|

|

03-25-2020, 01:33 PM

03-25-2020, 01:33 PM

|

#1

|

|

Recycles dryer sheets

Join Date: Mar 2013

Posts: 106

|

Good day to sell?

Good day to sell if you havenít?!? Or did we bottom two days ago and this is the rebound?

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

03-25-2020, 02:39 PM

03-25-2020, 02:39 PM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2004

Location: Diablo Valley (SF Bay Area)

Posts: 2,705

|

I stink at market timing. So in that I bought 2 individual stocks today I'd say " it's a great time."

|

|

|

03-25-2020, 02:42 PM

03-25-2020, 02:42 PM

|

#3

|

|

Full time employment: Posting here.

Join Date: Jan 2008

Location: Flyover America

Posts: 679

|

Nobody knows nothin.....

|

|

|

03-25-2020, 02:43 PM

03-25-2020, 02:43 PM

|

#4

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2004

Location: Diablo Valley (SF Bay Area)

Posts: 2,705

|

Quote: Quote:

Originally Posted by capjak

Nobody knows nothin.....

|

[emoji106][emoji106]

|

|

|

03-25-2020, 02:46 PM

03-25-2020, 02:46 PM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,154

|

Quote: Quote:

Originally Posted by moneymaker

Good day to sell if you havenít?!? Or did we bottom two days ago and this is the rebound?

|

Do you really think someone knows the answer to that?

__________________

Retired since summer 1999.

|

|

|

03-25-2020, 02:50 PM

03-25-2020, 02:50 PM

|

#6

|

|

Full time employment: Posting here.

Join Date: May 2011

Posts: 770

|

It's a good day to sell if you believe the market will continue dropping, but if you think the market will rise from here it's a good day to buy. Hope that helps. [emoji43]

__________________

you interpret daily life according to your ideas of what is possible or not possible - Seth Speaks

|

|

|

03-25-2020, 02:51 PM

03-25-2020, 02:51 PM

|

#7

|

|

Full time employment: Posting here.

Join Date: Jun 2014

Posts: 521

|

Quote: Quote:

|

Do you really think someone knows the answer to that?

|

I know that if you say it's the bottom and I say it's not the bottom, one of us will be right.

|

|

|

03-25-2020, 03:00 PM

03-25-2020, 03:00 PM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2013

Posts: 9,358

|

My best guess is yes.

__________________

Even clouds seem bright and breezy, 'Cause the livin' is free and easy, See the rat race in a new way, Like you're wakin' up to a new day (Dr. Tarr and Professor Fether lyrics, Alan Parsons Project, based on an EA Poe story)

|

|

|

03-25-2020, 03:08 PM

03-25-2020, 03:08 PM

|

#9

|

|

Thinks s/he gets paid by the post

Join Date: Dec 2014

Location: St. Charles

Posts: 3,919

|

Quote: Quote:

Originally Posted by moneymaker

Good day to sell if you havenít?!? Or did we bottom two days ago and this is the rebound?

|

Given the big drop at the end of the day, I guess there were a lot of traders that thought it was a good time to sell.

For us, we don't NEED to sell, so we won't. If I needed to fund the next years expenses, yes, I would have sold today, but just 1-2 years, not the whole shebang.

Just me. You may be right, I might be crazy, but it might just be a lunatic... nevermind.

__________________

If your not living on the edge, you're taking up too much space.

Never slow down, never grow old!

|

|

|

03-25-2020, 04:09 PM

03-25-2020, 04:09 PM

|

#10

|

|

Recycles dryer sheets

Join Date: Mar 2013

Posts: 106

|

This is just open for discussion to generate some insight and opinions.

Two days in the green- thought it was worthy to discuss.

I obviously have no idea which is why I posted. Iím kinda hoping it goes down for a while, maybe Dow 15k? Iím 37 and would love to be buying in that area!

|

|

|

03-25-2020, 04:10 PM

03-25-2020, 04:10 PM

|

#11

|

|

Recycles dryer sheets

Join Date: Mar 2013

Posts: 106

|

Quote: Quote:

Originally Posted by audreyh1

Do you really think someone knows the answer to that?

|

Donít take things so literal. Obviously no.

|

|

|

03-25-2020, 08:10 PM

03-25-2020, 08:10 PM

|

#12

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2013

Location: Twin Cities

Posts: 3,941

|

Whereís that chart showing how investors trying to time the stock market do exactly the wrong thing at the right time?

|

|

|

03-25-2020, 08:40 PM

03-25-2020, 08:40 PM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2016

Location: Colorado

Posts: 8,971

|

It depends....

|

|

|

03-25-2020, 09:44 PM

03-25-2020, 09:44 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Go back to sleep. Set your alarm for March of 2022.

|

|

|

03-26-2020, 06:47 AM

03-26-2020, 06:47 AM

|

#15

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2007

Posts: 1,085

|

I believe that 10 years from now, the stock market will be higher than it is today. What it does between now and then (especially in the next 6 months or so) I have no idea. I do think there will be a lot of volatility in the short term though.

|

|

|

03-26-2020, 06:55 AM

03-26-2020, 06:55 AM

|

#16

|

|

Full time employment: Posting here.

Join Date: Feb 2012

Posts: 648

|

I'll qualify my answer with the fact that in the past I've been incredibly wrong when I attempted to market time... but that with this current market I've gotten it mostly right (at least so far it appears that way).

I took out a lot of cash when the DOW was at 29,200

I put a third of it back in at 22,500

I put another third of it back in at 19,200

I put the last third of it back in two days ago around 20,000ish...

I don't think there is much of a possibility of a fast recovery back to where we were in February... so probably more downside risk than up. I just didn't want to miss the sales. I think it's safe to say in 3 years the market will be higher than it is now (famous last words though... right?)

A lot of what's happening with this market doesn't look familiar when peaking back at 100+ years of history. The fall was way too fast/sudden. There really is no sense of what comes after that kind of change.

I did see a chart this morning that showed what happened 6 months, 12 months, 3 years after each 10% single day climb (I think there have been a half dozen) the market has had in history. In every case but one the 3 year out look from that point forward was very good. In the neighborhood of 15-17% average annual returns. Indicating now is a really good time to get Value stocks.

I will say however, the one case where that didn't happen was 1929... there was a day where the markets shot back up 10% and the next three years weren't all that great... as we know. However in 1933 it happened again with a 15% rise in a single day (I believe). The three years following that one were outstanding. Tuesday... smells a bit like that one outlier, maybe?

So again, who knows...

|

|

|

03-26-2020, 08:22 AM

03-26-2020, 08:22 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by Markola

Whereís that chart showing how investors trying to time the stock market do exactly the wrong thing at the right time?

|

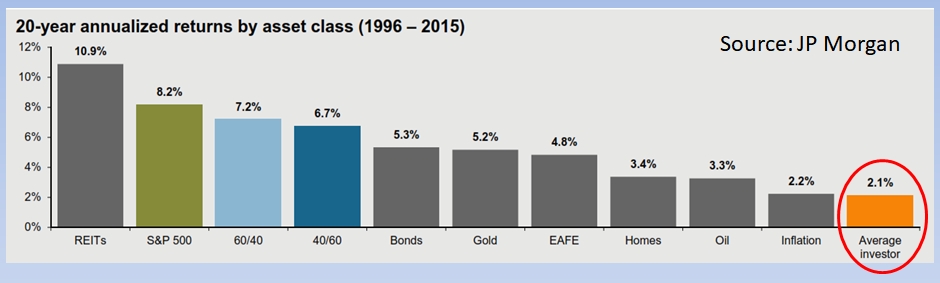

Well, I can't hit that bullseye exactly, but I can offer some circumstantial evidence. Here is a graphic that I use in my Adult-Ed investing course:

My words that go with the chart speculate that there are four reasons for the underperformance: (1) Fear of investing in stocks, (2) Fear leading to selling into sharp market declines, (3) Attempting to time the market, (4) Trading instead of Investing

And, really, #s 2, 3,and 4 are just forms of market timing.

Circumstantial evidence, second example: When I was laying out the course in 2018 I spent some time talking to a TDAmeritrade branch manager. This was following 2017 where various indices were up 20-40%. Since TDAmeritrade at that time was really specializing in serving amateur traders, I asked her what their customers had achieved in 2017. There was a long, embarressed pause an then she said: "One and a half percent." Same argument again: short term trading is another form of market timing.

The thing about timing the market is that when volatility is high, it is relatively easy to get lucky. But it is not possible to get consistently lucky. We are seeing posts here from people who legitimately got lucky trying to time this market and got out, but we are not seeing how things turn out after they get back in again. Some will again get lucky and we will hear from them. Others will end up missing the recovery. We will not hear from them.

|

|

|

03-26-2020, 10:22 AM

03-26-2020, 10:22 AM

|

#18

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jan 2006

Location: Rio Grande Valley

Posts: 38,154

|

Quote: Quote:

Originally Posted by moneymaker

Don’t take things so literal. Obviously no.

|

Then why do people keep asking questions like this if they already know the answer?

I am a pretty literal person regardless.

__________________

Retired since summer 1999.

|

|

|

03-26-2020, 11:53 AM

03-26-2020, 11:53 AM

|

#19

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2005

Posts: 4,366

|

At -20% or more down I'm a buyer. I bought at -20% and -30%, reducing my bond allocation. On the way back up I'd like to wait until we hit -0% before restoring my allocation to normal. I don't know what the market will do, up or down, but I know buying at -20% or more down from a peak is a pretty good deal.

|

|

|

03-26-2020, 12:02 PM

03-26-2020, 12:02 PM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Aug 2011

Location: West of the Mississippi

Posts: 17,266

|

Even a dead cat will bounce if you drop it from high enough. Or so they say.

I will readjust my AA if there is another big drop. And/or do more Roth conversions. But, no way I am going to bet the farm on a quick V shaped recovery. The Bear Market of 1973-74 took over 20 years to get back to even on a real basis.

__________________

Comparison is the thief of joy

The worst decisions are usually made in times of anger and impatience.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|