COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

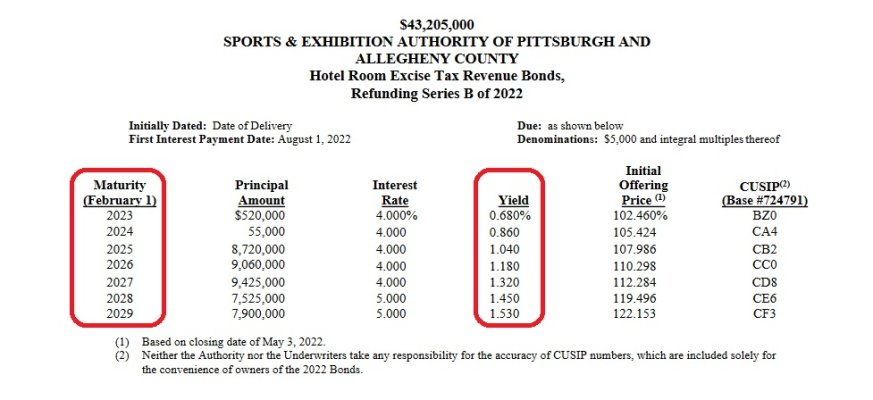

Starting to see some 4%+ YTMs in my state with reasonable durations. YTCs over CD rates. I have a huge chunk of bonds maturing in the next 6-12 months. I hope things continue to improve for reinvesting these funds. I am nibbling now.