NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

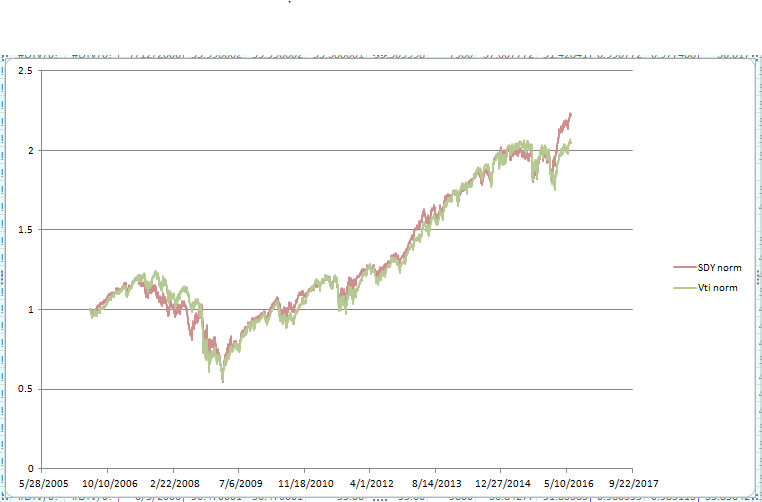

The difference is in whether dividends are included or not. Charts on many Web sites show only the share prices, and not total returns.

I use Morningstar when looking for total returns with dividends reinvested. And it says that over the last 10 years, the annualized return of SDY is 8.46%, and that of VTI is 7.74%.

I use Morningstar when looking for total returns with dividends reinvested. And it says that over the last 10 years, the annualized return of SDY is 8.46%, and that of VTI is 7.74%.