Romer

Recycles dryer sheets

I rolled my 401K over into my Schwab IRA so I have some cash to invest

I plan on an Indexed fund, a bond fund, maybe an international fund and a maybe some stocks. Lots of threads on those products

Not saying I am buying this stock, but interested in opinions on this based on how I am looking at the parameters and if I am missing anything.

I was looking for stocks that pay dividends with low risk of going belly up

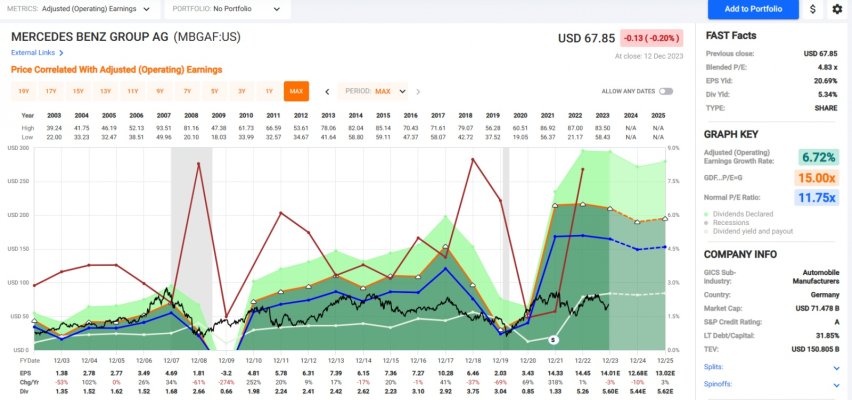

Came across Mercedes Benz in a stock screener Mercedes Benz Group MBGAF

Currently $67 a share which is half way between 52 week high and low

It pays an annual dividend that has a return rate of 8.44%

It is rated well by all the services supporting Schwab

It's debt has reduced over the last 5 years. It's long term debt to equity is 70 which isn't bad nor really good (I think). Honda is lower with a ratio of 42 where as Ford is above 200.

Price to earnings ratio is 4.4. I believe that is low so it is undervalued

EPS 15.28 which is 15 times what Ford is. That is good I believe

again, interested in how more experienced folks would look at this stock, what additional parameters etc. This is how I selected stocks previously and have had some real winners and a few losers over the last 40 years. Never had anyone to run the methodology I picked up reading with anybody before.

I am not asking for you to give me the loaf of bread, but to help me grow the wheat to better pick the bread I bake Am I growing the wheat correctly is a better way to put it.

Am I growing the wheat correctly is a better way to put it.

Lots of other threads on funds, Bonds, etc. This thread is focused on this stock and are there better ways to look at it then I am.

I plan on an Indexed fund, a bond fund, maybe an international fund and a maybe some stocks. Lots of threads on those products

Not saying I am buying this stock, but interested in opinions on this based on how I am looking at the parameters and if I am missing anything.

I was looking for stocks that pay dividends with low risk of going belly up

Came across Mercedes Benz in a stock screener Mercedes Benz Group MBGAF

Currently $67 a share which is half way between 52 week high and low

It pays an annual dividend that has a return rate of 8.44%

It is rated well by all the services supporting Schwab

It's debt has reduced over the last 5 years. It's long term debt to equity is 70 which isn't bad nor really good (I think). Honda is lower with a ratio of 42 where as Ford is above 200.

Price to earnings ratio is 4.4. I believe that is low so it is undervalued

EPS 15.28 which is 15 times what Ford is. That is good I believe

again, interested in how more experienced folks would look at this stock, what additional parameters etc. This is how I selected stocks previously and have had some real winners and a few losers over the last 40 years. Never had anyone to run the methodology I picked up reading with anybody before.

I am not asking for you to give me the loaf of bread, but to help me grow the wheat to better pick the bread I bake

Lots of other threads on funds, Bonds, etc. This thread is focused on this stock and are there better ways to look at it then I am.