Running_Man

Thinks s/he gets paid by the post

- Joined

- Sep 25, 2006

- Messages

- 2,844

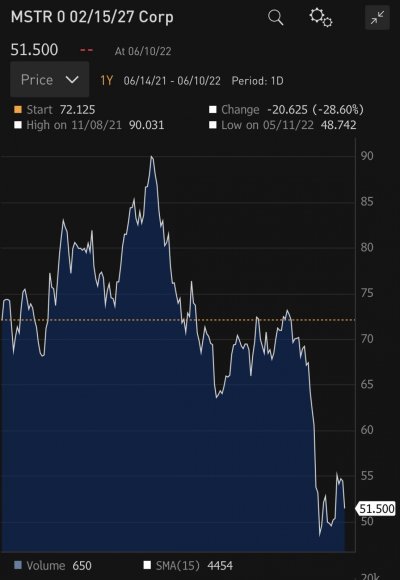

Microstrategy on way to zero

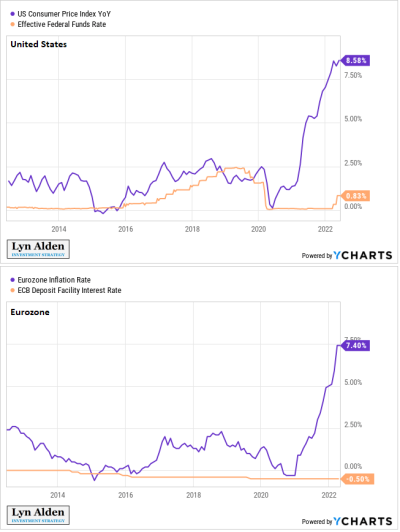

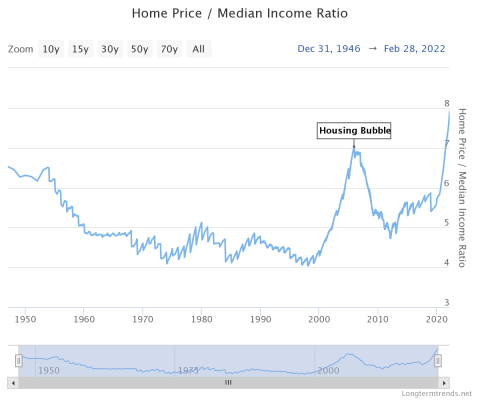

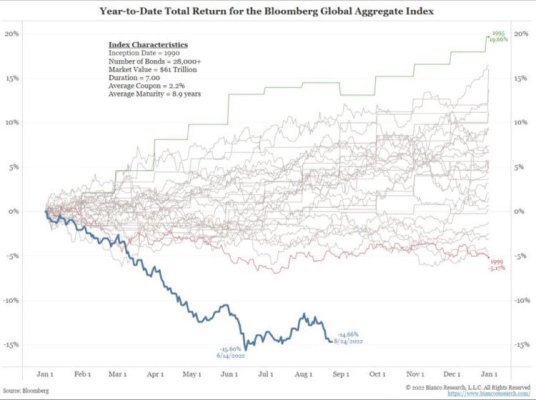

This is a 5 year zero interest bond convertible into Microstratgey stock at 1200. Problem is bitcoin is collapsing, their actual sales of software has negative comparison and had a large loss last qtr. Things are getting real in the finance world and many companies like Microstrategy were set up to take advantag of low or zero interest rates, which is the same as printing money.. With 2.4 billion in debt and 500million annual in sales @ 10% interest on their loans MSTR would exceed 50% of revenues to meet interest payment. Since the price of bitcoin has dropped 20% since it's March Qtr the loss this qtr is 1,2 billion and rising. When the value of bitcoin drops below 21K and they get margin call, they will have to go all in on all their bitcoin or sell to raise cash and pay off debt. Likelihood of total wipeout is high with this one but if you look for a turn around this bond will be better than the stock.

This is a 5 year zero interest bond convertible into Microstratgey stock at 1200. Problem is bitcoin is collapsing, their actual sales of software has negative comparison and had a large loss last qtr. Things are getting real in the finance world and many companies like Microstrategy were set up to take advantag of low or zero interest rates, which is the same as printing money.. With 2.4 billion in debt and 500million annual in sales @ 10% interest on their loans MSTR would exceed 50% of revenues to meet interest payment. Since the price of bitcoin has dropped 20% since it's March Qtr the loss this qtr is 1,2 billion and rising. When the value of bitcoin drops below 21K and they get margin call, they will have to go all in on all their bitcoin or sell to raise cash and pay off debt. Likelihood of total wipeout is high with this one but if you look for a turn around this bond will be better than the stock.

Attachments

Last edited: