Off-topic from an outlier, but re: good/bad times.

Almost no dog in the fight, but re: "money".

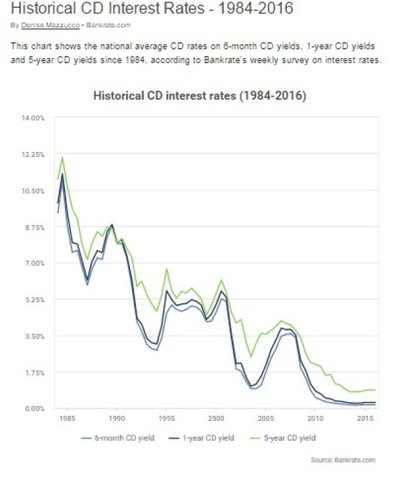

Ultra dull, uninteresting "investor", though you may not think of it that way... Since the early days, much of our money has been tied up in the banks in the form of CD's. Maybe not so good compared to smarter money, but along the way, no surprises... none.

A fair return through 2000, and then into IBonds from 2000 through 2003. Currently averaging about 5%. and no way to go lower, unless the government defaults.

Now content to spend the declining years watching the market intently... the way I watch a soccer match.

So... another chart:

Almost no dog in the fight, but re: "money".

Ultra dull, uninteresting "investor", though you may not think of it that way... Since the early days, much of our money has been tied up in the banks in the form of CD's. Maybe not so good compared to smarter money, but along the way, no surprises... none.

A fair return through 2000, and then into IBonds from 2000 through 2003. Currently averaging about 5%. and no way to go lower, unless the government defaults.

Now content to spend the declining years watching the market intently... the way I watch a soccer match.

So... another chart: