Cortina

Recycles dryer sheets

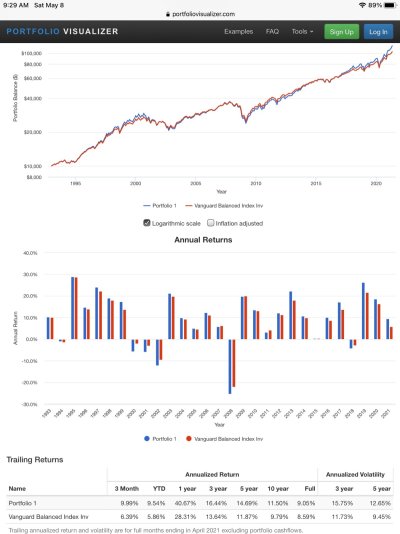

Nothing new here , just a "real example" with some actual figs .............

In July 2016 , I opened an account with Schwab ("forced" on me , by Smith Barney not wanting to deal anymore with accounts owned by non US residents) - Grand : So I transfered in cash and some Stock, 95% of value was in stock. Lot of money for me - figure is irrelevant , but there were 6 digits in total $.

Up to now I have worked hard with it - buying stock , selling stock - not trying to time markets , but just make sensible profits where I could and trying to diversify from the one stock I started with . Up to today , I have a return of 157% (cash is now about 20% of total , and I have seven holdings vs the one I started with)

I was feeling quite good about this ................ untill

I calculated what my return would have been if I had done NOTHING.

Answer : up 190% , and that's ignoring any return and the compounding affect of reinvesting dividends from those initial shares

Hmm ..... I don't feel so good (smart) anymore. me thinks there is a lesson in there somewhere !

In July 2016 , I opened an account with Schwab ("forced" on me , by Smith Barney not wanting to deal anymore with accounts owned by non US residents) - Grand : So I transfered in cash and some Stock, 95% of value was in stock. Lot of money for me - figure is irrelevant , but there were 6 digits in total $.

Up to now I have worked hard with it - buying stock , selling stock - not trying to time markets , but just make sensible profits where I could and trying to diversify from the one stock I started with . Up to today , I have a return of 157% (cash is now about 20% of total , and I have seven holdings vs the one I started with)

I was feeling quite good about this ................ untill

I calculated what my return would have been if I had done NOTHING.

Answer : up 190% , and that's ignoring any return and the compounding affect of reinvesting dividends from those initial shares

Hmm ..... I don't feel so good (smart) anymore. me thinks there is a lesson in there somewhere !