First of all - expected long term total return (appreciation?) of a bond fund with reinvested dividends at any point in time will generally be the current SEC yield. For example, Vanguard Total Bond Market Index Fund VBTLX on 1/6/20 had an 30 day SEC yield of 2.25%. So it should do slightly better than inflation pre-tax. That's probably all that you can expect to earn on funds you invest today. If interest rates rise quite a bit and you add funds after the rise, you can expect the total return on those funds to be correspondingly higher.

In terms of composition:

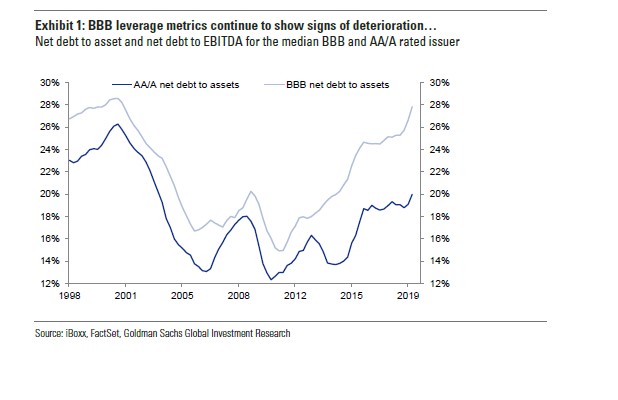

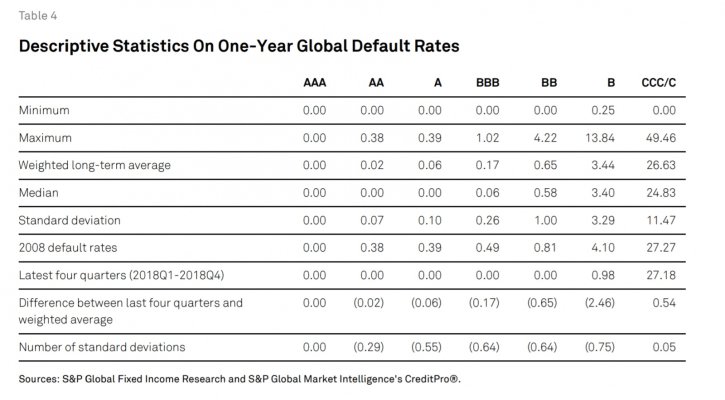

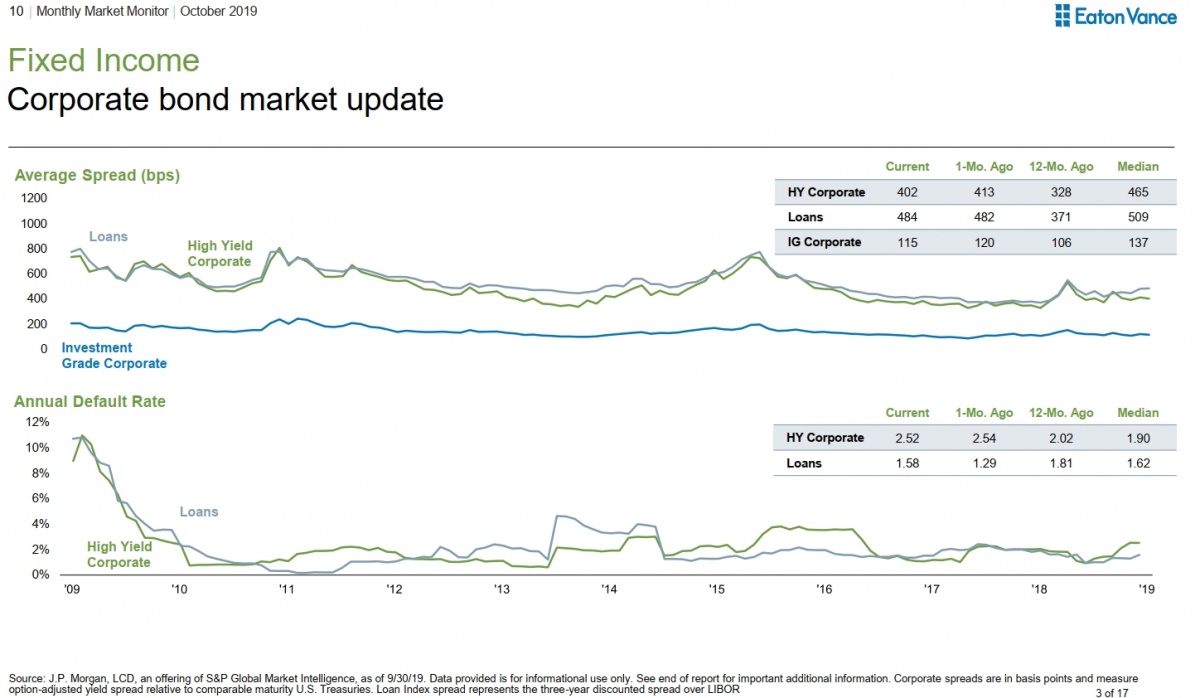

Buying a US broad base index bond fund makes no sense at the present time, for instance the vanguard total bond fund holds 70% US Treasuries, which you could buy at zero cost versus the 0.15% annual cost of vanguard = to almost 9 percent of the total yield of the bond fund and 30% corporates of which 50% are BBB that trade at historic low yields.

VBTLX does not hold 70% US Treasuries. It holds 62.3% in US Government-backed debt, of which Treasury AND Agency combined is 43.7%.

And the ER is not 0.15%, it is 0.05%. Big difference.

I use the Fidelity US Bond Index fund FXNAX as my core intermediate bond fund.

It holds 70.71% in US Government debt of which 43.45% is US treasuries, and another 25.64% is in (Agency) mortgage-backed securities. The foreign government exposure in this fund is extremely small.

It holds 23.50% in investment grade corporate securities. It only holds 9.08% overall in BBB rated debt. And a tiny fraction (0.03% BB) below BBB.

The expense ratio is 0.025%. I am quite happy to pay 0.025% ER and not mess with individual bonds even the easy to buy US Treasuries. Plus I have exposure to US Govt mortgage-backed bonds and to investment grade corporate debt.

Agree.

And I think it makes more sense to actively manage bond investments, either yourself or using a fund or manager.

When I contrast FXNAX with DODIX and FTBFX - two popular actively managed core bond funds, FXNAX is far more conservative and holds far less BBB or lower rated debt as well as being far less expensive to own.

Dodge and Cox Income DODIX holds 32.79% in Agency mortgage-backed securities and 9.36% in US Government debt which would include treasuries. It holds 35.04% in corporate bonds. Of this a whopping 29.90% of the entire fund is BBB rated debt, and another 5.61% in below BBB rated debt (i.e. non investment grade). It has a higher foreign debt exposure. ER is 0.42%.

Fidelity Total Bond Fund FTBFX owns 52.08% in US government debt, of which 31.64% is US government including treasuries, and 19.38% is (Agency) mortgage-backed securities. It holds 37.07% in corporate debt which includes 18.43% in BBB rated debt and 13.02% in below BBB rated debt (non investment grade) for a total of 31.45% of the entire fund in BBB or lower rated debt. ER is 0.45%.

The FXNAX profile matches what I want in terms of diversification against my equity funds (Treasuries and US-Govt backed debt has far lower correlation to equities than corporate debt and high yield debt), so I have a large investment in this fund at extremely low cost.

And frankly I don't understand the criticism of index funds holding BBB debt when I suspect many active bond funds hold far more plus a good chunk of even lower rated debt.