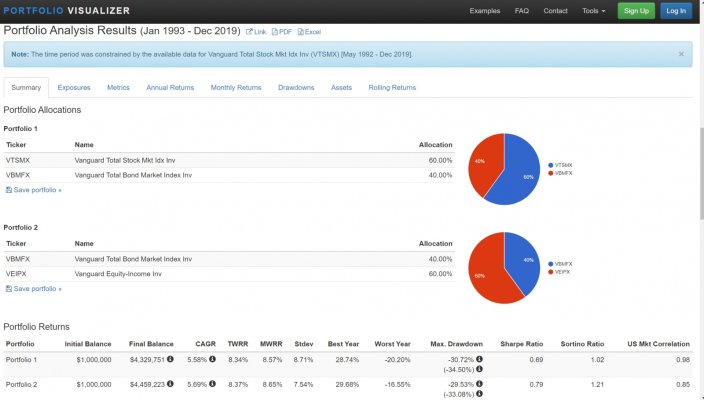

So while I am not drawing down on my assets yet and currently subscribe to the Total Return approach, I am still intrigued by the Income/Dividend approach. I understand the attraction to creating a "reliable" income stream that allows you to somewhat "set it and forget it" as it relates to price fluctuations, but have always believed a Total Return/Rebalance approach would beat the Income/Dividend approach... apparently not according to this writer? He makes some valid arguments with his examples and for someone who perhaps only needs to draw down 3% or less of their assets, I can see how this approach may be that much more enticing. So I will ask a question that has been asked many times before... if 2 retired investors have the same objective (i.e. generate the same % of cash flow every year), who has the biggest balance at the end of 10, 15 yrs and at what cost (i.e. volatility)?

Total Return Investors, Dividend/Income Investors... pitch me!

https://apple.news/AuryF6Y1KPwqvFHzGcDZl3Q

Key quote: "I want to start out by stating that I am confident that the strategy I’m about to share will outperform the market (S&P 500) over the long run on a total return basis. However, I do not necessarily believe that it will outperform the S&P 500 over the shorter run, although it is possible that it would."

So while I am not drawing down on my assets yet and currently subscribe to the Total Return approach, I am still intrigued by the Income/Dividend approach. I understand the attraction to creating a "reliable" income stream that allows you to somewhat "set it and forget it" as it relates to price fluctuations, but have always believed a Total Return/Rebalance approach would beat the Income/Dividend approach... apparently not according to this writer? He makes some valid arguments with his examples and for someone who perhaps only needs to draw down 3% or less of their assets, I can see how this approach may be that much more enticing. So I will ask a question that has been asked many times before... if 2 retired investors have the same objective (i.e. generate the same % of cash flow every year), who has the biggest balance at the end of 10, 15 yrs and at what cost (i.e. volatility)?

Total Return Investors, Dividend/Income Investors... pitch me!