No, not trolling. I think Joe was eliciting some supportive posts from forum members.

After all, he's not the only one here who has shares of Tesla and ARK funds. It would be nice to hear from other shareholders.

I don't hold these shares, so do not know what to tell him other than to be careful. This is something a guy has to decide for himself.

I recall there was fella on the forum who had tens of thousands of Tesla shares. He updated the forum on his NW milestone whenever Tesla hit a new high. I definitely would be interested in hearing from him on how he is dealing with the downside. Losing tens of millions in a span of a few months must be a bit nerve wrecking.

Last edited:

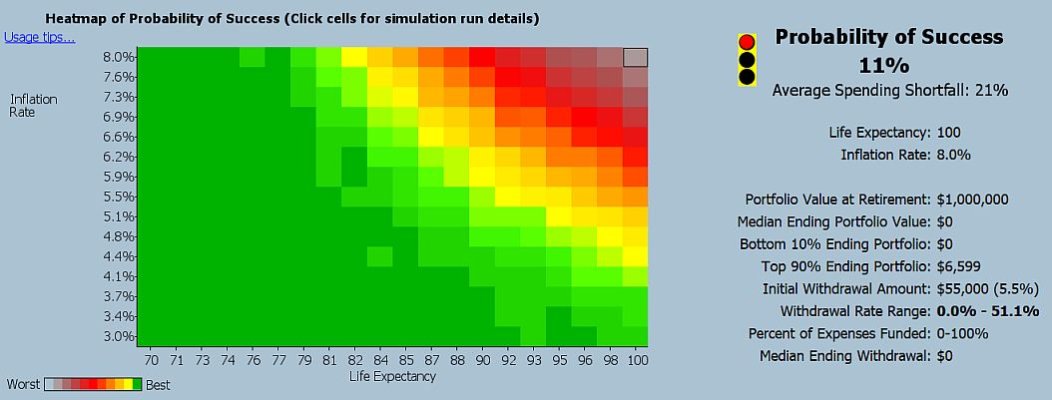

or this

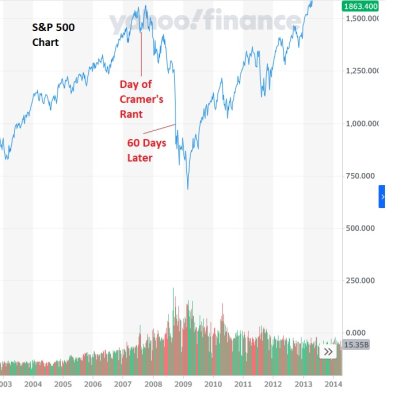

or this