Anything new from anyone?

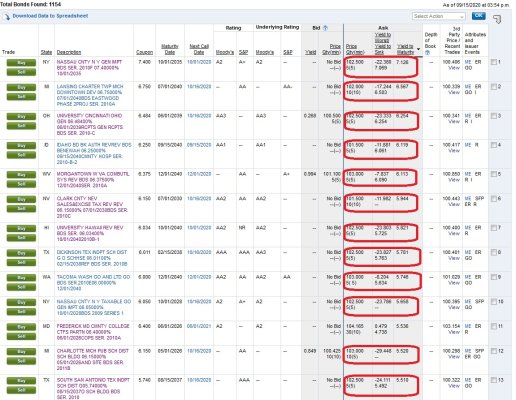

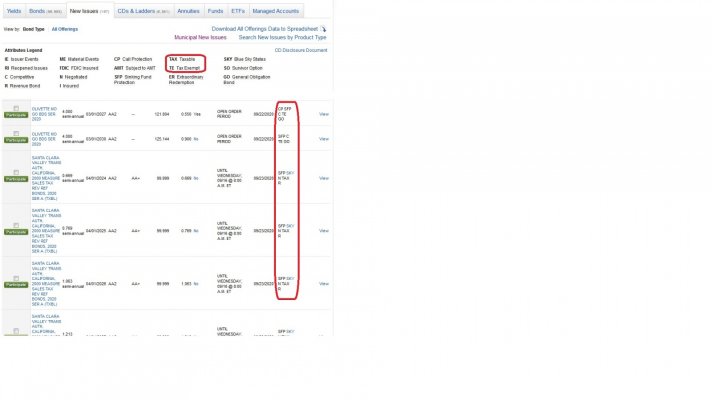

Taxable muni market is pretty much untouchable. Risk/reward simply is not there - nothing to buy.

In the tax free, I do see some AA-rated long term zero coupons, many with insurance backing, that are catching my attention which the market is beginning to stay clear of. I'm guessing there is higher perceived risk, but my thinking is that with a longer time horizon, there is greater opportunity for things to work themselves out. I'll have to consider that position in more depth.

With my money that is looking for a (new) home (and another chunk of maturities and calls coming on 10/1), I've begun nibbling on bank common and preferred shares. Folks are avoiding the sector, and prices have come down so far that most of the community banks are ripe for takeover. Just yesterday, one that I have (symbol STND) announced it was being acquired for 70% premium (all cash deal) above current share price. Dividend yields of 5% to 8% are quite easy to find right now, and these are well-covered sustainable dividends. Look for those trading well below tangible book value with lots of insider purchasing and you've got a good safety net. Historical takeover price is 140% of tangible book value, which is exactly what STND is being acquired for. I also look at a high ratio of deposits to market cap - acquirers like to capture deposit hoards on the cheap. I did very well playing this during 2012-2017 and it looks like the same thing all over again...possibly with even greater gains possible. We have banks on sale + cheap money which leads to increased M&A activity. Anyhow, I'm not going all in on the sector, but redeploying interest payments and some amount of maturities and calls into new purchases which cannot find anywhere to go in munis. Obviously CDs and treasuries are pretty much untouchable at this time as well.

Sorry for going off-topic with the banks. Just another area which I've done extremely well with during difficult economic times where the whipping of the sector gets overdone.