So I am a 60/40 guy who re-balances at the end of each year and am generally all in after a re-balance, meaning I don't stack cash to do market timing buys. However, when these rare big drops in equities occur, it has me thinking... should I have a trigger that forces an early re-balance to take advantage of the significant market drop (stocks on sale) or, let it ride "as is" and revisit at the end of the year as normal? Just curious if any of you have set up "rules" to trigger early re-balancing, particularly in a scenario of falling equities like we have had recently, whereby you are selling bonds to buy stocks? I suppose if you have a rule the same could be said for a significant stock run... sell stocks to buy bonds? Do you have that guide you during these turbulent times?

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Re-balance Triggers... Do You Have Them?

- Thread starter DawgMan

- Start date

iloveyoga

Thinks s/he gets paid by the post

35/65 quarterly rebalance.

foxfirev5

Thinks s/he gets paid by the post

- Joined

- Mar 22, 2009

- Messages

- 2,987

I'm a 40/60 guy with a tilt to dividends. I don't feel comfortable going all the way down to 35% equities before I rebalance. With plenty of dry powder I'm taking a gradual approach and dropping a few k/day into equities for now. We'll see how it works out

I'm 50/45* and will probably re-balance in April given the severity of this week's drop. Don't want to ride the entire year unbalanced, but don't want to rush in where...

well, you know who rushes in.

*Happened to be pretty cash-heavy this month and boy am I glad

well, you know who rushes in.

*Happened to be pretty cash-heavy this month and boy am I glad

stepford

Thinks s/he gets paid by the post

I'm a 50/50 guy, but an undisciplined rebalancer. Notionally I rebalance if equities get above 55, but do it in little 1% nibbles (kinda reverse DCA). As a result I was back up to 52% before the bottom fell out this week. Think I must be down somewhere close to 45/55 now - I guess these days it depends on the time of day.

More to the point I've never had to rebalance back into equities. Market performance always took care of that for the 6-7 years that I've been maintaining this AA. I guess I would consider rebalancing if I got below 30/70, but even then I would wait for year's end before doing so.

More to the point I've never had to rebalance back into equities. Market performance always took care of that for the 6-7 years that I've been maintaining this AA. I guess I would consider rebalancing if I got below 30/70, but even then I would wait for year's end before doing so.

LOL!

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 25, 2005

- Messages

- 10,252

Yes, I have triggers. But one can do the math and see how it may not matter.

Suppose you are 60/40 and stocks drop 20% and bonds stay the same. Then you will be 48/40 which is about the same as 55/45. So if you have triggering band of -5% from 60% to buy equities, then your stocks have to drop 20%.

But if you are 80/20 and stocks drop 20% and bonds stay the same, then you will be 64/84 or 76/24 and you will not have hit a 5% rebalance trigger.

Even if you rebalance, you are not going to increase your portfolio performance all that much. If you switch 5% of your portfolio value to stocks and stocks go up 20%, then your extra performance over doing nothin is 5% of 20% or a mere 1% extra performance for the year.

By the same token, if you make a mistake and buy 5% more stocks too early and they drop another 20%, then you will diminish your performance over benchmark by only an additional 1%.

For most performance numbers plus-or-minus 1% is just noise. You would get the same performance differences from owning more international than others or maybe you didn't have the "right" bond fund.

The math is relentless, but not as relentless as the randomness of everything.

Suppose you are 60/40 and stocks drop 20% and bonds stay the same. Then you will be 48/40 which is about the same as 55/45. So if you have triggering band of -5% from 60% to buy equities, then your stocks have to drop 20%.

But if you are 80/20 and stocks drop 20% and bonds stay the same, then you will be 64/84 or 76/24 and you will not have hit a 5% rebalance trigger.

Even if you rebalance, you are not going to increase your portfolio performance all that much. If you switch 5% of your portfolio value to stocks and stocks go up 20%, then your extra performance over doing nothin is 5% of 20% or a mere 1% extra performance for the year.

By the same token, if you make a mistake and buy 5% more stocks too early and they drop another 20%, then you will diminish your performance over benchmark by only an additional 1%.

For most performance numbers plus-or-minus 1% is just noise. You would get the same performance differences from owning more international than others or maybe you didn't have the "right" bond fund.

The math is relentless, but not as relentless as the randomness of everything.

- Joined

- Oct 13, 2010

- Messages

- 10,735

With the rising market in past months, I've been "taking some off the table" by rebalancing a couple or three times a year, usually when there's some activity which upsets the balance. Now that equities have headed south, I'll be in no particular hurry to rebalance. That said, I do have bands defined, and my spreadsheet cells will light-up when the bands are exceeded.

