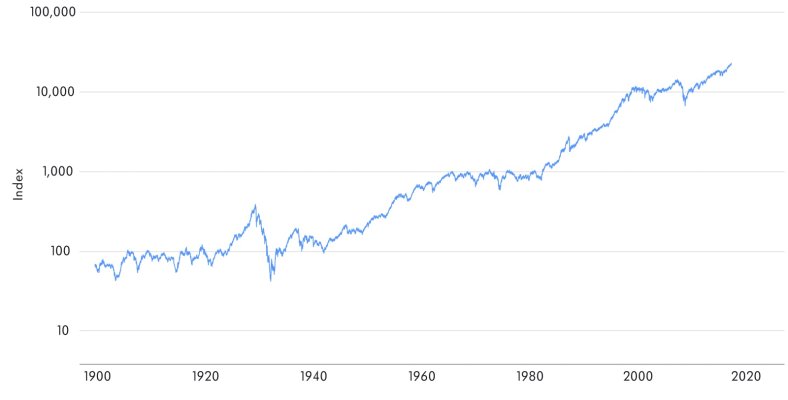

Due mainly to stimulus measures, the U.S. deficit is expected to hit $3 trillion this year; meanwhile, total assets held by the Federal Reserve are on their way to $9 trillion...

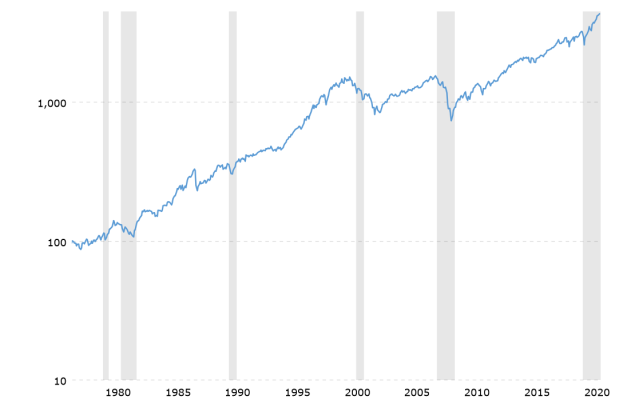

According to Morningstar, mutual funds and ETFs saw net inflows of $722 billion in the first six months of the year, the largest semiannual amount going back to 1993. As of the end of 2020, a record $5.4 trillion sat in funds that passively track the S&P 500, Axios reports...

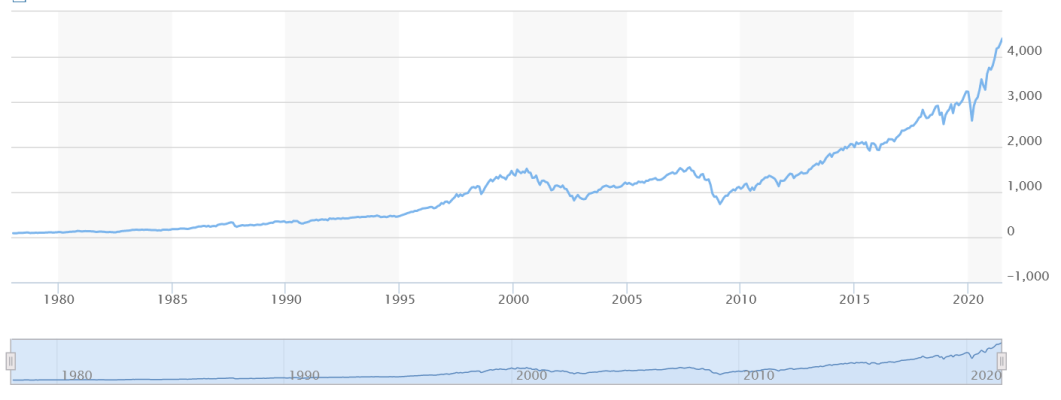

Stocks as a percent of households’ financial assets are above 40% for the first time ever. What’s more, Americans are trading on margin like never before. At the end of June, margin accounts totaled an unheard-of $882 billion, up 50% from just a year earlier...

Thanks in large part to $1,200 stimmy checks, there’s been an explosion in the number of retail investors. Ahead of its initial public offering (IPO), Robinhood reports that it now has as many as 18 million users, up almost double from 2019...

Of course. Brain fart!

Of course. Brain fart!