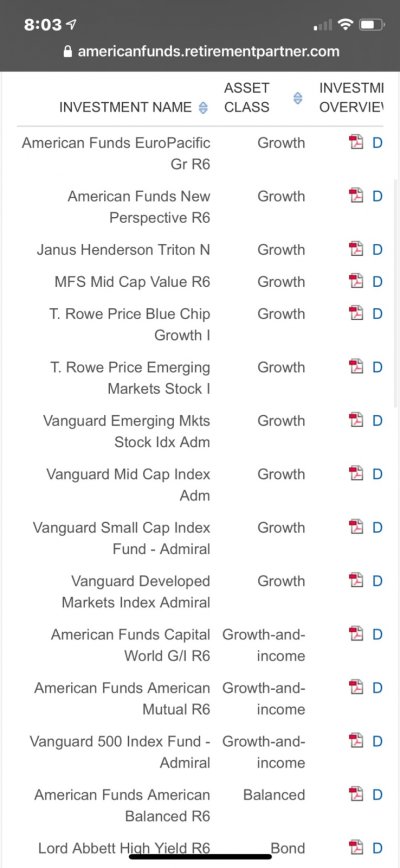

Ok, I’ve been at my new job for almost 4 years and have been hesitant to rollover my 401k to my new job due to their lack of fund choices. They have only one Vanguard index fund choice and the rest are mutual and target date funds.

My question is should I roll over to my present employer plan or open up a vanguard or fidelity account and rollover there? I was there for almost 18 years and has about 500k.

Thanks everyone in advance for your important

Scott

My question is should I roll over to my present employer plan or open up a vanguard or fidelity account and rollover there? I was there for almost 18 years and has about 500k.

Thanks everyone in advance for your important

Scott