I've got quite a few allocation segments, but the bands are pretty simple and not scientifically derived. Say I have a 4.6% allocated to Swiss equities. My sell trigger is defined as 4.6% * 1.10 = 5.0%. And likewise on the buy trigger 4.6% * .90 = 4.1%.

I've got quite a few allocation segments, but the bands are pretty simple and not scientifically derived. Say I have a 4.6% allocated to Swiss equities. My sell trigger is defined as 4.6% * 1.10 = 5.0%. And likewise on the buy trigger 4.6% * .90 = 4.1%.

N02L84ER

Thinks s/he gets paid by the post

Yes, I have re-balance triggers. Over the past 5 years, I think they were hit 3 or 4 times and each time I sold stock funds and purchased fixed income, producing somewhat smaller returns going forward into the bull market. I do not do an annual re-balance, only trigger re-balances. This year, I was getting close to a trigger before this correction occurred so it will take awhile before I get a trigger to sell fixed income and purchase stock funds. Regardless, I plan to stick with my trigger rules going forward and not make any exchanges until a trigger is hit.

Closet_Gamer

Thinks s/he gets paid by the post

I rebalance when I'm 5% out of whack -- super rare -- as I use new money to nudge myself back towards balance each month.

frayne

Thinks s/he gets paid by the post

I rebalance when I'm 3%-5% out of whack on the high side in equites. I refer to it as scrape the icing off the cake. That has usually happened two to three times a year during the last five years.

- Joined

- Oct 13, 2010

- Messages

- 10,735

I just pulled my numbers and noticed that the equity indexes for US, Hong Kong, and Singapore all didn't trigger a rebalance, but Canada and Australia did! I'm in no particular hurry to get those lines back within the bands, though, as the sum of international equities is still in bounds.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My AA is 94/6. I require myself to re-balance if I get 2 percentage points out of whack either direction (so <92/8 or >96/4). Also, I allow myself to re-balance anytime I feel like it even if it's within that range.

Since I have such a heavy stock allocation and the market has behaved as it has, I've not yet been required to re-balance since I retired in 2016.

As I've said several times here before, I do have an intent to leisurely and unscientifically increase my AA towards 97/3 or so on market dips. This week I moved from 93 to 93.5 to 94 as the market was dropping.

In the big scheme of things, it won't make much of any difference. But it does scratch a psychological itch for me to re-balance into equities as things are falling.

We could see a rapid snap back up - I hear that is not uncommon with sharp drops. We could also see a further and more protracted drop. My crystal 8-ball is in the shop, so I'll just wait and see with the rest of us. If it does drop further, I'll probably continue to move in 0.5% increments as people (including me) seem more fearful.

Since I have such a heavy stock allocation and the market has behaved as it has, I've not yet been required to re-balance since I retired in 2016.

As I've said several times here before, I do have an intent to leisurely and unscientifically increase my AA towards 97/3 or so on market dips. This week I moved from 93 to 93.5 to 94 as the market was dropping.

In the big scheme of things, it won't make much of any difference. But it does scratch a psychological itch for me to re-balance into equities as things are falling.

We could see a rapid snap back up - I hear that is not uncommon with sharp drops. We could also see a further and more protracted drop. My crystal 8-ball is in the shop, so I'll just wait and see with the rest of us. If it does drop further, I'll probably continue to move in 0.5% increments as people (including me) seem more fearful.

easysurfer

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 11, 2008

- Messages

- 13,151

I do the re-balance once a year approach. During both boring and not so boring times like now  .

.

.

.

Last edited:

Wide bands either side of a nominal 50/50 (10% bands) means I very seldom have to rebalance but when I do it's sell high, buy low baby! Suits my basically lazy approach to investing just fine. Frankly I don't understand the annual rebalance approach on a specific date as it would seem that unless it coincides with a major market movement at that time it would have a minor impact (if any) on ones overall return. But maybe I'm deluding myself (as usual)

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

My target is 50/50. I'm approaching 47/53. If I get down to 45/55 I'll rebalance.

SnowballCamper

Full time employment: Posting here.

- Joined

- Aug 17, 2019

- Messages

- 691

In the TSP, I can rebalance without transaction costs, so I have done it about monthly over the last few years. I don't think this is numerically optimal, but I've had the benefit of seeing gains harvested into the G fund.

I recall reading something about price momentum making the time interval a less optimal criteria. A pre-defined tolerance for your AA (that isn't too small) is probably best, and it probably takes a bit of work with a simulator to find the numerically optimal tolerance.

I doubt we'll be recovered from this past week's drop by the time next month's rebalance is due. I guess that means I'll be putting those old gains back into equities, and at a relatively low price.

It is nice to have outgrown the urge to chase gains... the market can do whatever, I'll rebalance, and eventually it will go back up...hopefully before I have to spend it.

