targatom2019

Recycles dryer sheets

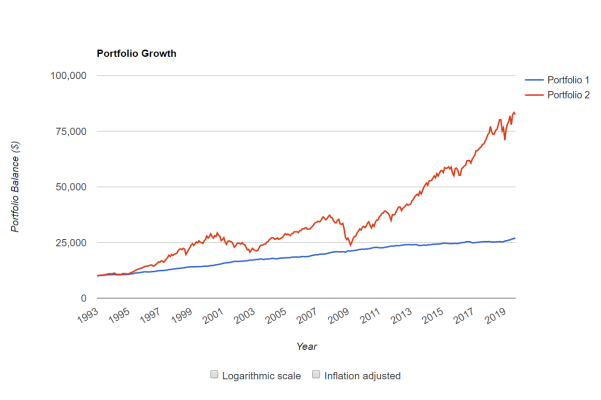

I was making 120K per year and all of my investments were in 100% equities the last 25 years but I just quit my high stress job at the age of 50 and have about 3mill in all my investment accounts(Rollover IRA, Roth and brokerage account). I have zero debt, 150K cash for emergency fund, I am currently in 60/40 and I DO NOT need to touch my investment accounts since my rental income covers all my expenses.

Thanks

Thanks

Last edited: