Luvtoride

Thinks s/he gets paid by the post

Interesting article in Morningstar regarding Asset Allocation strategy in retirement. I hope the link works.

https://www.morningstar.com/article...tterstocksthanbondsinretirement&elqTrack=true

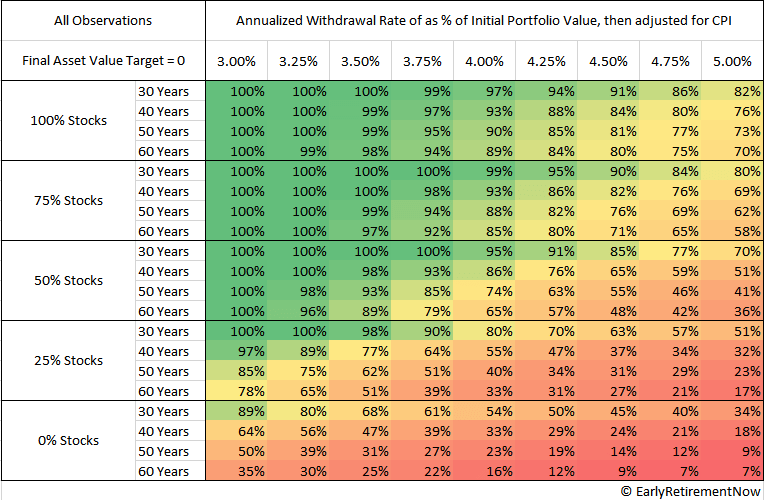

This may be preaching to the choir here, as many of you speak about your high allocations of equities during your retirement years. This article looks at the historical withdrawl rates (using 20 year periods) "possible" based on assets lasting at least 30 years, for 3 portfolios-

1) Aggressive 100% equities

2) Moderate 50% equities, 40% bonds and 10% cash

3) Conservative 90% bonds, 10% cash

I'm not sure if its a complete surprise, but the Aggressive portfolio results in the highest level of safe withdrawls for almost all simulated periods. In addition, this AA results in a higher capital preservation rate (also analyzed in 20 year historical simulations) than the other strategies.

The one area this analysis didn't consider was "sequence of return" risks during any particular 20 year simulation period used.

I know there are many here who tend to have lower equity exposure to help "sleep at night", especially after dips like we've seen since Black Friday, but this article makes a strong case that retirement portfolios should have more equity exposure than typically used during the distribution phase.

I know many here have 100% equity portfolios. You may be onto the best strategy.

Interesting to think about.

https://www.morningstar.com/article...tterstocksthanbondsinretirement&elqTrack=true

This may be preaching to the choir here, as many of you speak about your high allocations of equities during your retirement years. This article looks at the historical withdrawl rates (using 20 year periods) "possible" based on assets lasting at least 30 years, for 3 portfolios-

1) Aggressive 100% equities

2) Moderate 50% equities, 40% bonds and 10% cash

3) Conservative 90% bonds, 10% cash

I'm not sure if its a complete surprise, but the Aggressive portfolio results in the highest level of safe withdrawls for almost all simulated periods. In addition, this AA results in a higher capital preservation rate (also analyzed in 20 year historical simulations) than the other strategies.

The one area this analysis didn't consider was "sequence of return" risks during any particular 20 year simulation period used.

I know there are many here who tend to have lower equity exposure to help "sleep at night", especially after dips like we've seen since Black Friday, but this article makes a strong case that retirement portfolios should have more equity exposure than typically used during the distribution phase.

I know many here have 100% equity portfolios. You may be onto the best strategy.

Interesting to think about.