I recall reading something about price momentum making the time interval a less optimal criteria. A pre-defined tolerance for your AA (that isn't too small) is probably best, and it probably takes a bit of work with a simulator to find the numerically optimal tolerance.

I doubt we'll be recovered from this past week's drop by the time next month's rebalance is due. I guess that means I'll be putting those old gains back into equities, and at a relatively low price.

It is nice to have outgrown the urge to chase gains... the market can do whatever, I'll rebalance, and eventually it will go back up...hopefully before I have to spend it.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Yes, I have triggers. But one can do the math and see how it may not matter.

Suppose you are 60/40 and stocks drop 20% and bonds stay the same. Then you will be 48/40 which is about the same as 55/45. So if you have triggering band of -5% from 60% to buy equities, then your stocks have to drop 20%.

But if you are 80/20 and stocks drop 20% and bonds stay the same, then you will be 64/84 or 76/24 and you will not have hit a 5% rebalance trigger.

Even if you rebalance, you are not going to increase your portfolio performance all that much. If you switch 5% of your portfolio value to stocks and stocks go up 20%, then your extra performance over doing nothin is 5% of 20% or a mere 1% extra performance for the year.

By the same token, if you make a mistake and buy 5% more stocks too early and they drop another 20%, then you will diminish your performance over benchmark by only an additional 1%.

For most performance numbers plus-or-minus 1% is just noise. You would get the same performance differences from owning more international than others or maybe you didn't have the "right" bond fund.

The math is relentless, but not as relentless as the randomness of everything.

+1

Yes, people do it to be able to feel good that they have the discipline to buy low/sell high, but the truth that is the little gain is masked out by other things such as the composition of your stocks or your bonds.

Katsmeow

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 11, 2009

- Messages

- 5,308

My target is 50/50. I'm approaching 47/53. If I get down to 45/55 I'll rebalance.

Ditto.

