|

|

06-27-2018, 06:13 PM

06-27-2018, 06:13 PM

|

#21

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,139

|

Quote: Quote:

Originally Posted by Lsbcal

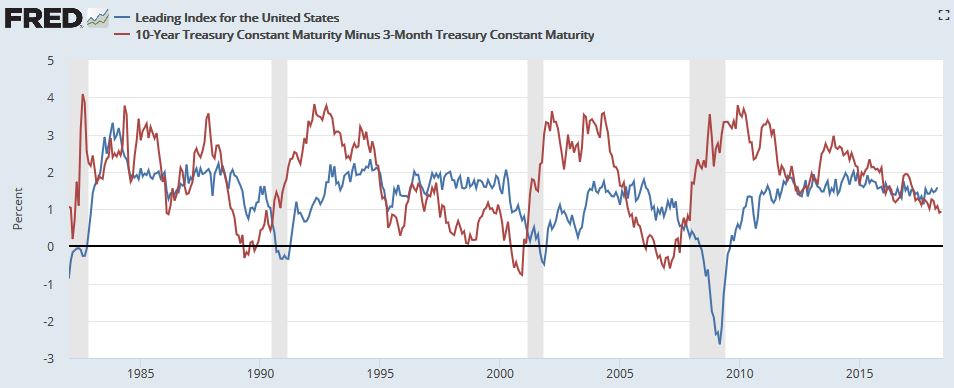

I think the Fed has been identified with using the 10 year minus the 3 month Treasury to look at yield curve flattening. Below is a nice Fed chart showing the entry into the last 3 recessions (grey shaded areas). You can see how the flattening (red line below X axis) has been a very early indicator of trouble but not an actionable timing signal I think. Also at present it is pretty far from flat. The 10year minus 2 year is closer to flat and so that becomes a focus of scare articles.

Perhaps a better timing signal is the Leading Index (blue line) falling significantly. At present it is benign.

. |

FWIW I thought that 10 year compared to 2 year was the conventional measure of curve flatness?

__________________

Retired since summer 1999.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

06-27-2018, 06:27 PM

06-27-2018, 06:27 PM

|

#22

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2015

Posts: 1,890

|

I'll wait until it inverts before I get all panicky.

|

|

|

06-27-2018, 06:37 PM

06-27-2018, 06:37 PM

|

#23

|

|

Full time employment: Posting here.

Join Date: Mar 2004

Posts: 526

|

As a long term buy-and-hold investor with a preference for equity index funds, I’ve been in Vanguard Target Retirement 2025 for about 5 years. But since I’ll be 65 in a week (now working part-time), I don’t want to be heavily in equities as I gradually retire in the next year or two, possibly on the cusp of a recession or especially, a bear market.

So yesterday I moved into the TR2020 fund. But that’s still over 50% equities. I try really hard to stay the course, but at this age I sure don’t want to get caught retiring into a bear market. I’m about to roll over my 401(k) (now in equities) into Vanguard. Maybe I’ll park it in bonds and cash, and following Kitces, move back into more equities after I quit working altogether (working p/t now).

Sigh. I vowed never to time the market, but it does seem like this pre-retirement phase deserves a more conservative allocation.

|

|

|

06-28-2018, 12:11 AM

06-28-2018, 12:11 AM

|

#24

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2012

Posts: 3,931

|

Quote: Quote:

Originally Posted by trumpeting_angel

Sigh. I vowed never to time the market, but it does seem like this pre-retirement phase deserves a more conservative allocation.

|

It does, because sequence of returns risk is very real and you might not otherwise seriously consider it until it's too late.

There are a couple of issues/items to consider that should give you pause:

1. If a market downturn should happen, will you need to be drawing on the invested funds? When you draw on the invested funds during a downturn, you are locking in losses at that time - those (permanent) losses will not be made back if/when the market recovers. As you draw down during a market down turn, a fixed withdrawal amount will translate into a higher percentage of portfolio value.

2. What happens most recently in the market is going to have the greatest effect on your portfolio value, as it is applied to all prior contributions and gains. This is the basis of sequence of returns risk and why folks should move to a more conservative allocation as they near/reach retirement. You want that lifetime of contributions and gains to be able to carry you through retirement. Putting lots of it at risk is not justified for most folks.

3. In general, I find talk is cheap. Many folks easily say "Oh when the crash comes, I'll just stay the course, keep investing, and do just fine longer term - it's always worked out". Ask anyone near retirement who was too heavily invested in 2008 how that plan worked out. Honestly ask yourself where your threshold for pain is. Suppose you just retired, have $1M with a 50/50 allocation. The equity portion declines by 50% and the bonds stay flat. Now you're at $750k. Things aren't so rosy any longer. That's 50/50 - many swinging a big stick laugh at 50/50 and even 75/25...again, until it's too late. You'll see many folks very confident in their posts, freely handing out investment advice, what to invest in, laughing at folks who are conservative, using high equity allocation because they are doing so well with it ... today. That's what happens at market highs when things are going well. Avoid getting swept up in the euphoria.

Investment objective and risk tolerance - address those honestly and you'll be fine.

|

|

|

06-28-2018, 05:05 AM

06-28-2018, 05:05 AM

|

#25

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2016

Location: Colorado

Posts: 8,971

|

Quote: Quote:

Originally Posted by njhowie

It does, because sequence of returns risk is very real and you might not otherwise seriously consider it until it's too late.

There are a couple of issues/items to consider that should give you pause:

1. If a market downturn should happen, will you need to be drawing on the invested funds? When you draw on the invested funds during a downturn, you are locking in losses at that time - those (permanent) losses will not be made back if/when the market recovers. As you draw down during a market down turn, a fixed withdrawal amount will translate into a higher percentage of portfolio value.

2. What happens most recently in the market is going to have the greatest effect on your portfolio value, as it is applied to all prior contributions and gains. This is the basis of sequence of returns risk and why folks should move to a more conservative allocation as they near/reach retirement. You want that lifetime of contributions and gains to be able to carry you through retirement. Putting lots of it at risk is not justified for most folks.

3. In general, I find talk is cheap. Many folks easily say "Oh when the crash comes, I'll just stay the course, keep investing, and do just fine longer term - it's always worked out". Ask anyone near retirement who was too heavily invested in 2008 how that plan worked out. Honestly ask yourself where your threshold for pain is. Suppose you just retired, have $1M with a 50/50 allocation. The equity portion declines by 50% and the bonds stay flat. Now you're at $750k. Things aren't so rosy any longer. That's 50/50 - many swinging a big stick laugh at 50/50 and even 75/25...again, until it's too late. You'll see many folks very confident in their posts, freely handing out investment advice, what to invest in, laughing at folks who are conservative, using high equity allocation because they are doing so well with it ... today. That's what happens at market highs when things are going well. Avoid getting swept up in the euphoria.

Investment objective and risk tolerance - address those honestly and you'll be fine.

|

+1 Great advice. I am 2 years from retirement and I am at 35/55/10. Having moved to that mix gradually over about the last year and I have missed almost nothing in the equity market. Sometimes I think even that AA is too aggressive.  I plan to sit tight until I retire and then rebalance slowly back into equities over the next 5-7 years.

|

|

|

06-28-2018, 05:31 AM

06-28-2018, 05:31 AM

|

#26

|

|

Recycles dryer sheets

Join Date: Sep 2012

Location: in the sticks

Posts: 473

|

Quote: Quote:

Originally Posted by njhowie

It does, because sequence of returns risk is very real and you might not otherwise seriously consider it until it's too late.

There are a couple of issues/items to consider that should give you pause:

1. If a market downturn should happen, will you need to be drawing on the invested funds? When you draw on the invested funds during a downturn, you are locking in losses at that time - those (permanent) losses will not be made back if/when the market recovers. As you draw down during a market down turn, a fixed withdrawal amount will translate into a higher percentage of portfolio value.

2. What happens most recently in the market is going to have the greatest effect on your portfolio value, as it is applied to all prior contributions and gains. This is the basis of sequence of returns risk and why folks should move to a more conservative allocation as they near/reach retirement. You want that lifetime of contributions and gains to be able to carry you through retirement. Putting lots of it at risk is not justified for most folks.

3. In general, I find talk is cheap. Many folks easily say "Oh when the crash comes, I'll just stay the course, keep investing, and do just fine longer term - it's always worked out". Ask anyone near retirement who was too heavily invested in 2008 how that plan worked out. Honestly ask yourself where your threshold for pain is. Suppose you just retired, have $1M with a 50/50 allocation. The equity portion declines by 50% and the bonds stay flat. Now you're at $750k. Things aren't so rosy any longer. That's 50/50 - many swinging a big stick laugh at 50/50 and even 75/25...again, until it's too late. You'll see many folks very confident in their posts, freely handing out investment advice, what to invest in, laughing at folks who are conservative, using high equity allocation because they are doing so well with it ... today. That's what happens at market highs when things are going well. Avoid getting swept up in the euphoria.

Investment objective and risk tolerance - address those honestly and you'll be fine.

|

+1

Retired in 2013, DW still working, was terrified of what you describe above. I was ultra conservative and missed a big (further) runnup due to Fed intervention. I could not have anticipated the level that the Fed was willing to go to prop up the market. My conservative stance cost me in additional returns but it was the cost of ‘insuring’ against a huge drop right at retirement. Today I am no worse off (and a bit better) than I was when I retired. No big windfall since 2013 like the market, but no huge drop either. I am more comfortable now easing back in and will take advantage of the repricing that seems to be taking place. Getting closer to age eligibility for SS makes a big difference as well.

|

|

|

06-28-2018, 05:47 AM

06-28-2018, 05:47 AM

|

#27

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2003

Location: Florida's First Coast

Posts: 7,717

|

I do not think there will be a flat out stock market retreat this time. But heck what do I know?

I think it will get nickeled and dimed down with 100 - 300 point declines over time, rather than one or two whopping 1000-5000 point drops quickly. Unless of course there is a life event that triggers something.

The net net will be the same, an overall decline in the market or a small recession. One of those things that if one talks about something enough, it will eventually happen.

__________________

"Never Argue With a Fool, Onlookers May Not Be Able To Tell the Difference." - Mark Twain

|

|

|

06-28-2018, 08:12 AM

06-28-2018, 08:12 AM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,338

|

Quote: Quote:

Originally Posted by njhowie

..... Ask anyone near retirement who was too heavily invested in 2008 how that plan worked out. Honestly ask yourself where your threshold for pain is. ....

|

That's me... ~60/40 or perhaps even more equities in 2008 and planning to retire at 55 in 2010. It was scary... by AA was literally screaming at me to rebalance but I didn't have the courage but I did stay the course... just held pat and did not sell. While we will never know what I would have done if I had been retired at that time, I suspect that I would have done the same thing... just held pat. Only real move was to OMY, but that was as much due to some things going on in our personal life as it was to improve our finances.

I'm coming around to think that a good strategy for dealing with sequence of turns risk might be to start out with a relatively conservative AA and simply rebalance equities only where they exceed target and just otherwise stand pat... that would naturally nudge you to redeem/live on bonds during downturns until stocks recover.

For example, start with $100 starting value at 60/40 and 3.5% WR... a 35% decline in equities and 5% rise in bond values... at end of year your portfolio is $81 and AA before withdrawals would be 48/52.... after 3.5 withdrawal your portfolio is 77.5....39 stocks and 38.5 bonds of ~50/50.

OTOH, if you start with $100 at 50/50 and the same assumptions, you end the year at 40/60 after withdrawals.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

06-28-2018, 08:27 AM

06-28-2018, 08:27 AM

|

#29

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by audreyh1

FWIW I thought that 10 year compared to 2 year was the conventional measure of curve flatness?

|

There was a Fed paper discussing the correlation of recessions and the 10yr, 3mo yield curve. Also this use of the yield curve is one of the components in the Fed’s Leading Index.

|

|

|

06-28-2018, 08:36 AM

06-28-2018, 08:36 AM

|

#30

|

|

Thinks s/he gets paid by the post

Join Date: May 2014

Posts: 1,390

|

I thought it was going to be the end of the World the day the 10 year hit 3% for my Mreits. That didn't happen. What did happen was those stocks were already going down well in anticipation of rates rising. Once it hit 3% it was very much muted. It was already priced in.

