|

|

01-07-2022, 07:10 PM

01-07-2022, 07:10 PM

|

#21

|

|

Recycles dryer sheets

Join Date: May 2016

Posts: 313

|

Just to clarify some points that seem confused up above, growth stocks are those which have most of their earnings many years in the future. To calculate the value of those earning's today, they are divided by the interest rate for all the years in between. When inflation makes higher interest rates likely, those future returns get repeatedly divided by a larger number. That's why high P/E growth stocks take a big hit from inflation.

Right now we have supply side inflation. People are going out and shopping, but there's not enough goods to fill that demand. The backlog of container ships waiting for ports was one example. The Fed thinks inflation will drop in the first half of 2022 ... but they were wrong about inflation's duration before. And they keep adding more rate hikes, which seems like a response to higher inflation than expected.

When the Fed hikes "rates", it's the Fed funds rate - the rate large banks can borrow from the Fed. As those banks have to pay more, they demand higher rates to loan out their money. Bonds are impacted as well, but it's not linear - short duration bonds may be impacted by the full amount of the rate hike, while longer duration bonds might not react by as much. The part I'm less certain about is if 4 rate hikes means 0.25% each, or a total of 1% higher rates by the end of 2022.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

01-08-2022, 10:47 AM

01-08-2022, 10:47 AM

|

#22

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

I don't know how the year will progress but last year was great and yet we had some trying months.

Example: Vanguard Large Growth index (VUG or VIGAX) was up 27.2% in 2021. Yet January 2021 down -0.9% and September 2021 down -5.3%. So far this month it is down -5.2% after 5 trading days. So where is large tech headed?

Top 10 stocks in VUG that make up 50% of the index:

Apple

Microsoft

Alphabet

Amazon

Tesla

Nvidia

Meta

Home Depot

Adobe

Visa

The market can be volatile at times. Sometimes it is even describing a trend. But really, 5 trading days are not enough to hang your hat on. And I haven't figured out how to factor in Fed interest rate policy into a trading strategy.

|

|

|

01-08-2022, 11:52 AM

01-08-2022, 11:52 AM

|

#23

|

|

Moderator Emeritus

Join Date: Apr 2011

Location: Conroe, Texas

Posts: 18,735

|

Quote: Quote:

Originally Posted by Lsbcal

I don't know how the year will progress but last year was great and yet we had some trying months.

Example: Vanguard Large Growth index (VUG or VIGAX) was up 27.2% in 2021. Yet January 2021 down -0.9% and September 2021 down -5.3%. So far this month it is down -5.2% after 5 trading days. So where is large tech headed?

Top 10 stocks in VUG that make up 50% of the index:

Apple

Microsoft

Alphabet

Amazon

Tesla

Nvidia

Meta

Home Depot

Adobe

Visa

The market can be volatile at times. Sometimes it is even describing a trend. But really, 5 trading days are not enough to hang your hat on. And I haven't figured out how to factor in Fed interest rate policy into a trading strategy.

|

Not much with the FED is expected until March. But they are tapering QE by slowing down MBS purchases and that should help unload the FED's balance sheet.

There is still almost $2 Trillion dollars floating back and forth between the FED banks and other qualified institutions on a daily basis through reverse repos. This is money that has no place to go as they "printed" too much and the banks, etc, have not found borrowers for it.

__________________

*********Go Yankees!*********

|

|

|

01-08-2022, 12:12 PM

01-08-2022, 12:12 PM

|

#24

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2015

Posts: 1,890

|

Quote: Quote:

Originally Posted by aja8888

Not much with the FED is expected until March. But they are tapering QE by slowing down MBS purchases and that should help unload the FED's balance sheet.

There is still almost $2 Trillion dollars floating back and forth between the FED banks and other qualified institutions on a daily basis through reverse repos. This is money that has no place to go as they "printed" too much and the banks, etc, have not found borrowers for it.

|

QE is a double whammy: When they stop buying, rates go up and when they sell everything they bought, rates go up more. That will cause rates to be inflated until they sell everything, just like they were deflated when they bought it. I guess they could hold it all to maturity and let the treasury deal with the fallout.

__________________

Consistently sets low goals and fails to achieve them.

|

|

|

01-08-2022, 12:22 PM

01-08-2022, 12:22 PM

|

#25

|

|

gone traveling

Join Date: Nov 2021

Posts: 43

|

Quote: Quote:

Originally Posted by OverThinkMuch

Just to clarify some points that seem confused up above, growth stocks are those which have most of their earnings many years in the future. To calculate the value of those earning's today, they are divided by the interest rate for all the years in between. When inflation makes higher interest rates likely, those future returns get repeatedly divided by a larger number. That's why high P/E growth stocks take a big hit from inflation.

|

Rate of change in inflation does not impact the returns of value versus growth stocks. Those returns you mentioned are computed in inflation adjusted earnings. IE Discounted Cash Flow (DCF) Formula.

However interest rates are usually increased to combat high inflation, the corollary is that in times of high inflation, growth stocks will be more negatively impacted. In the other words it presents investors with an opportunity to load up on companies like MSFT, NVDA, FB, GOOG, AMD, QQQ etc

It also allows one to enjoy current returns of value stocks/Index ETFs like SCHD if you bought them when those stocks were on sale. That is when growth stocks were flying high.

|

|

|

01-08-2022, 12:44 PM

01-08-2022, 12:44 PM

|

#26

|

|

Moderator Emeritus

Join Date: Apr 2011

Location: Conroe, Texas

Posts: 18,735

|

Quote: Quote:

Originally Posted by corn18

QE is a double whammy: When they stop buying, rates go up and when they sell everything they bought, rates go up more. That will cause rates to be inflated until they sell everything, just like they were deflated when they bought it. I guess they could hold it all to maturity and let the treasury deal with the fallout.

|

They have already started tapering by buying less MBS's. With MBS's they can just let those mortgages "roll off" after the mortgages are paid off and that's what they typically do, but they have a huge load of them on the balance sheet so that will take a long while.

They are in a tight spot with inflation running amuck. If things get worse, inflation wise, watch for price controls on certain commodities like were implemented back after WWII and I believe in the early 1970's.

In any event, interest rates will go up on these balance sheet reduction and QE tapering measures unless the stock and bond markets crash so badly that the Pres/Congress goes nuts trying to protect their own personal portfolios! (then we may see the FED PUT!  )

Notice that globally, many countries central banks have already tapered and are raising interest rates significantly. Check Japan, Russia, Canada, etc.

__________________

*********Go Yankees!*********

|

|

|

01-09-2022, 08:56 AM

01-09-2022, 08:56 AM

|

#27

|

|

Recycles dryer sheets

Join Date: May 2016

Posts: 313

|

Quote: Quote:

Originally Posted by DjBrown

Rate of change in inflation does not impact the returns of value versus growth stocks. Those returns you mentioned are computed in inflation adjusted earnings. IE Discounted Cash Flow (DCF) Formula.

|

If you're trying to split hairs over inflation vs interest rates, can you name a time when the U.S. ignored inflation and kept interest rates the same? The Fed keeps an eye on inflation so it can raise interest rates (the Fed funds rate) to combat it.

Investopedia captures my thought on this:

"Therefore, when valuing stocks using the discounted cash flow method, in times of rising interest rates, growth stocks are negatively impacted far more than value stocks. Since interest rates are usually increased to combat high inflation, the corollary is that in times of high inflation, growth stocks will be more negatively impacted."

https://www.investopedia.com/article...ck-returns.asp

|

|

|

01-09-2022, 09:06 AM

01-09-2022, 09:06 AM

|

#28

|

|

Recycles dryer sheets

Join Date: May 2016

Posts: 313

|

Quote: Quote:

Originally Posted by aja8888

Not much with the FED is expected until March. But they are tapering QE by slowing down MBS purchases and that should help unload the FED's balance sheet.

|

Note the markets won't wait until March.

Polling the Fed revealed they have gone from 3 expected rate hikes to 4 this year. They've also gone past tapering - they might start tightening in 2022, which the market was not expected so soon.

10 year treasury rates moved up 0.27% in the past week. I think that signals the bond market finally believes the Fed will impact interest rates, and some of that is being priced in. But 4 rate hikes... I believe are 0.25% each. So that still leaves 0.73% of rate hikes not priced into the bond market.

https://www.treasury.gov/resource-ce...spx?data=yield

I have leveraged exposure to Financial Select Sector SPDR Fund (XLF), which went up +4% this week. That approach seems to be doing well so far, and I would assume performs well after each rate hike.

|

|

|

01-09-2022, 09:12 AM

01-09-2022, 09:12 AM

|

#29

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

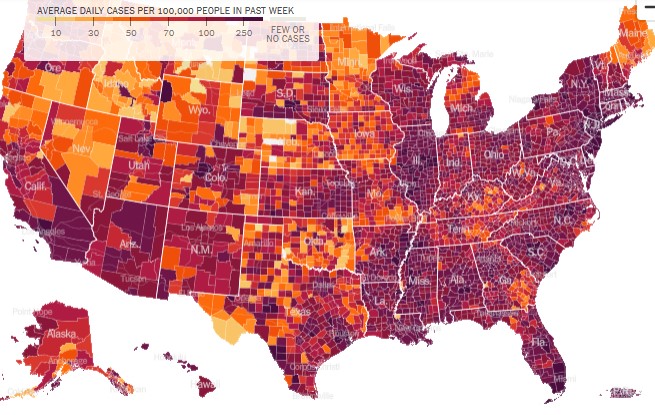

The current Covid infections are horrific. I would not be too sure of the near term market direction. NY Times chart of USA:

link: https://www.nytimes.com/interactive/...vid-cases.html

|

|

|

01-09-2022, 09:24 AM

01-09-2022, 09:24 AM

|

#30

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,154

|

Yeah, it’s bad. I’m very curious to see if the US exhibits the sharp spike then drop pattern as was seen in South Africa.

We’ve already exceeded over a million cases reported in one day, and the 7 day average will probably get there. And a lot of people are doing antigen tests at home which are not included in the reporting.

__________________

Retired since summer 1999.

|

|

|

01-09-2022, 09:35 AM

01-09-2022, 09:35 AM

|

#31

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,376

|

Quote: Quote:

Originally Posted by Lsbcal

|

But luckily while most of the cases reported are from Omnicron, the severity of the higher cases caused by Omnicron are much lower.

In the last week I have heard about many friends and family who have contracted covid... much more frequency than a year or 18 months ago... but none of the instances mentioned resulted in hospitalizations... symptoms ranged from none (totally asymptomatic) to sniffles to higher fever and flu-like symptoms.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

01-09-2022, 09:52 AM

01-09-2022, 09:52 AM

|

#32

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by pb4uski

But luckily while most of the cases reported are from Omnicron, the severity of the higher cases caused by Omnicron are much lower.

In the last week I have heard about many friends and family who have contracted covid... much more frequency than a year or 18 months ago... but none of the instances mentioned resulted in hospitalizations... symptoms ranged from none (totally asymptomatic) to sniffles to higher fever and flu-like symptoms.

|

Yes but will this slow the economy in a prolonged way? Will it slow the punch bowl removal? Will tech have a renewed run because work from home gets a refresh? Lots of uncertainty.

Hospitalizations in the USA are going way up and the CDC has said that this might peak later in the month. Is this a crisis brewing that we are too wherry to recognize?

I am scaring myself just theorizing on this.

|

|

|

01-09-2022, 10:05 AM

01-09-2022, 10:05 AM

|

#33

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2006

Location: Boise

Posts: 7,882

|

Quote: Quote:

Originally Posted by OverThinkMuch

But 4 rate hikes... I believe are 0.25% each.

|

They typically have been quarter point changes, but the Fed could do bigger or smaller. They have done half point rate changes in the not-to-distant past.

I think they'd rather be gradual though. It seems to me their preference is to just do quarter point hikes or drops every quarter until whatever they're addressing has responded to their satisfaction. Some would say they start too late, aren't aggressive enough, or go on too long sometimes. While I can understand those comments, I think that the Fed has a very challenging job and more or less gets it right.

__________________

"At times the world can seem an unfriendly and sinister place, but believe us when we say there is much more good in it than bad. All you have to do is look hard enough, and what might seem to be a series of unfortunate events, may in fact be the first steps of a journey." Violet Baudelaire.

|

|

|

01-09-2022, 10:25 AM

01-09-2022, 10:25 AM

|

#34

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,154

|

Quote: Quote:

Originally Posted by Lsbcal

Yes but will this slow the economy in a prolonged way? Will it slow the punch bowl removal? Will tech have a renewed run because work from home gets a refresh? Lots of uncertainty.

Hospitalizations in the USA are going way up and the CDC has said that this might peak later in the month. Is this a crisis brewing that we are too wherry to recognize?

I am scaring myself just theorizing on this.  |

Yeah, hospitalizations are going to exceed prior peak simply due to the sheer numbers - much higher total daily number of infections.

And unfortunately the hospitals are in much worse shape this time around due to staffing shortages and burnout/fatigue.

__________________

Retired since summer 1999.

|

|

|

01-09-2022, 10:51 AM

01-09-2022, 10:51 AM

|

#35

|

|

Moderator Emeritus

Join Date: Apr 2011

Location: Conroe, Texas

Posts: 18,735

|

Two friends in my ROMEO group got the virus over a week ago. They have been absent from our daily coffee meetups. Both are in their 70's and did not require hospitalization. They just stayed at home and are past it with minimal issues. both had the Moderna vaccinations and booster which probably helped minimize the effect.

I know the above report has nothing to do with the FED's game plan but it's timely info. Here's a tidbit of info with respect to the FED's QE situation and what is in store for tapering:

From mises.org

Jan 8,2022

https://mises.org/wire/federal-reser...ying-mortgages

Quote: Quote:

"The total assets of the Federal Reserve reached $8.7 trillion in November 2021. This is just about double the $4.5 trillion of November 2016, five years before—and we thought it was really big then. Today’s Federal Reserve assets are ten times what they were in November 2006, 15 years ago, when they were $861 billion, and none were mortgages."

“The Federal Reserve now owns on its balance sheet $2.6 trillion in mortgages. That means about 24% of all outstanding residential mortgages in this whole big country reside in the central bank, which has thereby earned the remarkable status of becoming by far the largest savings and loan institution in the world……

This $2.6 trillion in mortgages is 48% more than the Federal Reserve’s $1.76 trillion of five years ago, and of course, infinitely greater than the zero of 2006. Remember that from the founding of the Federal Reserve until then, the number of mortgages it owned had always been zero.”

|

The rest of the article is a good read and provides additional historical items.

__________________

*********Go Yankees!*********

|

|

|

01-09-2022, 11:50 AM

01-09-2022, 11:50 AM

|

#36

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2013

Posts: 11,078

|

Quote: Quote:

Originally Posted by audreyh1

Yeah, hospitalizations are going to exceed prior peak simply due to the sheer numbers - much higher total daily number of infections.

And unfortunately the hospitals are in much worse shape this time around due to staffing shortages and burnout/fatigue.

|

+1

DW'S SIL needs surgery and she can't get it in Florida at this time, looking like Atlanta as long as she can get in there. That doctor is currently out with Covid but did a zoom conference with her. She is dealing with serious problems and at this time they don't know what her real issue is.

|

|

|

01-09-2022, 01:57 PM

01-09-2022, 01:57 PM

|

#37

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2016

Posts: 1,336

|

This thread went off on a few tangents, but as far as the OP goes if you look at history fed hikes don't necessarily equate to falling stock prices. I think people wish it were that simple. Stocks typically peak at the end of a FED tightening phase when the yield curve inverts. We are far from that as of now.

The reality is that the yield curve is very healthy as of now ( 3 month bill rate of .09 and 10 year bond at 1.75). Thats a decent cushion for the banks and if in fact longer rates rise due to tapering they'll be in even better shape!

__________________

Retired 1/6/2017 at 50 years old

Immensely grateful

“The most important quality for an investor is temperament, not intellect.”—Warren Buffett

|

|

|

01-12-2022, 06:45 AM

01-12-2022, 06:45 AM

|

#38

|

|

Recycles dryer sheets

Join Date: May 2016

Posts: 313

|

Quote: Quote:

Originally Posted by FREE866

Stocks typically peak at the end of a FED tightening phase when the yield curve inverts. We are far from that as of now.

The reality is that the yield curve is very healthy as of now ( 3 month bill rate of .09 and 10 year bond at 1.75).

|

According to the Investopedia definition, it's 2 year and 10 year treasuries.

2021 ended with 2y at 0.73% and 10y at 1.52%.

Jan 11th, 2y is 0.90% and 10y at 1.75%.

That's a big rise for less than 2 weeks, and it was triggered by new expectations from the Fed. I think we'll see more in March, when the Fed is expected to act.

https://www.investopedia.com/terms/i...yieldcurve.asp

"One of the most popular methods of measuring the yield curve is to use the spread between the yields of ten-year Treasuries and two-year Treasuries to determine if the yield curve is inverted."

|

|

|

01-12-2022, 07:33 AM

01-12-2022, 07:33 AM

|

#39

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by OverThinkMuch

According to the Investopedia definition, it's 2 year and 10 year treasuries.

2021 ended with 2y at 0.73% and 10y at 1.52%.

Jan 11th, 2y is 0.90% and 10y at 1.75%.

That's a big rise for less than 2 weeks, and it was triggered by new expectations from the Fed. I think we'll see more in March, when the Fed is expected to act.

https://www.investopedia.com/terms/i...yieldcurve.asp

"One of the most popular methods of measuring the yield curve is to use the spread between the yields of ten-year Treasuries and two-year Treasuries to determine if the yield curve is inverted." |

I personally use the 3month, 10 year values. The last times this inverted was May-19 and still SP500 was up 11% until Jan-20. But then it inverted again in Jan-20 and then we had a 2 month crash due to the pandemic news.

I don't think one can easily hang ones hat on the indicator alone. But inversion would be a go slow indicator I think.

|

|

|

01-12-2022, 07:57 AM

01-12-2022, 07:57 AM

|

#40

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2016

Posts: 1,336

|

Quote: Quote:

Originally Posted by OverThinkMuch

According to the Investopedia definition, it's 2 year and 10 year treasuries.

2021 ended with 2y at 0.73% and 10y at 1.52%.

Jan 11th, 2y is 0.90% and 10y at 1.75%.

That's a big rise for less than 2 weeks, and it was triggered by new expectations from the Fed. I think we'll see more in March, when the Fed is expected to act.

https://www.investopedia.com/terms/i...yieldcurve.asp

"One of the most popular methods of measuring the yield curve is to use the spread between the yields of ten-year Treasuries and two-year Treasuries to determine if the yield curve is inverted." |

The fed funds rate is much more applicable than the 2 year and here is why:

Banks borrow at the shorter rate not the 2 year rate. Fed funds are still at .25 and with the 10 year rising the yield curve is actually steepening, which helps banks tremendously. So even a few rate hikes by the FED has them in a good position.

__________________

Retired 1/6/2017 at 50 years old

Immensely grateful

“The most important quality for an investor is temperament, not intellect.”—Warren Buffett

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|