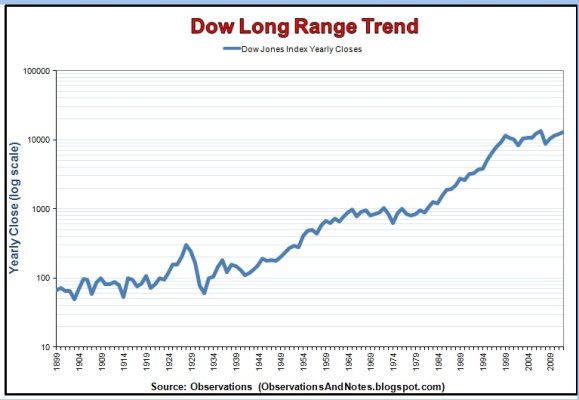

As Dow approaches 15 k and above looking to move out of equities in anticipation of the coming stock market correction.

Question is, what Vanguard or Fidelity funds are closet to cash without going to the money market and to at least be above the 0.7 - 1.0 % management fee. In other words a fund that gets me out of equities that returns at least 1.5-2% to avoid becoming a negative return overall.

The goal is to sell SOON and be on the sideline during the downward correction ( as in the period 2007-2010 ). I recognize the sale would be a taxable event except for those funds in my IRA.

Question is, what Vanguard or Fidelity funds are closet to cash without going to the money market and to at least be above the 0.7 - 1.0 % management fee. In other words a fund that gets me out of equities that returns at least 1.5-2% to avoid becoming a negative return overall.

The goal is to sell SOON and be on the sideline during the downward correction ( as in the period 2007-2010 ). I recognize the sale would be a taxable event except for those funds in my IRA.