What will the 10 year and 2 year do? I have no idea. Too many unknowns right now. But the 10 year has come down a little since not only reaching 3% , but advancing a bit past it.

__________________

Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things. Charlie Munger

The first rule of compounding: Never interupt it unnecessarily. Charlie Munger

|

|

|

06-28-2018, 08:46 AM

06-28-2018, 08:46 AM

|

#32

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,139

|

Quote: Quote:

Originally Posted by Lsbcal

There was a Fed paper discussing the correlation of recessions and the 10yr, 3mo yield curve. Also this use of the yield curve is one of the components in the Fed’s Leading Index.

|

That sounds interesting. Do you have any links?

__________________

Retired since summer 1999.

|

|

|

06-28-2018, 08:53 AM

06-28-2018, 08:53 AM

|

#33

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,139

|

Quote: Quote:

Originally Posted by UnrealizedPotential

I thought it was going to be the end of the World the day the 10 year hit 3% for my Mreits. That didn't happen. What did happen was those stocks were already going down well in anticipation of rates rising. Once it hit 3% it was very much muted. It was already priced in.

What will the 10 year and 2 year do? I have no idea. Too many unknowns right now. But the 10 year has come down a little since not only reaching 3% , but advancing a bit past it.

|

Some of the bond talking heads out there have noted something like 3.22% or 3.26% as the critical level to cross for the 10 year. We’ll see. It’s been having difficulty getting there.

__________________

Retired since summer 1999.

|

|

|

06-28-2018, 08:59 AM

06-28-2018, 08:59 AM

|

#34

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by audreyh1

That sounds interesting. Do you have any links?

|

Here is the Fed paper: https://www.newyorkfed.org/research/...es/ci12-5.html

And here is the description of the Leading Index (it mentions "state" because there are separate ones for the states but the one I use is for the entire US):

Quote: Quote:

|

The leading index for each state predicts the six-month growth rate of the state's coincident index. In addition to the coincident index, the models include other variables that lead the economy: state-level housing permits (1 to 4 units), state initial unemployment insurance claims, delivery times from the Institute for Supply Management (ISM) manufacturing survey, and the interest rate spread between the 10-year Treasury bond and the 3-month Treasury bill.

|

|

|

|

06-28-2018, 09:04 AM

06-28-2018, 09:04 AM

|

#35

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,139

|

Thanks much!

__________________

Retired since summer 1999.

|

|

|

06-28-2018, 09:12 AM

06-28-2018, 09:12 AM

|

#36

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,349

|

Quote: Quote:

Originally Posted by njhowie

... Suppose you just retired, have $1M with a 50/50 allocation. The equity portion declines by 50% and the bonds stay flat. Now you're at $750k. Things aren't so rosy any longer. ...

|

With respect, this would be faulty thinking.

Consider thunderstorms. They come along from time to time and we know that. This afternoon you're home and a particularly strong one comes along; thunder, lightning, rain & hail. You're not enjoying this and the dog is scared. You're really not scared, though, because you have enough food in the house that you won't have to go out even if the storm lasts through the dinner hour. You've also bought or built a good house, so you are not concerned about the storm causing any significant long-term damage. And, importantly, you know that the storm will pass. (Too bad the dog doesn't.  )

Your theoretical 50% drop in equities is the investment equivalent of a thunderstorm. It isn't fun, but it really isn't a big deal either. Since WWII all of the investment storms have ended within 3-5 years of the first hit. Also, importantly, six of the best 10 market days in the last 20 years occurred within two weeks of the 10 worst days .

So ...

Case 1/Somewhat Conservative Investor: He/she simply settles in, spending from the safe fixed-income tranche, and waits for the 3-5 years he/she expects it to take for the market to recover. All during that recovery period, too, the market trend is (historically) upward so even if our conservative investor needs or wants to sell some equities after a few years, the hit will not be too bad.

