Some of you may recognize me the newbie here to the forum, and I am hoping to get some additional insight into my investing. So far the advice you folks have given has been invaluable.

After finally getting "serious" about the wife and I's financed (I will admit getting married 7months ago also helped force the issue), I have finally tracked down what I think is all of our accounts.

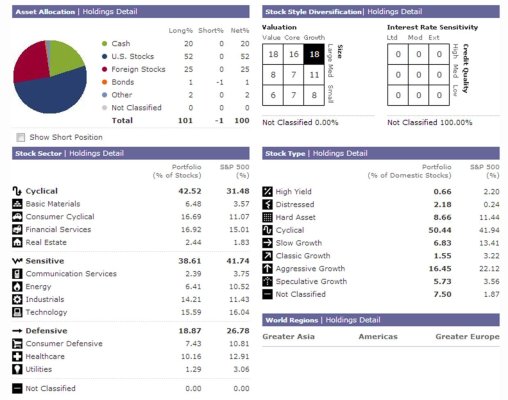

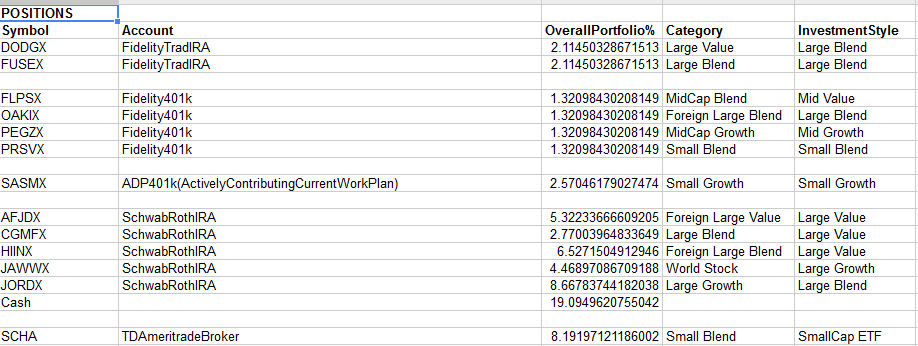

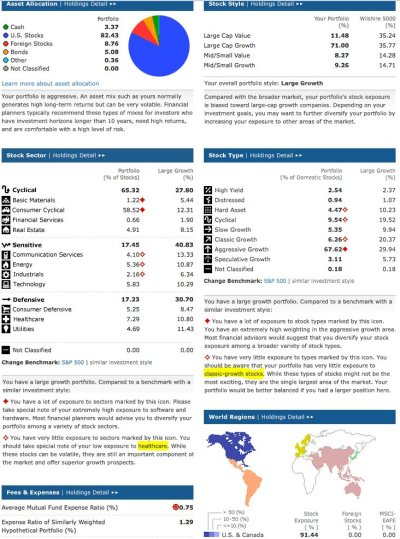

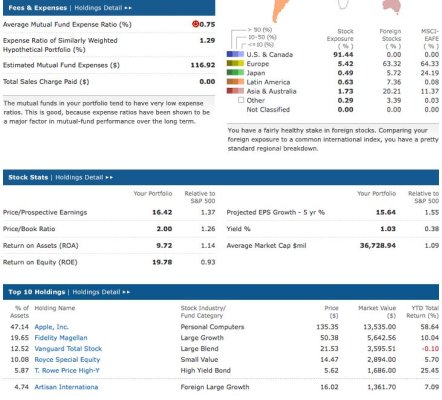

And what I found is we hold 13 positions across 5 different accounts. I feel I am more than diversified but if I were going to change up any elections it would be on the Schwab Roth account that holds 5 positions. A couple of the funds in that portfolio are a bit weak according to Morningstar with only 1 and 2 stars.

We will also be opening an additional traditional IRA by year end and will need to find a fund home for this lonesome $5,500 that you all are welcome to recommend for us. I don't own any vanguard yet so I am open to those funds

POSITIONS

SYM ACNTTYP ALLOC

DODGX FidelityTradIRA 50%

FUSEX FidelityTradIRA 50%

(12.11% of total portfolio)

FLPSX Fidelity401k 25%

OAKIX Fidelity401k 25%

PEGZX Fidelity401k 25%

PRSVX Fidelity401k 25%

(30.366% of total portfolio)

SASMX ADP401k 100%

(3.75%of total portfolio)

AFJDX SchwabRothIRA 11.31%

CGMFX SchwabRothIRA 5.85%

HIINX SchwabRothIRA 13.84%

JAWWX SchwabRothIRA 9.52%

JORDX SchwabRothIRA 18.42%

(45.27% of total portfolio)

SCHA TDAmeritradeBroker 100%

(8.49% of total portfolio)

After finally getting "serious" about the wife and I's financed (I will admit getting married 7months ago also helped force the issue), I have finally tracked down what I think is all of our accounts.

And what I found is we hold 13 positions across 5 different accounts. I feel I am more than diversified but if I were going to change up any elections it would be on the Schwab Roth account that holds 5 positions. A couple of the funds in that portfolio are a bit weak according to Morningstar with only 1 and 2 stars.

We will also be opening an additional traditional IRA by year end and will need to find a fund home for this lonesome $5,500 that you all are welcome to recommend for us. I don't own any vanguard yet so I am open to those funds

POSITIONS

SYM ACNTTYP ALLOC

DODGX FidelityTradIRA 50%

FUSEX FidelityTradIRA 50%

(12.11% of total portfolio)

FLPSX Fidelity401k 25%

OAKIX Fidelity401k 25%

PEGZX Fidelity401k 25%

PRSVX Fidelity401k 25%

(30.366% of total portfolio)

SASMX ADP401k 100%

(3.75%of total portfolio)

AFJDX SchwabRothIRA 11.31%

CGMFX SchwabRothIRA 5.85%

HIINX SchwabRothIRA 13.84%

JAWWX SchwabRothIRA 9.52%

JORDX SchwabRothIRA 18.42%

(45.27% of total portfolio)

SCHA TDAmeritradeBroker 100%

(8.49% of total portfolio)

Last edited: