So I know the question of "what international stock allocation should I have" gets batted around here from time to time, but as I finish my rebalancing, I always seem to struggle here. I am 12 months away from my "plan" to RE (should I choose to or the markets not blow up on me) and I find as each year passes and I reevaluate my AA, I get somewhat more conservative as I have bought into the philosophy of "if you have won the game, why keep on playing". That said, at this point, I feel I will ride off into the sunset with a 60/40 AA and maintain that for the foreseeable future. While my AA generally stays set every year at 60/40, I tinker some with what makes up the stock/bond allocations. Like many, I rely on the calculators/simulators that use past history and perhaps some temperament on future returns to help set my path moving forward each year. As it relates to the international stock allocation portion, I get both arguments... 1) US stock allocation gives you enough international exposure by itself or 2) a 15% - 25% international allocation is recommended in this world economy. As I get older, I tend to lean towards 1) and currently hold about 10% in international thinking I may just want to stay there and further raise my US allocation. Yes, US CAPE is high and international stocks have been beaten up lately making them look like a better buy, but I tend to think based on my end game there is less long term risk in staying more heavily weighted in US stocks than increasing my exposure to international.

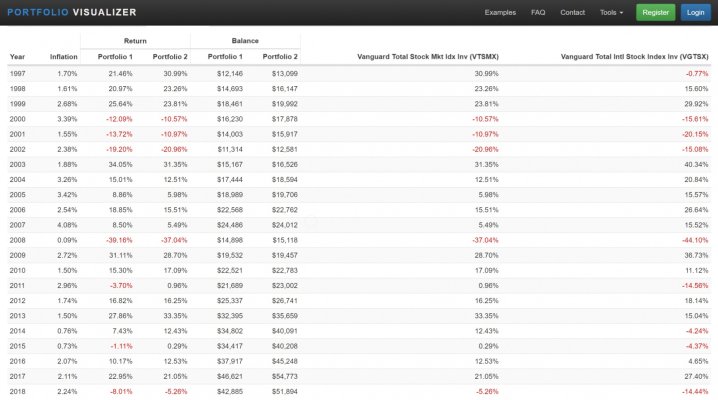

Has anyone put some the indexes next to each other comparing long term returns? Eg. S&P, DOW, Nasdaq, Large/Small Foreign, Emerging Market indexes in a pretty side by side chart showing returns/volatility?

Aside from most of the "professional" AA advice recommending a portion in international stocks for diversification, give me your arguments for 1) or 2), especially if you are in/about to retire.

Has anyone put some the indexes next to each other comparing long term returns? Eg. S&P, DOW, Nasdaq, Large/Small Foreign, Emerging Market indexes in a pretty side by side chart showing returns/volatility?

Aside from most of the "professional" AA advice recommending a portion in international stocks for diversification, give me your arguments for 1) or 2), especially if you are in/about to retire.