If you are an investor in Tesla I'm sure you've gotten the news already about the company joining the S and P 500 in December, 2020. News many have been waiting on. I am excited about the prospects and looking forward to the coming years as an investor in Tesla. Cheers!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone else a Tesla investor?

- Thread starter Blue531

- Start date

If you are an investor in Tesla I'm sure you've gotten the news already about the company joining the S and P 500 in December, 2020. News many have been waiting on. I am excited about the prospects and looking forward to the coming years as an investor in Tesla. Cheers!

I've been adding over the past couple of weeks as share price declined a little. They are up big on the SP500 news.

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I had bought 100 shares of TSLA for the first time during the recent dip. I had used some profits from NIO to make the purchase, which has done very well for me using my “play” money.

Andre1969

Thinks s/he gets paid by the post

I bought a whopping 5 shares not too long ago, just to dip my toe in the water. I'm up about 29%. Starting to think maybe I should have put my whole foot in

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

Bought 5 shares pre-split at 900. I wanted to pick up 10 more and didn't pull the trigger.

Just as important I purchased a Model Y now I get it.

Just as important I purchased a Model Y now I get it.

Last edited:

Christine

Full time employment: Posting here.

- Joined

- Dec 31, 2014

- Messages

- 670

It looks like we are a few.

Just read that TSLA is the most shorted stock. And the largest addition to the S&P 500. So a record number of shares will have to be bought. I guess that might lead to margin calls for some of the shorts.

Then I am a real noob so what do I know. It will be interesting to watch.

Just read that TSLA is the most shorted stock. And the largest addition to the S&P 500. So a record number of shares will have to be bought. I guess that might lead to margin calls for some of the shorts.

Then I am a real noob so what do I know. It will be interesting to watch.

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Congrats to all of you. Have not purchased but it is an interesting/baffling stock.

It seems a dubious long-term play at this level, particularly given the waves of competition. But I see that the battery tech could be the hidden value.

Just cannot or have not come up with any rational basis that the stock is not overvalued but it seems to be a cult stock for the youngs.

It seems a dubious long-term play at this level, particularly given the waves of competition. But I see that the battery tech could be the hidden value.

Just cannot or have not come up with any rational basis that the stock is not overvalued but it seems to be a cult stock for the youngs.

I bought $20k worth a few years ago at a pre-split price of ~ $135 and sold about two years later with a gain of about 70% and put the proceeds in Wells Fargo. D'oh! I wasn't a big fan of the huge price swings so decided to bail. That $20k would be worth about $325k today. I kick myself sometimes, but knowing myself, I'm sure I would've sold at some other price along the way as I was always wary of them running out of cash. According to Elon, they were about a month away from bankruptcy while ramping up the Model 3 production. Now we own it through a couple of growth funds (VIGAX and FBGRX).

A couple years later (a week ago actually) we bought a Model Y and love it!

A couple years later (a week ago actually) we bought a Model Y and love it!

Last edited:

I have 60 shares that I'll probably hold as long as we have a taxable brokerage account. I sold 60 shares at a pre-split $1905 this year. That locked in enough gains that I don't feel stupid keeping 60 shares, and Tesla isn't wagging our portfolio.

I own 150 shares of Tesla, purchased at different times over the past few years. Since the split, I've done very well selling Puts and Calls. (Since you have to buy/sell options in lots of 100, TSLA options were outside my comfort range prior to the split!) The stock's volatility has resulted in some very attractive options trades. Also, I'm a long-term believer in the company and it's future, so I believe in the underlying security, rather than just "trading a name."

As of Oct. 30, only 6.46% of TSLA was short - there are dozens and dozens of stocks with a higher percentage of shares short. However, when you do the calculation by market cap, then Tesla ends up near the top, as 6.46% of a $434 billion market cap is a lot of money! Percentage of shares is more relevant data, as a higher number of shares short can lead to a classic "short squeeze" when the stock prices rises, then begins to get "artificially" inflated as the shorts buy shares at higher and higher prices to cover their positions.

As of Oct. 30, only 6.46% of TSLA was short - there are dozens and dozens of stocks with a higher percentage of shares short. However, when you do the calculation by market cap, then Tesla ends up near the top, as 6.46% of a $434 billion market cap is a lot of money! Percentage of shares is more relevant data, as a higher number of shares short can lead to a classic "short squeeze" when the stock prices rises, then begins to get "artificially" inflated as the shorts buy shares at higher and higher prices to cover their positions.

