Enjoy the Ride

Dryer sheet wannabe

I bought Target on 8/7/14 and it's gone up 25% since then. At that time, I think their revenue forecast was down and having some trouble with Canadian operation. I figured it's a good dividend play so it'll probably go back up. If not, I'll just hold onto it for dividends. It's got a solid history of dividends so can't really go wrong. My sell target originally was when it goes up about 17%, which is 52 week high.

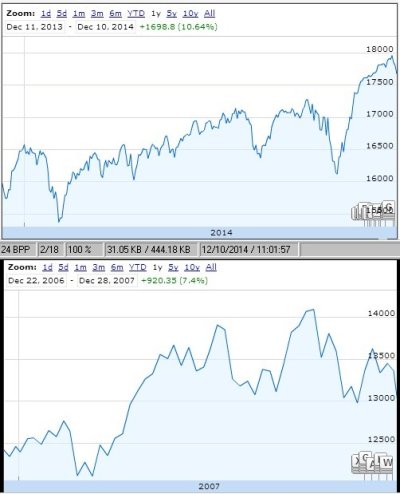

As you can tell, I don't know much about this stock. Extent of my research is reading Value Line report. Should I sell this? If I sell, don't know what to do with cash… it'll probably just sit in cash b/c I don't see any other good dividend stocks that are undervalued and market index seems pretty high.

As you can tell, I don't know much about this stock. Extent of my research is reading Value Line report. Should I sell this? If I sell, don't know what to do with cash… it'll probably just sit in cash b/c I don't see any other good dividend stocks that are undervalued and market index seems pretty high.