@MarieL, I teach a six-hour Adult-Ed class on investing. On the wrap-up slide I tell them this: "Investing is boring. If you're not bored, you're not doing it right."

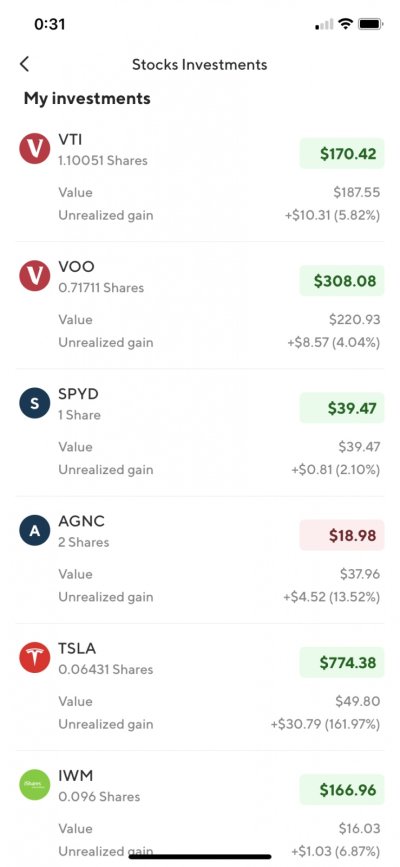

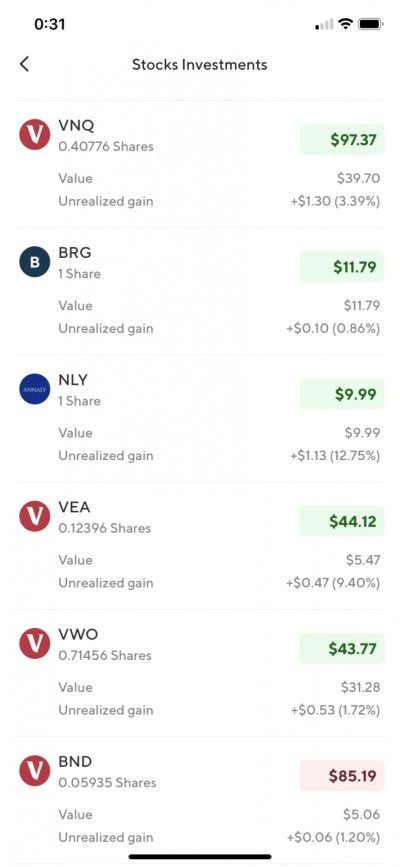

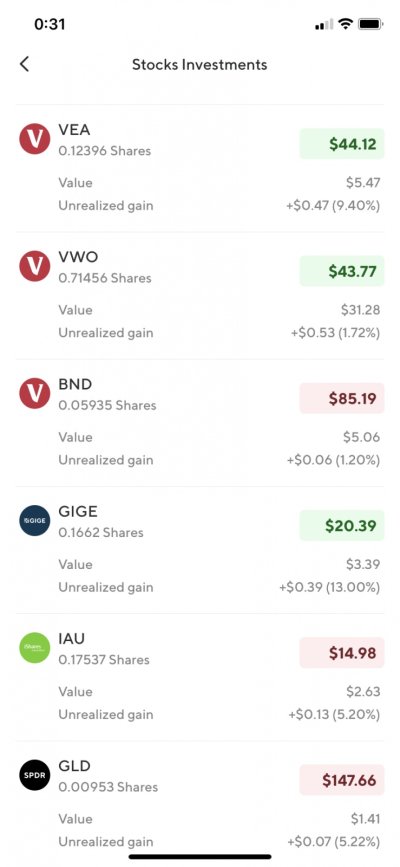

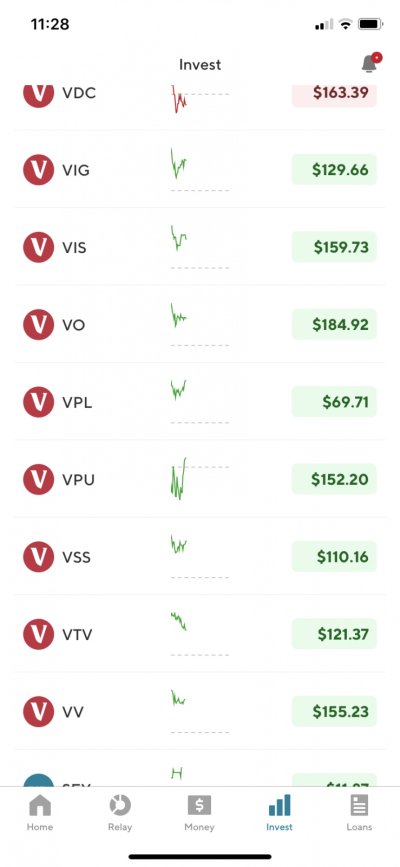

With that portfolio I don't think you're bored. To echo others, it is way too complex. Waaaay too complex.

With regard to diversification you seem to be making a common mistake. The point of diversification is to own a large number of stocks (probably over 100) arranged across size, line-of-business, and geographic categories. With that number (or more) the zigs and the zags of individual stocks cancel each other out. The academics would say "You have diversified away individual stock risk, leaving only market risk, which cannot be diversified away in an equity portfolio." So ... one mutual fund with the proper constituents (like "total US market") is all you need to be diversified. And, actually, if you add little bits and snippets like a small cap fund you are reducing diversification by a tiny amount.

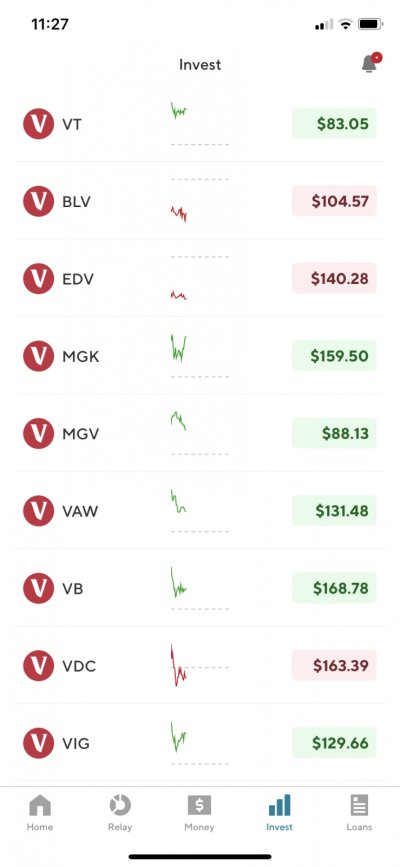

Back to the portfolio, I suggest that you lock your frenzied investing mouse in a closet and take time to read "The Coffee House Investor" by Bill Schultheis and "The Bogleheads Guide to Investing" by Taylor Larimore et al. After those, "Winning the Loser's Game" by Charles Ellis or "A Random Walk Down Wall Street" by Burton Malkiel.

For reference, DW and I have 90% of our seven-figure portfolio in just three funds: VTWAX, total world stocks, and two funds/US Total Market and International Total Market in a proportion that makes them behave like VTWAX. Really we should sell the two and buy VTWAX; we only hold them for obsolete historical reasons. Buying the world is the ultimate in diversification.

Relax. Get bored. And continue your good savings practices. You will win the game with patience and without needless effort.