You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

October 10th Market Plunge

- Thread starter MoneyChic

- Start date

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

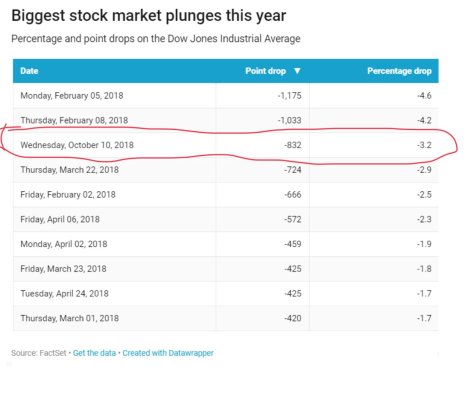

This might help put today in perspective:

That does indicate today’s move was pretty sizable! Not many that big in the past few years.

NYEXPAT

Thinks s/he gets paid by the post

I would say that you should stick to your plan!

marko

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 16, 2011

- Messages

- 8,430

Isn’t this like the 10 year anniversary of the 2008 market plunge? Or was that on the 9th?

Yep, 10 year anniversary Wikipedia

So, with this drop......another 10 years of bull run ahead of us?

38Chevy454

Thinks s/he gets paid by the post

Just a little bump in the road, I'm still on cruise control.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Just a little bump in the road, I'm still on cruise control.

It could be a bad metaphor. This guy was on Tesla autopilot when it happened.

I own 30 or so individual stocks and simply add to them when the price is right. The price is still not right for most but some are getting closer.

All pay dividends and nothing fundamental has changed that would affect that for my holdings.

A step toward a buying opportunity plain and simple.

All pay dividends and nothing fundamental has changed that would affect that for my holdings.

A step toward a buying opportunity plain and simple.

gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

Don't buy until you feel too fearful to buy.

Thanks for the comments everyone. I’m still on the fence on this one, but leaning towards investing some today- not all of my cash, but just the amount that was scheduled to be invested in a couple of weeks anyway.

It will be interesting to see what happens when the markets open today.

It will be interesting to see what happens when the markets open today.

Don't buy until you feel too fearful to buy.

This does not apply to me because I was itching to buy more stocks when market bottomed in 2008. I sold all my bonds and bought stocks at that time. I was looking for more cash but didn't find any!

My anecdotal experiences says wait for at least a year if you were waiting for market crash and then start DCA. If you are trying to buy an opportunistic buy then forget about it, no-one can see future.

I’m not waiting for a market crash because I’ll continue to have more income to invest every year for many more years. I’m just DCAing the cash I have from a recent real estate sale over the course of a few months.

JustCurious

Thinks s/he gets paid by the post

- Joined

- Sep 20, 2006

- Messages

- 1,396

On July 11, about 3 months ago, the S&P 500 was at 2,774 which is a little lower than yesterday when it was at 2,785 after the so called "market plunge." Of course in July the market was on it's upward march, but the point is it was at the same level as it is now. I don't understand how people get concerned about a "market plunge" but were unconcerned 3 months ago when the market was at the same level.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

On July 11, about 3 months ago, the S&P 500 was at 2,774 which is a little lower than yesterday when it was at 2,785 after the so called "market plunge." Of course in July the market was on it's upward march, but the point is it was at the same level as it is now. I don't understand how people get concerned about a "market plunge" but were unconcerned 3 months ago when the market was at the same level.

I agree, as long as the prior date for comparison purposes is fairly recent, as opposed to some ancient date many years ago. Three months is definitely recent enough.

USGrant1962

Thinks s/he gets paid by the post

I sold some stock a couple of weeks ago to fund the next two years of spending (sitting as cash in Vanguard Prime MM). That combined with this drop has caused my U.S. stock allocation to hit a rebalancing limit.

Today I'll place an order to move some of my 401(k) bond allocation to U.S. stocks.

This is my first official rebalance since ER

Today I'll place an order to move some of my 401(k) bond allocation to U.S. stocks.

This is my first official rebalance since ER

- Joined

- Nov 27, 2014

- Messages

- 9,212

If I were DCA’ing, I woul be like the OP and want to put a little more in now. Maybe a reasonable acceleration would be to double up on the next buy? I don’t know, but I’d probably put some extra in now.

I own 30 or so individual stocks and simply add to them when the price is right. The price is still not right for most but some are getting closer.

All pay dividends and nothing fundamental has changed that would affect that for my holdings.

A step toward a buying opportunity plain and simple.

I invest in a very similar way. It’s been working for 8 years, no problems. If I have some cash, I buy when the market drops.

Fedup

Thinks s/he gets paid by the post

I took a little nibbling through options. I can’t remember when I sold early this year, but I might get it back a little cheaper.

- Joined

- Nov 27, 2014

- Messages

- 9,212

On July 11, about 3 months ago, the S&P 500 was at 2,774 which is a little lower than yesterday when it was at 2,785 after the so called "market plunge." Of course in July the market was on it's upward march, but the point is it was at the same level as it is now. I don't understand how people get concerned about a "market plunge" but were unconcerned 3 months ago when the market was at the same level.

Also, the S&P was at about 2,720 at the beginning of the year. So we’re essentially flat at this point. Of course there was a lot of volatility this year. No worried yet. Of course at less than a 50% equity AA, I don’t worry too much anyway.

calmloki

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Either you all have nerves of steel or there is some whistling in the graveyard going on. I don't like it when $40k vanishes in a week. My morning mood is not improved when I go to Discover online bank to check on a fund transfer and see this message:

Account service is limited at this time.

Some of our website features are currently unavailable.

Any previously scheduled transactions, bill payments, and loan payments will process as normal

Your balance and account history has been updated as of 10/11/2018

You can view 45 days of account history

New funds transfers and loan payments cannot be scheduled

We appreciate your patience and regret any inconvenience.

Makes a big ol' chicken man want to start stuffing the mattress rather than counting on digital cash representations.

Account service is limited at this time.

Some of our website features are currently unavailable.

Any previously scheduled transactions, bill payments, and loan payments will process as normal

Your balance and account history has been updated as of 10/11/2018

You can view 45 days of account history

New funds transfers and loan payments cannot be scheduled

We appreciate your patience and regret any inconvenience.

Makes a big ol' chicken man want to start stuffing the mattress rather than counting on digital cash representations.

38Chevy454

Thinks s/he gets paid by the post

It could be a bad metaphor. This guy was on Tesla autopilot when it happened.

I don't own or plan to own any Tesla car or stock

Similar threads

- Replies

- 16

- Views

- 557

- Replies

- 36

- Views

- 4K