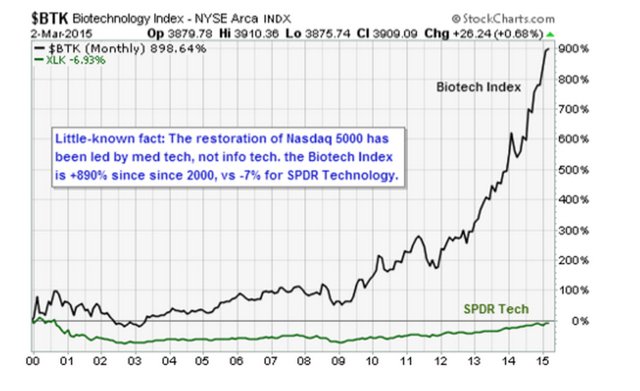

From @StockTwits: Biotech is the best performing sector of the decade:

2015 (so far) +17%

2014 +34%

2013 +67%

2012 +29%

Huge breakthrough in oncology area. People will live longer because of these progresses and you will need more treatment and more $$$. Recalibrate your er model and invest in this business to fund your medical expense down the road. I remember one member said here using your AT&T dividend to pay your monthly phone bills. Same idea here.

Sent from my iPad using Early Retirement Forum

2015 (so far) +17%

2014 +34%

2013 +67%

2012 +29%

Huge breakthrough in oncology area. People will live longer because of these progresses and you will need more treatment and more $$$. Recalibrate your er model and invest in this business to fund your medical expense down the road. I remember one member said here using your AT&T dividend to pay your monthly phone bills. Same idea here.

Sent from my iPad using Early Retirement Forum