HawaiiShrimp

Recycles dryer sheets

I am pretty heavily invested in Tesla since August last year. The return has been exceptionally well so far.

aaronc879

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jan 10, 2006

- Messages

- 5,351

I will be invested now thru my equity index funds but don't hold TSLA as an individual stock. Years ago I had enough cash to pay off my small mortgage on a cheap condo. I had considered using the money to buy 200 shares of Tesla but paid off the condo instead. If I had bought those shares for $8000 they would now be worth $800,000.

Ready

Thinks s/he gets paid by the post

I wanted to buy Tesla last year when it was $180 per share but I got spooked when a well known analyst predicted it could go down to $10/share. Just another reminder of why I should never listen to financial analysts.

We did “invest” in two Model 3’s but in spite of what Elon says, they have not turned out to be appreciating assets.

We did “invest” in two Model 3’s but in spite of what Elon says, they have not turned out to be appreciating assets.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Tesla currently has a trailing P/E of 844. Yes, it is finally positive.

I wonder how much higher the P/E of the S&P, which is at 31 right now, will be boosted up by this move.

In March 2000, when the market was at the top before the dotcom implosion, the S&P sported a P/E in the range of 26-27.

I wonder how much higher the P/E of the S&P, which is at 31 right now, will be boosted up by this move.

In March 2000, when the market was at the top before the dotcom implosion, the S&P sported a P/E in the range of 26-27.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Tesla currently has a trailing P/E of 844. Yes, it is finally positive.

I wonder how much higher the P/E of the S&P, which is at 31 right now, will be boosted up by this move.

In March 2000, when the market was at the top before the dotcom implosion, the S&P sported a P/E in the range of 26-27.

The "mix" of the S&P 500 keeps changing, so not sure how relative the 2000 mix of companies and their cumulative P/E is to what 2020 mix is with the shift towards companies that have a higher P/E. Inclusion of Tesla will definitely make this a more volatile index IMHO.

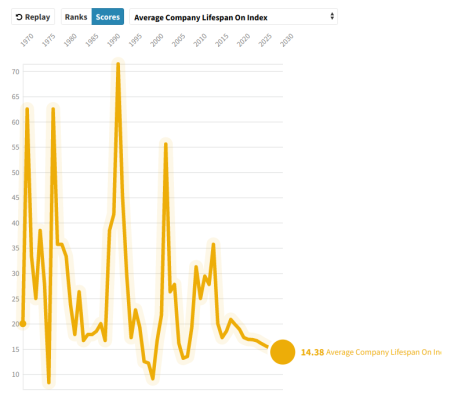

This shows how much the mix has changed over time, good as a point of reference.

https://www.qad.com/blog/2019/10/sp-500-companies-over-time

Kind of interesting is to see how the relative "age" of companies have dropped, then considering what market events occurred as the index hit it's "low" age of companies. Example, lows in/around 1975, early 1980's, 1990, 1999 and 2008.

We are heading there again, so..... draw whatever conclusions you want, just seem to align to some key periods of challenges in the market. Also note what happened after those events, the relative age of companies in the S&P shot way up - flight to quality?

Last edited:

KarlH

Recycles dryer sheets

I bought 7 shares pre-split, and am up 50%. I will watch prices when it joins the S&P, but am not expecting a major surge. If I find my initial investment value doubles, I will probably take the profit and invest that in something new, but we will have to see.

I’ve been an investor in TSLA since the IPO.

Many analysts simply don’t understand how to view Tesla, so the range of estimates is huge.

Now that Tesla has a second factory, and is in the process of building two more, I am more confident in their future than ever.

Short term, who knows, long term it is very solid imho.

Many analysts simply don’t understand how to view Tesla, so the range of estimates is huge.

Now that Tesla has a second factory, and is in the process of building two more, I am more confident in their future than ever.

Short term, who knows, long term it is very solid imho.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

It is beyond overvalued but in this market anything can happen. Amazon was considered overvalued for many many years until people realized the only store in the future will be Amazon.

Texas Proud

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 16, 2005

- Messages

- 17,264

IMO it was overvalued years ago and is just more so today...

It does not make sense that it has a higher market value than Toyota, VW. Mercedes, GM, Honda and Ford combined...

However, I do have shares of this in at least one mutual fund and probably will have more of it in other index funds...

It does not make sense that it has a higher market value than Toyota, VW. Mercedes, GM, Honda and Ford combined...

However, I do have shares of this in at least one mutual fund and probably will have more of it in other index funds...

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Tesla is trying for 500,000 cars in 2020. Total car production of the world is 92 million.

If Tesla already has such a high market cap that is the sum of several major car makers, while producing such a small number of cars (0.5%) compared to the total production number of the incumbents, then what will happen when Tesla manages to drive all of them out of business and become THE car maker of the world?

Will Tesla stock then become 99% the total value of the S&P? Imagine that current stock indexers no longer need to buy 500 stocks, and just buy Tesla alone to capture 99% of the index.

It's mind boggling.

PS. If Tesla can deliver all that it promises, then it will not produce 92 million cars/year. Remember about ride sharing and Tesla 3's autonomous driving turning any car into a taxi? The world would not need as many cars. Musk also claimed his cars will last 1,000,000 miles.

If Tesla already has such a high market cap that is the sum of several major car makers, while producing such a small number of cars (0.5%) compared to the total production number of the incumbents, then what will happen when Tesla manages to drive all of them out of business and become THE car maker of the world?

Will Tesla stock then become 99% the total value of the S&P? Imagine that current stock indexers no longer need to buy 500 stocks, and just buy Tesla alone to capture 99% of the index.

It's mind boggling.

PS. If Tesla can deliver all that it promises, then it will not produce 92 million cars/year. Remember about ride sharing and Tesla 3's autonomous driving turning any car into a taxi? The world would not need as many cars. Musk also claimed his cars will last 1,000,000 miles.

Last edited:

I have never owned Tesla as an individual stock and likely never will. I have watched Cathie Wood of Ark Investment Management speak about the company a few times, talk about why she thinks it will go higher, but I could never comfortable with it as a long term investment.

Maybe they have an advantage in battery technology/production and autonomous software but I believe there is too much competition to justify their current valuation. And frankly over the past 5+ years I have expected some big government smackdown or big lawsuits regarding the autonomous driving aspect as currently being practiced out on public roads to the extent that it might damage the company.

Maybe they have an advantage in battery technology/production and autonomous software but I believe there is too much competition to justify their current valuation. And frankly over the past 5+ years I have expected some big government smackdown or big lawsuits regarding the autonomous driving aspect as currently being practiced out on public roads to the extent that it might damage the company.

Tesla is trying for 500,000 cars in 2020. Total car production of the world is 92 million.

If Tesla already has such a high market cap that is the sum of several major car makers, while producing such a small number of cars (0.5%) compared to the total production number of the incumbents, then what will happen when Tesla manages to drive all of them out of business and become THE car maker of the world?...

How can Microsoft have such a big market cap when they produce no cars?

Yes, Tesla does build cars and they do a lot of other things too.

In addition, they are seen as the market leader in a market that has a huge amount of potential, with very little competition.

Analysts that consider Tesla only on the number of cars they build have been wrong for years. Analysts who also consider the state of competition, the energy side of the business, the cost savings/margin of sales, and Tesla’s infrastructure plans, those are the ones that are generally closer to the mark.

Some people have been stating that the “competition” will chew up Tesla have been stating that for 8 years. They don’t seem to realize that Tesla wants competition. I think Elon is getting frustrated with how long it is taking for the competition to get their act together.

Car-Guy

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Not me... Besides not liking EV's, I just I haven't seen many on the road.... Like maybe 1 every few months. (Yes I know, it's where I live)

Just this morning I heard on the business news that Consumer Reports ranked Tesla 25th out of 26 brands for reliability... Hey they said it, not me.

With that said, I might consider it (hey money is money) but I'd buy it as one of my shorter term speculations buys... That too may change at some point.

Just this morning I heard on the business news that Consumer Reports ranked Tesla 25th out of 26 brands for reliability... Hey they said it, not me.

With that said, I might consider it (hey money is money) but I'd buy it as one of my shorter term speculations buys... That too may change at some point.

Last edited:

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Consider that Tesla now has the market cap equal to ALL other auto manufacturers. If all of the others went out of business then the auto industry as a whole (consisting only of Tesla) would have a similar market cap to before Tesla showed up.

Either all of the other car manufacturers were drastically undervalued before Tesla came along, the demand for any type of car is going to skyrocket like it has never done since the horse (and with more telecommuting I don't really see this), the cost and profit of making a car is going to skyrocket, or Tesla is very very overvalued.

You pick.

Either all of the other car manufacturers were drastically undervalued before Tesla came along, the demand for any type of car is going to skyrocket like it has never done since the horse (and with more telecommuting I don't really see this), the cost and profit of making a car is going to skyrocket, or Tesla is very very overvalued.

You pick.

Similar threads

- Replies

- 26

- Views

- 2K

- Replies

- 16

- Views

- 1K

- Replies

- 26

- Views

- 2K

- Replies

- 16

- Views

- 555

- Replies

- 35

- Views

- 922