NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

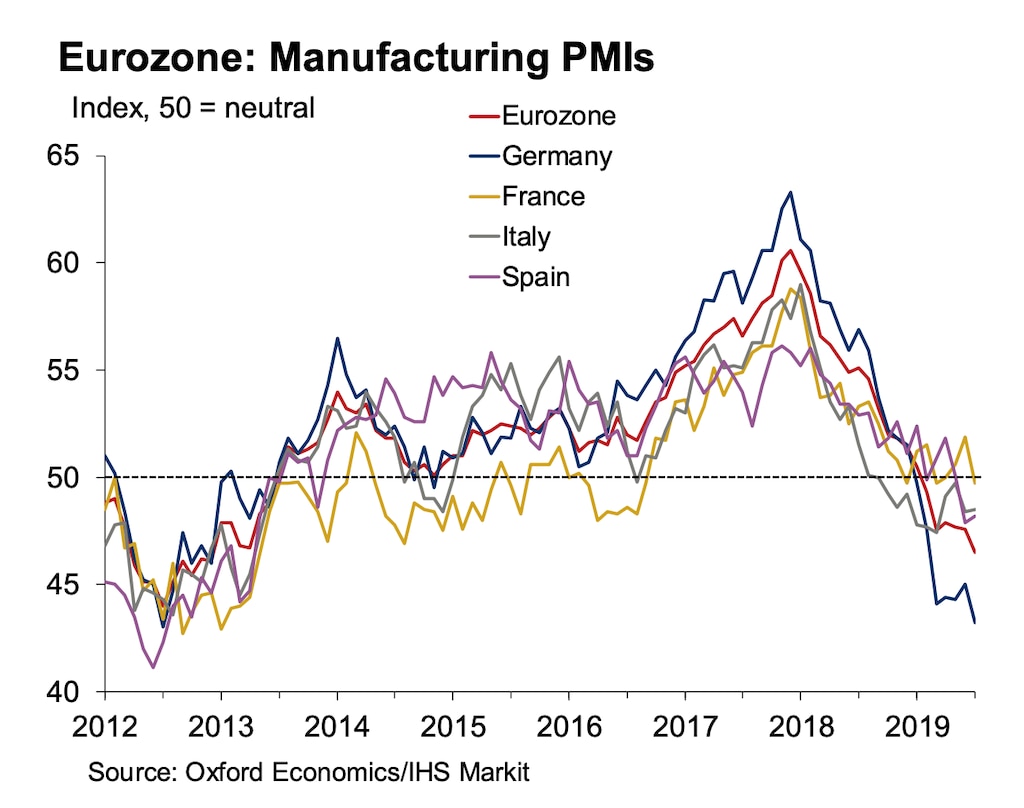

Draghi, the President of EU Central Bank, just said "this outlook is getting worse and worse, ... it’s getting worse and worse in those countries where manufacturing is very important.”

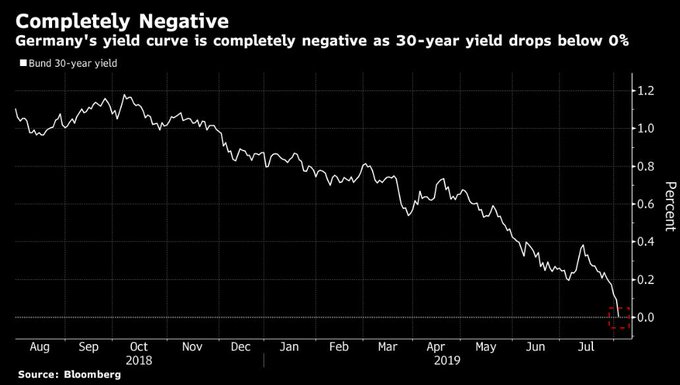

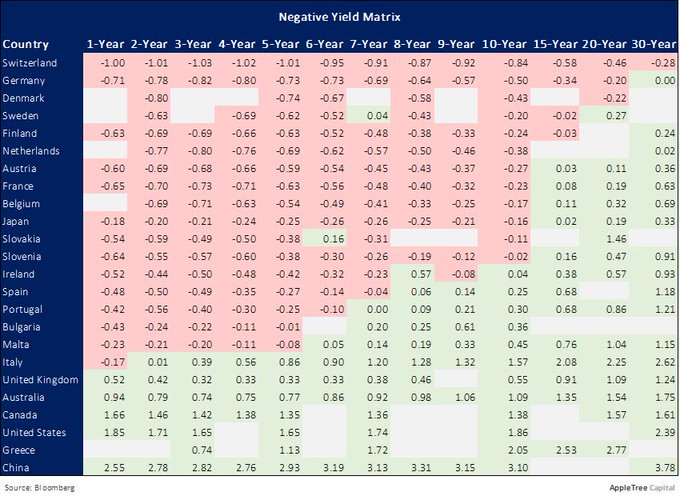

They are looking to do more stimulus. More negative interest rates?

They are looking to do more stimulus. More negative interest rates?