freedom2022

Recycles dryer sheets

- Joined

- Sep 24, 2021

- Messages

- 131

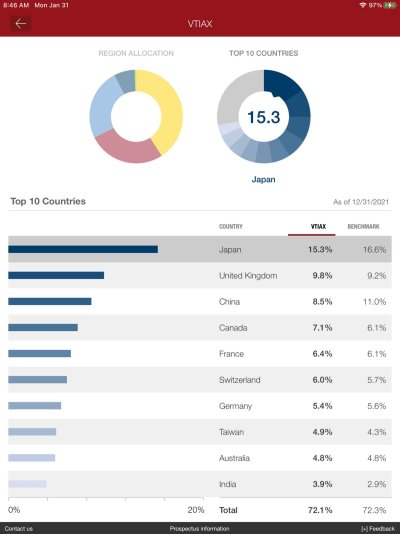

Most international stocks etf weight heavily on Japan's big corporations.

It is understandable since Japan is number 3 in the world GDP.

However, Japan's economy has been stagnant for a couple decades.

I come to think it is better to own country based etf such as EWG,

iShares MSCI Germany ETF.

Any thoughts? Thanks in advance.

It is understandable since Japan is number 3 in the world GDP.

However, Japan's economy has been stagnant for a couple decades.

I come to think it is better to own country based etf such as EWG,

iShares MSCI Germany ETF.

Any thoughts? Thanks in advance.