papadad111

Thinks s/he gets paid by the post

- Joined

- Oct 4, 2007

- Messages

- 1,135

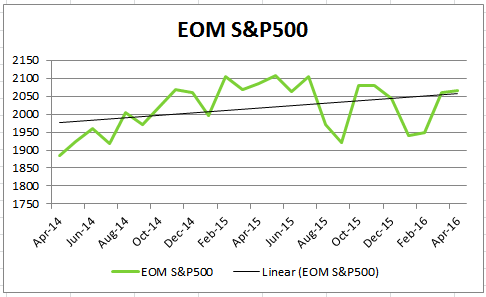

Discussion continues on market being flat for last 2 years. Perhaps mods can add this poll in .

Poll: The flat market at 2000 on SP500, first hit in July 2014 continues. Nearing 2 years of essentially flat market. Do you consider the flat market "good times"... The market could have fallen. Or "bad times"...will we ever get out of neutral....

Poll: The flat market at 2000 on SP500, first hit in July 2014 continues. Nearing 2 years of essentially flat market. Do you consider the flat market "good times"... The market could have fallen. Or "bad times"...will we ever get out of neutral....