Fedup

Thinks s/he gets paid by the post

I seriously doubt it. Lol

Is there a Stock Addict Anonymous group I can attend?

Yes, It meets every Tuesday at the city library , 8pm right after the A.A. meeting ( Ameriprise Anonymous )

Is there a Stock Addict Anonymous group I can attend?

I do miss the pastry and coffee from the meetings though. Stock club complete with guest speaker, book recommendations and all kinds of guesses where Mr Market was going.

I do miss the pastry and coffee from the meetings though. Stock club complete with guest speaker, book recommendations and all kinds of guesses where Mr Market was going.My crystal ball thinks this is then big one. Regardless, my plan is to wait til Jan to rebalance. I'm hoping to get this market crash thing done with. Kind of like waiting for that big volcano in the news several weeks back to blow its top.

I bought a few dow stocks yesterday (several times). Not a lot (~$100k) and I may buy again today (and DCA them) if it takes another big drop.

On it's way up, buy now before the rush!

All indicators are good , so why did the market drop . People working company profits up , interest rates jumped . Watch what happens by the end of the year . China will sign a trade agreement , the fed will realize that inflation is not bad and announce they will slow down interest rates and the market will have a year end rally.

Most likely that’s what is going to happen.

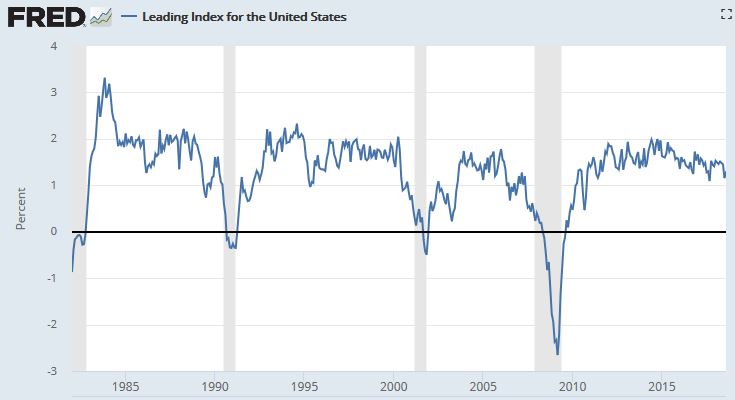

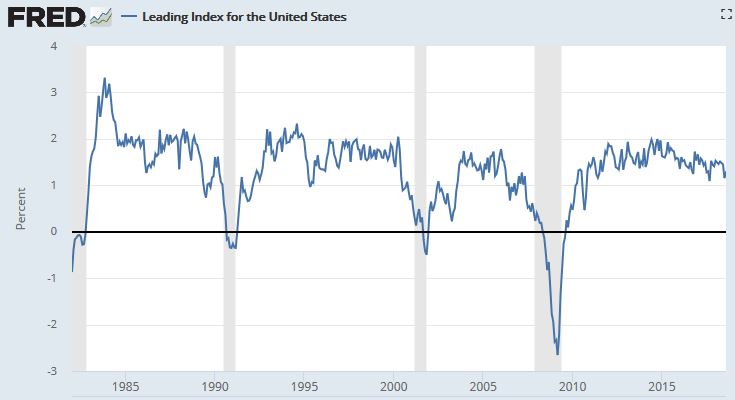

This Fed series says we are not headed into recession territory yet (grey bands are recession periods). Most likely good times ahead for several months.

When we had the bump in late January-early February 2018 I did some soul searching and decided I was not comfortable with my AA. It wasn't predicated on a belief that the market was about to crash, but after assessing my needs, and what would happen if the market continued to climb, or stay put, or fall back, I found an AA that seemed to better suit my situation, and my personal risk tolerance.

i guess I hit the sweet spot, because this isn't bothering me.

Either you all have nerves of steel or there is some whistling in the graveyard going on. I don't like it when $40k vanishes in a week. My morning mood is not improved when I go to Discover online bank to check on a fund transfer and see this message:

Account service is limited at this time.

Some of our website features are currently unavailable.

Any previously scheduled transactions, bill payments, and loan payments will process as normal

Your balance and account history has been updated as of 10/11/2018

You can view 45 days of account history

New funds transfers and loan payments cannot be scheduled

We appreciate your patience and regret any inconvenience.

Makes a big ol' chicken man want to start stuffing the mattress rather than counting on digital cash representations.

I'm about 75% stocks and haven't lost anything in the last two days. I've still got every share I had on Tuesday, I have exactly the same ownership % in thousands of US and foreign companies.

All indicators are good , so why did the market drop . People working company profits up , interest rates jumped.

If this stuff scares you too much you shouldn't be in the market.

I am not scared. I am excited. I ask myself how I can profit.

"Wherever there is danger, there lurks opportunity; whenever there is opportunity, there lurks danger. The two are inseparable. They go together." -- Earl Nightingale