The low coupon holding are sold first to meet redemptions and fund holders assume the loss. But to meet fund duration and balance rules (all silly), they sell the highest coupon holdings. This is when investors like me place low ball limit orders to buy notes at well above market yields. Don't expect a fund to buy the higher coupon debt until money starts flowing in.

I don't know anything about TBM (VBTLX) but looking at the details of this fund it invests mostly in government securities. I could do that on my own.

https://investor.vanguard.com/mutual-funds/profile/portfolio/vbtlx

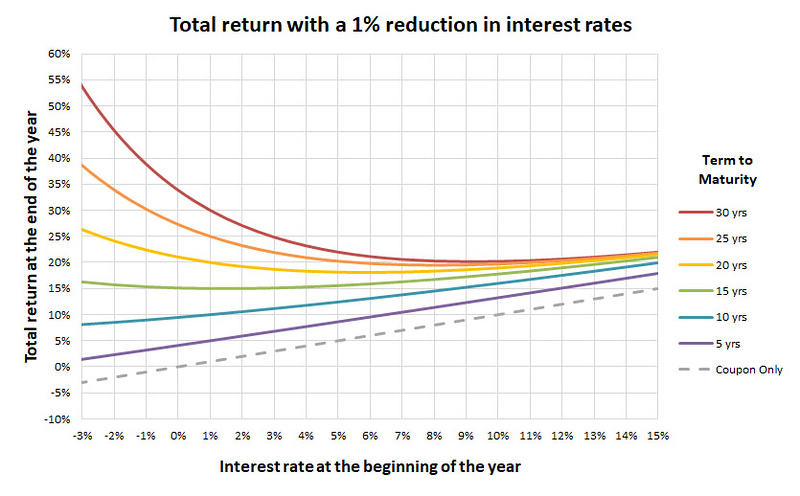

The average coupon is only 2.6% and average effective maturity is 8.9 years. So it's not exactly something that I would ever consider buying. I personally would not put any new money into this when you could buy treasuries with shorter duration or CDs at higher yields without any risk of capital loss. I can't tell you what to do with your current holdings. That question should be directed to people who believe in these bond funds.