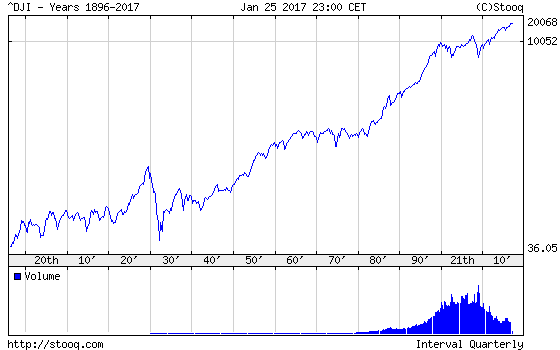

So, stocks are up .. Dow hits 28,000+ .. are we going for 30,000-35,000 next year .. or are equities become expensive ? Will you do a Warren Buffett .. holding a lot of cash ?? Ray Dalio preparing for a downturn too, but many of the Wall St. pundits say Dalio is wrong. Are you lowering allocation for equities ? Or are we having more of that bull market in 2020 ?

Last edited: