|

|

Fed taking away the punch bowl

01-06-2022, 05:39 AM

01-06-2022, 05:39 AM

|

#1

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Fed taking away the punch bowl

Yesterday, the Dow dropped 393, and that's -1.07%. The S&P was down -1.94%, and the Nasdaq was the worst at -3.34%.

I was working on fixing a refrigerant leak on a mini-split, and when I got done and looked at my stocks again after the market closed, saw that the market had taken a hard tumble. The cause: the Fed's released meeting minutes showed a hawkish stance that the market did not expect. Hah!

Inflation was higher than 7% and people were shrugging it off, thinking the Fed would not dare taking away the punch bowl?

The ARK ETFs by Cathie Wood took a hard hit, losing more than 7% yesterday. I don't have any of these funds but look at them often as an indicator of market froth. They went up big in 2020, and when I learned of them in early 2021 they already topped out and have been going downhill since.

I have been watching my portfplio, and try not to have high P/E stocks. Even my growth tech stocks have a P/E not higher than that of the S&P. Not every stock went down. Some of my mining and industrial metal stocks went up yesterday, as well as some defensive names. Of course, more of my stocks went down than up, and my loss was more or less commensurate with my stock AA of 70%.

It's going to be an interesting year.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

01-06-2022, 07:08 AM

01-06-2022, 07:08 AM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2014

Posts: 1,543

|

I am expecting a strange year. Lots of balls in the air for us right now. DS passed in November and her son and I are closing that estate/selling house. etc... DM is in skilled nursing but most likely turning into LTC. To cover some unexpected costs and have some dry powder I cancelled all of my DRIP's and have scaled back my 401k contributions to get only the match. But, no selling for me. Will be switching from my airline miles card to my cash back card. Both vehicles are fine so only regular maint scheduled. November wedding for DD is half paid for already with deposits/prepaid etc... All but one of our income sources received raises this year. When DS estate is settled and LTC situation is clear, I will be looking for some low hanging fruit with equities. When/if the market is flat or loses big time I will put extra on the mortgage principal. Lots of options.

__________________

-Big Dawg-FI since 9/2010. Failed ER in 2015. 2/15/2023=DONE! "Blow that dough"-Robbie

" People say I'm lazy, dreaming my life away Well, they give me all kinds of advice designed to enlighten me When I tell them that I'm doing fine watching shadows on the wall "Don't you miss the big time, boy. You're no longer on the ball" -John Lennon-

|

|

|

01-06-2022, 07:12 AM

01-06-2022, 07:12 AM

|

#3

|

|

Thinks s/he gets paid by the post

Join Date: Feb 2014

Posts: 3,081

|

Just like the year 2000 the Fed printed like mad for Y2K, this time for pandemic reasons, and is now undoing it. Meme stocks, NFTs and Crypto are the top froth and are being taken down. Even the interest in FIRE is a froth as people think easy money investments will bail them out of work.

Most young investors have no experience of a hostile Fed, it should be interesting.

|

|

|

01-06-2022, 07:20 AM

01-06-2022, 07:20 AM

|

#4

|

|

gone traveling

Join Date: Nov 2021

Posts: 43

|

Quote: Quote:

Originally Posted by NW-Bound

I have been watching my portfplio, and try not to have high P/E stocks. Even my growth tech stocks have a P/E not higher than that of the S&P.

|

Rates will not change future of high P/E companies like Nvidia. Consider yourself lucky you can buy them now at a sale price.

|

|

|

01-06-2022, 08:50 AM

01-06-2022, 08:50 AM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Many companies will continue to do fine in terms of growing their sales. However, their valuation will change.

Nvidia is currently still valued at $702 billion, on the 2021 sales of $16.7 billion and profits of $4.3 billion. That's too rich for my taste. I already have some in the ETF SMH that I hold, and don't need to buy more. For individual stocks that I buy directly, I prefer a much more reasonable P/E ratio.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

01-06-2022, 11:21 PM

01-06-2022, 11:21 PM

|

#6

|

|

Full time employment: Posting here.

Join Date: Jan 2013

Posts: 620

|

Quote: Quote:

Originally Posted by jim584672

Most young investors have no experience of a hostile Fed, it should be interesting.

|

It should be a fun show to watch

|

|

|

01-07-2022, 06:34 AM

01-07-2022, 06:34 AM

|

#7

|

|

Recycles dryer sheets

Join Date: May 2016

Posts: 313

|

I sold all my cryptocurrency just before the Fed news was getting out, which was a strange experience. I see a risky year with potential Fed mistakes, valuation problems, and uncertainty not reflected in the market's optimism. So I escaped a -10% drop in ETH.

Look at the Fed's recent behavior. How many months did the Fed say inflation was transitory, before admitting they were wrong? I think it was November they expected 2 rate hikes in 2022... then 3 in December.. and now another month, another rate hike. If the Fed is unstable, do we expect stability in 2022?

I'm still heavily in equities - I've just removed leverage and high growth. My plan is to have less risk in a risky year... still investing in index funds, but not in high tech or high P/E companies that get hurt during inflation.

I'm keeping my leveraged bank and financial options - banks tend to do well when they can charge more.

|

|

|

01-07-2022, 08:11 AM

01-07-2022, 08:11 AM

|

#8

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2015

Posts: 1,890

|

I'm not an active investor, but like following those who are. I have heard that a volatile market is good for active investors vs. indexers. I don't know why that is. I guess it is possible that it separates the wheat from the chaff.

__________________

Consistently sets low goals and fails to achieve them.

|

|

|

01-07-2022, 09:28 AM

01-07-2022, 09:28 AM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Quote: Quote:

Originally Posted by corn18

I'm not an active investor, but like following those who are. I have heard that a volatile market is good for active investors vs. indexers. I don't know why that is. I guess it is possible that it separates the wheat from the chaff.

|

It can be good. Sometimes everything seems to get sold in a batch, the PE400,000 companies get sold along with the PE8 companies, then people realize maybe the PE8 company was ok and that one gets bought back.

|

|

|

01-07-2022, 09:32 AM

01-07-2022, 09:32 AM

|

#10

|

|

Thinks s/he gets paid by the post

Join Date: Aug 2015

Posts: 1,890

|

Quote: Quote:

Originally Posted by Fermion

It can be good. Sometimes everything seems to get sold in a batch, the PE400,000 companies get sold along with the PE8 companies, then people realize maybe the PE8 company was ok and that one gets bought back.

|

Is that happening now? Noticed the NASDAQ is dropping harder than the DOW or S&P500. Is that what happened in 2000?

__________________

Consistently sets low goals and fails to achieve them.

|

|

|

01-07-2022, 09:47 AM

01-07-2022, 09:47 AM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by Fermion

It can be good. Sometimes everything seems to get sold in a batch, the PE400,000 companies get sold along with the PE8 companies, then people realize maybe the PE8 company was ok and that one gets bought back.

|

+1

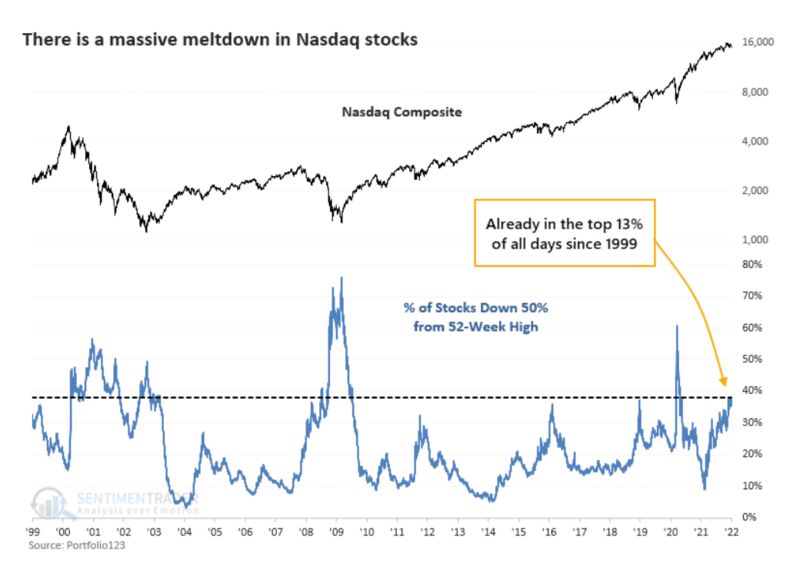

I just saw an interesting article which says that 40% of the Nasdaq stocks have lost 1/2 of the value from their high.

The article is on Bloomberg, which may not be reachable by all: "https://www.bloomberg.com/news/articles/2022-01-06/number-of-nasdaq-stocks-down-50-or-more-is-almost-at-a-record"

See the following chart that I linked. And yet, the Nasdaq index is not down that much yet.

After a bit of head scratching, I think it is because the megacaps gigacaps in the Nasdaq carry the ball, while the smaller names fall by the wayside. But eventually, these big "invincible" names with high P/E will come toppling down too. And there's a sign it is happening right now.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

01-07-2022, 09:50 AM

01-07-2022, 09:50 AM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by corn18

Is that happening now? Noticed the NASDAQ is dropping harder than the DOW or S&P500. Is that what happened in 2000?

|

Heh heh heh...

If there's anything I learned from the dotcom and tech fiasco from 2000, it's exactly that.

Heh heh heh...

What was projected to go to the moon will auger into the ground.

Heh heh heh...

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

01-07-2022, 09:56 AM

01-07-2022, 09:56 AM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by Fermion

It can be good. Sometimes everything seems to get sold in a batch, the PE400,000 companies get sold along with the PE8 companies, then people realize maybe the PE8 company was ok and that one gets bought back.

|

Forgot to add, another reason fairly valued companies get sold along with the overvalued ones is because of indexing and also bundling in ETFs.

Fewer people buy individual stocks. So, when they sold an ETF, they sold the whole batch.

And when they redeem their MF, the MF manager has to decide what to sell to raise the cash. And often, same as with individual investors the MF manager has a loss aversion and instead of dumping the problematic high P/E stocks, he hangs onto them hoping for a reversion, and sells the "innocent" stocks that have not been beaten down as badly.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

01-07-2022, 10:48 AM

01-07-2022, 10:48 AM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2006

Location: Boise

Posts: 7,882

|

Quote: Quote:

Originally Posted by corn18

I'm not an active investor, but like following those who are. I have heard that a volatile market is good for active investors vs. indexers. I don't know why that is. I guess it is possible that it separates the wheat from the chaff.

|

It's what active mutual fund managers always say when we hit a volatile patch. It's a pitch for their services and they hope to get additional AUM. It works because during volatile times people start to fear.

And it could be true except that the evidence shows that it isn't. Active managers are on average not better at investing whether it is during a turbulent time or a calm time.

__________________

"At times the world can seem an unfriendly and sinister place, but believe us when we say there is much more good in it than bad. All you have to do is look hard enough, and what might seem to be a series of unfortunate events, may in fact be the first steps of a journey." Violet Baudelaire.

|

|

|

01-07-2022, 11:31 AM

01-07-2022, 11:31 AM

|

#15

|

|

Recycles dryer sheets

Join Date: Sep 2021

Posts: 199

|

Quote: Quote:

Originally Posted by NW-Bound

Forgot to add, another reason fairly valued companies get sold along with the overvalued ones is because of indexing and also bundling in ETFs.

Fewer people buy individual stocks. So, when they sold an ETF, they sold the whole batch.

And when they redeem their MF, the MF manager has to decide what to sell to raise the cash. And often, same as with individual investors the MF manager has a loss aversion and instead of dumping the problematic high P/E stocks, he hangs onto them hoping for a reversion, and sells the "innocent" stocks that have not been beaten down as badly.

|

I think there are lots of reasons; these being some. I'd caution though anyone wanting to do a 'simple' compare to previous times. There are differences -- whether in just what triggers or outcome.

So, interest rates rise. Why? At a basic level, rates change when supply/demand changes -- but that can be on either the supply (lender) or demand (borrower) side. Currently, central bank(s) have previously had the position of unlimited supply; taking risk out of the equation to keep economy going. But now supply may get trimmed back while Congress increasing demand.....

So, interest rates rise. Why affect growth stocks more? Some are startups that have been burning cash & not generating positive earnings. Need cash? Always borrow more cheaply...until they can't. What about consumer having to pay more for credit card/mortgage/car loans etc? Will they keep buying gadgets? Could affect sales & thus earnings. Speaking of earnings, what does this do to present value of earning stream... makes it less profitable. Gap between return from earnings & what investor can get from bonds gets tighter.

I agree that index/etfs are a factor & would further say it is a growing factor. Some MFs use stock ETFs as really part of their cash management. Idle cash? buy an etf until needed...especially if cash isn't returning anything. Some pension funds will sell stocks to buy bonds to maintain their allocation, furthering the cycle.

Part of the key is how long this continues; it can almost feed on itself. Some tech companies have plenty of cash to weather a storm. How many folks were wondering why apple sold bonds when they had so much? Some companies will have a backlog of work -- esp with government growth plans -- that won't be stopped. Others may suspend growth plans which over time may have a ripple effect.

|

|

|

01-07-2022, 11:44 AM

01-07-2022, 11:44 AM

|

#16

|

|

Recycles dryer sheets

Join Date: Sep 2021

Posts: 199

|

Quote: Quote:

Originally Posted by corn18

I'm not an active investor, but like following those who are. I have heard that a volatile market is good for active investors vs. indexers. I don't know why that is. I guess it is possible that it separates the wheat from the chaff.

|

I'd suggest there are multiple reasons. Particularly if one isn't greedy. Most stocks won't be going in a straight line. They can buy & sell options & take small profits when opportunity arises. Requires patience. Some will sift through & find where they can sell one option & use those proceeds to buy another. Only way they don't make money is if the stock price doesn't move. Yes, they won't bat 1.000, but they also don't stand to lose much of original stake.

Look at a total stock index fund (cap weighted) . Buy the fund & you get 4000+ stocks. But 10 stocks make up more than 25%. Plenty of other stocks, usually in different sectors, that aren't affected the same way. Particularly true in cases where index going down slower than the top 10.

|

|

|

01-07-2022, 03:36 PM

01-07-2022, 03:36 PM

|

#17

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2012

Location: Reno

Posts: 1,338

|

Quote: Quote:

Originally Posted by NW-Bound

Yesterday, the Dow dropped 393, and that's -1.07%. The S&P was down -1.94%, and the Nasdaq was the worst at -3.34%.

The ARK ETFs by Cathie Wood took a hard hit, losing more than 7% yesterday. I don't have any of these funds but look at them often as an indicator of market froth. They went up big in 2020, and when I learned of them in early 2021 they already topped out and have been going downhill since.

I have been watching my portfplio, and try not to have high P/E stocks. Even my growth tech stocks have a P/E not higher than that of the S&P. Not every stock went down. Some of my mining and industrial metal stocks went up yesterday, as well as some defensive names. Of course, more of my stocks went down than up, and my loss was more or less commensurate with my stock AA of 70%.

It's going to be an interesting year.

|

I have some individual stocks in DW's smallest IRA rollover, most of which would be considered value stocks, and interestingly they have been up this week. (Micron is an exception). It will be interesting to see if we are seeing a movement towards value from growth (and if so whether it will have legs) and, I hesitate to mention, towards international?

Anyway your post reminds of this article I read lastnight on growth stocks, for what it is worth.

https://theirrelevantinvestor.com/20...growth-stocks/

|

|

|

01-07-2022, 05:57 PM

01-07-2022, 05:57 PM

|

#18

|

|

Recycles dryer sheets

Join Date: Oct 2013

Location: Chicago

Posts: 272

|

I recently heard one of the most catchy expressions about the excesses in the market.

"You can make a SPAC or a Coin or a meme out of a trashcan these days"

|

|

|

01-07-2022, 06:22 PM

01-07-2022, 06:22 PM

|

#19

|

|

Dryer sheet aficionado

Join Date: Dec 2021

Posts: 33

|

Quote: Quote:

Originally Posted by Bigdawg

To cover some unexpected costs and have some dry powder I cancelled all of my DRIP's and have scaled back my 401k contributions to get only the match.

|

Once your unexpected costs are met, you might consider ramping your 401k contributions back up to a comfortable max . . . but, if your plan allows, directing them into cash (or a money market fund).

Doing this will give you ready ammo on which to pull the trigger when you perceive that your target investments are at attractively low purchase prices. Again, only if this is something allowed by your 401k plan.

While w*king for my megacorp, I used this strategy over many years, with a Fidelity-run 401k plan. My objective was to retain the tax-deferred status of my investments, while beating my funds' annual returns by withholding my contributions when P/Es were high (directing payroll contributions into cash funds) and then deploying the accumulated cash once prices fell.

If I could purchase when a fund was below its January 1st NAV, I knew I was ahead of the game. With minimal effort I would be beating its annual return for the year.

Of course the success of this arbitrage-over-time strategy depends not only on your plan's flexibility, but on your willingness to monitor your holdings, and finesse the timing of your purchases. It's a way to transcend the mediocre returns of dollar cost averaging by accumulating cash, and then "buying low" when appropriate, rather then being imprisoned into a fixed, semi-monthly purchasing rhythm governed by your payroll department.

|

|

|

01-07-2022, 07:02 PM

01-07-2022, 07:02 PM

|

#20

|

|

Recycles dryer sheets

Join Date: May 2016

Posts: 313

|

Quote: Quote:

Originally Posted by free2020

I recently heard one of the most catchy expressions about the excesses in the market.

"You can make a SPAC or a Coin or a meme out of a trashcan these days"

|

It's worth considering how much of the market is invested in these. The stock market is roughly $50 trillion worth of assets. The 24 hour trading of the top joke/meme crypto coin (SHIB) is $1.2 billion... sounds like a lot, but it's tiny compared to the stock market.

The excitement over SPACs seems to have cooled. CNBC's tracking of top 50 SPACs shows a big decline after 2021 Q1. Hopes for great returns are not supported by data, which means investors get more cautious.

https://www.cnbc.com/quotes/.SPACCNBC

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|