Lsbcal

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

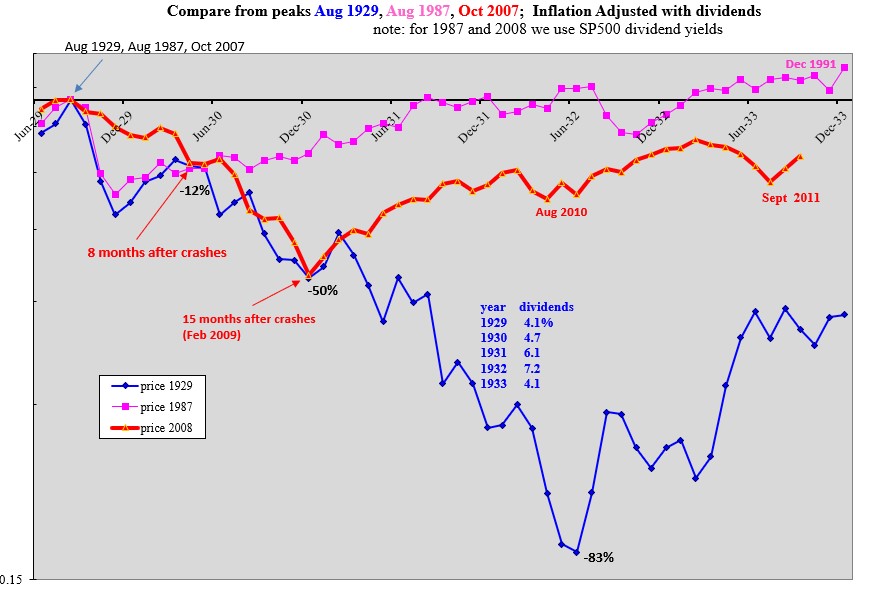

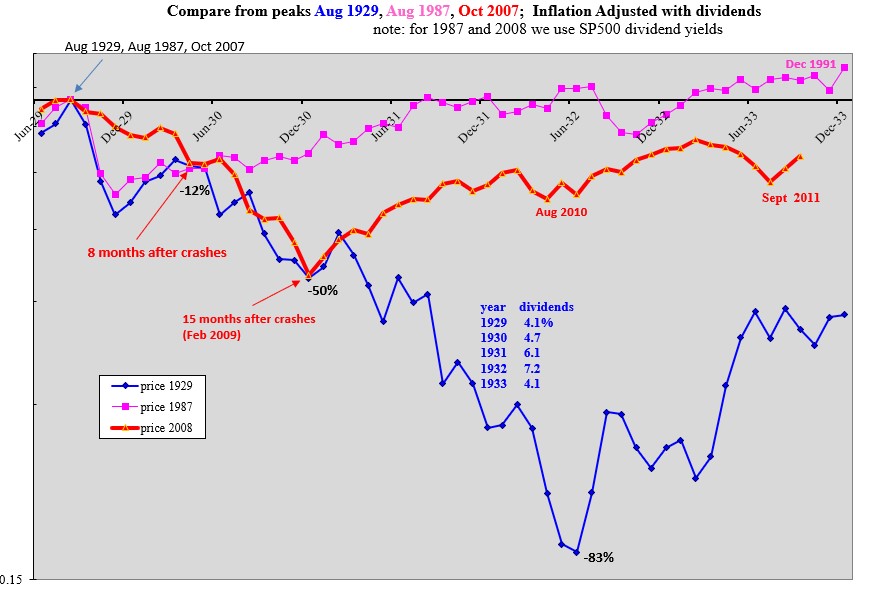

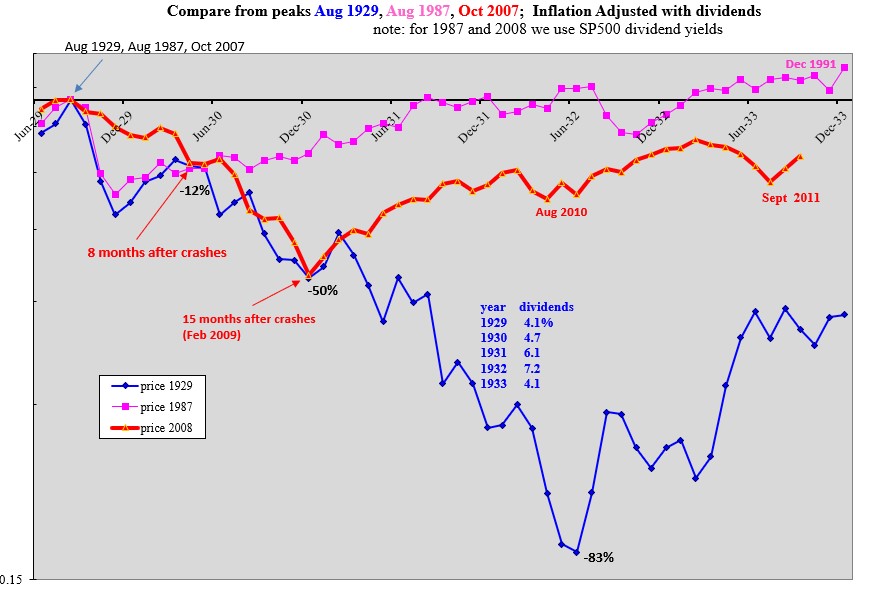

I do not rebalance on the down side because I want to limit risk in retirement. Suppose we are in for another period like the 1930's. It is not likely but is not impossible. When would you stop rebalancing?

Here is a chart comparing 3 bad market declines from their peaks. Do you see what I mean?

Here is a chart comparing 3 bad market declines from their peaks. Do you see what I mean?

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have a floor of minimum fixed income amount determined by annual spending needs. This has been part of my personal investment plan since day 1. I actually reached it in 2008/2009.I do not rebalance on the down side because I want to limit risk in retirement. Suppose we are in for another period like the 1930's. It is not like but is not impossible. When would you stop rebalancing?

Here is a chart comparing 3 bad market declines from their peaks. Do you see what I mean?

Back in 2008 I ended up rebalancing 3 times - catching a falling knife each time. I have since widened my bands considerably. It paid back during the rapid recovery, but I prefer to rebalance less often.

latexman

Thinks s/he gets paid by the post

My AA target is 60/40. On Friday I was 55/45 so I re-balanced.

Has anyone ever back-tested to determine the optimum trigger? Seems doable.

Has anyone ever back-tested to determine the optimum trigger? Seems doable.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

My AA target is 60/40. On Friday I was 55/45 so I re-balanced.

Has anyone ever back-tested to determine the optimum trigger? Seems doable.

Try "Portfolio Visualizer". Not much of a difference over the long run, however you do it.

The only thing that can make a large difference is a big market timing move, if you backtest it, which is of course easy to do in hindsight. Go all cash here. Then go all stock here. Wouldda, shouldda.

scrabbler1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 20, 2009

- Messages

- 6,699

My current target AA is 44/56. A few days ago, it was at 42/58 so I stayed put because I was still at +/- 2%, my limit. Now I am at 41/59, so it is time to rebalance. The stock side has dropped while at the same time the bond side is zooming up. I usually need the two asset classes moving in opposite directions.

Similar threads

- Replies

- 28

- Views

- 2K

- Replies

- 22

- Views

- 1K

- Replies

- 19

- Views

- 500

- Replies

- 38

- Views

- 2K