Case 2/Strategic Investor: He/she sees that stocks are on sale and begins buying, fully understanding that they might go down more before they go up. He/she may not fully rebalance because that fixed income tranche is comforting and he/she doesn't want it to get too low. But when the storm ends, this investor will be a very happy with his/her portfolio.

Case 3/Foolish Investor: Foolish investor really doesn't see roses, doesn't understand the market and bails. There are a lot of these. JP Morgan data says that the average individual investor, over long periods of time, does not keep up with inflation. This is due to panicking, confusing speculation with investing, and to being overly conservative with investment choices.

At age 70 we are probably Case 1. We are 75/25 and a 50% drop would be a seven figure drop for us. We have been through many thunderstorms before, though, beginning in 1987. We'll be sleeping well.

|

|

|

06-28-2018, 09:49 AM

06-28-2018, 09:49 AM

|

#37

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2012

Posts: 3,931

|

Quote: Quote:

Originally Posted by OldShooter

Your theoretical 50% drop in equities is the investment equivalent of a thunderstorm. It isn't fun, but it really isn't a big deal either.

...

At age 70 we are probably Case 1. We are 75/25 and a 50% drop would be a seven figure drop for us. We have been through many thunderstorms before, though, beginning in 1987. We'll be sleeping well.

|

That's a great position to be in, congrats!

However, I would contend that the size of your portfolio plays a significant role in your risk tolerance - similar for others, or should play a significant role. Most folks are not sitting on multi-million dollar portfolios that could easily weather a 50% drop in equity value. Entering retirement with $1M is a milestone for many, and a drop to $750k as in my example would be a very significant big deal to those cases.

|

|

|

06-28-2018, 10:01 AM

06-28-2018, 10:01 AM

|

#38

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2003

Location: Florida's First Coast

Posts: 7,717

|

Quote: Quote:

Originally Posted by njhowie

Entering retirement with $1M is a milestone for many, and a drop to $750k as in my example would be a very significant big deal to those cases.

|

I agree, for some even a 25% drop would mean the difference between being able to "Blow That Doe" on a really discretionary item or not.

__________________

"Never Argue With a Fool, Onlookers May Not Be Able To Tell the Difference." - Mark Twain

|

|

|

06-28-2018, 10:07 AM

06-28-2018, 10:07 AM

|

#39

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2018

Location: Tampa

Posts: 11,295

|

Quote: Quote:

Originally Posted by njhowie

That's a great position to be in, congrats!

However, I would contend that the size of your portfolio plays a significant role in your risk tolerance - similar for others, or should play a significant role. Most folks are not sitting on multi-million dollar portfolios that could easily weather a 50% drop in equity value. Entering retirement with $1M is a milestone for many, and a drop to $750k as in my example would be a very significant big deal to those cases.

|

We are closer to 2mm - still under the average on this forum with a 55/45 AA.

However our plans are to use a 3% WR of current portfolio (Clyatt 95% rule) for the near future and thus a 50% drop should cause us a net 25% portfolio drop and would effectively increase our WR to 4%.

That is the concept we will use vs. starting our retirement with a below 40% allocation.

__________________

TGIM

|

|

|

06-28-2018, 10:07 AM

06-28-2018, 10:07 AM

|

#40

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,349

|

Quote: Quote:

Originally Posted by njhowie

That's a great position to be in, congrats!

|

Thanks. We have been very lucky in life.

Quote: Quote:

Originally Posted by njhowie

However, I would contend that the size of your portfolio plays a significant role in your risk tolerance - similar for others, or should play a significant role. Most folks are not sitting on multi-million dollar portfolios that could easily weather a 50% drop in equity value.

|

Yes, but we had the same tolerance in 1987 when we were not dealing with big numbers. We have had some serious gut twinges along the way to where we are now. Nifty Fifty, tech bubble, mortgage derivatives crash, etc. but we have never once sold into a down market.

Quote: Quote:

Originally Posted by njhowie

Entering retirement with $1M is a milestone for many, and a drop to $750k as in my example would be a very significant big deal to those cases.

|

I agree totally. The point of my post is that it really should not be a big deal, any more than a passing thunderstorm is. Easy to say, hard to do.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|