corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

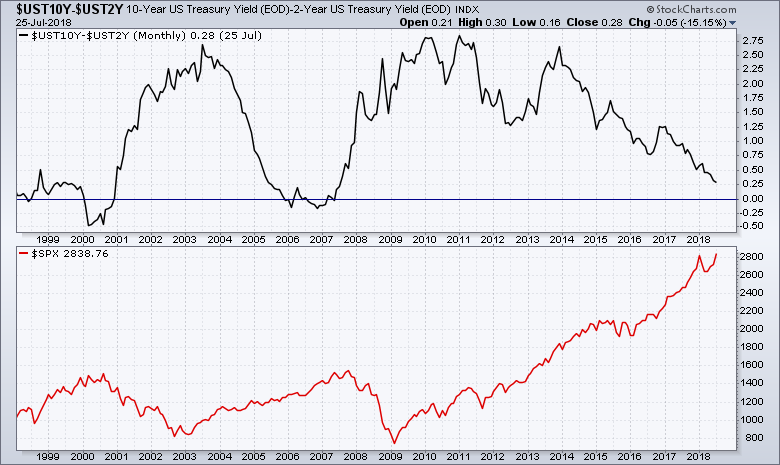

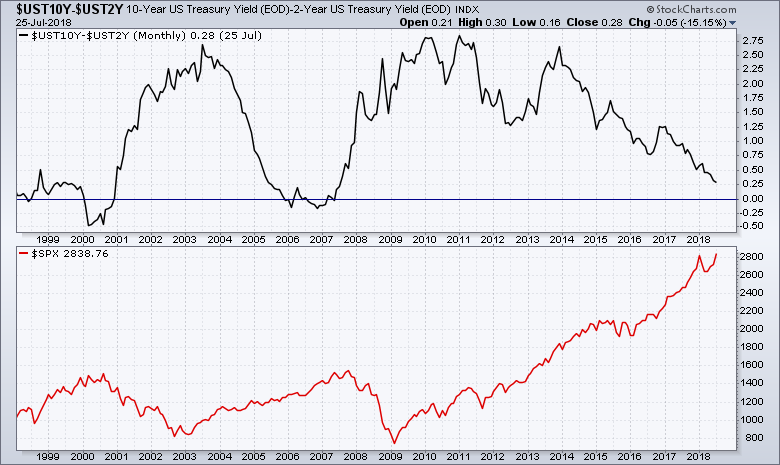

That looks ominous:

Guess I will have to not do anything.

Guess I will have to not do anything.

Here is the 10 - 2.

Here is the 10 - 2.

That looks ominous:

Guess I will have to not do anything.

Another interesting issue on yield curve: companies have a tax incentive in the new tax law to fund pensions. Essentially, their tax benefit is at the old 35% rate to the extent of funding by Sept 15 as opposed to 21%, a meaningful benefit. This is creating policy-driven demand for long Treasury bonds (driving rates lower), which will abate after Sept 15 (resetting rates higher).

Getting pensions funded is a good thing. I think this also suggests another reason the yield curve may not invert (though the rate on the 30 may fall below the rate on the 10)

Yes - I’m really interested to see if demand for long bonds drop (and long rates rise) after Sept 15.

If so, short TLT?

Another interesting issue on yield curve: companies have a tax incentive in the new tax law to fund pensions. Essentially, their tax benefit is at the old 35% rate to the extent of funding by Sept 15 as opposed to 21%, a meaningful benefit. This is creating policy-driven demand for long Treasury bonds (driving rates lower), which will abate after Sept 15 (resetting rates higher).

Getting pensions funded is a good thing. I think this also suggests another reason the yield curve may not invert (though the rate on the 30 may fall below the rate on the 10)