You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

RobinHood race from $2,500 to $250,000

- Thread starter Fermion

- Start date

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

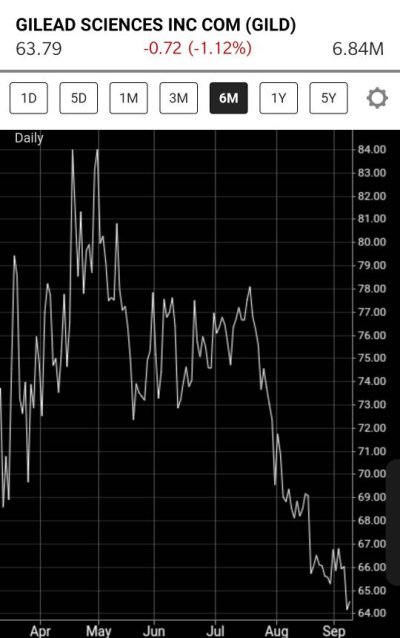

Gilead always comes back to the $70s and pays a 4.2% dividend while I wait, so I park relatively safe money there when it is in the low to mid $60s. It is not a stock that you will wake up one morning and see down 78% like STSA was today.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

People who held GE, F and several others used to say something similar not too long ago. [emoji39]. Happy trading! [emoji857]Gilead always comes back to the $70s and pays a 4.2% dividend while I wait, so I park relatively safe money there when it is in the low to mid $60s. It is not a stock that you will wake up one morning and see down 78% like STSA was today.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

People who held GE, F and several others used to say something similar not too long ago. [emoji39]. Happy trading! [emoji857]

Lets just say I sleep better at night holding Gilead at $63 than I would have holding Tesla at $500 post split.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Lol, I hear ya. But we must be the dummies, look at TSLA growth over past year. Heck, you'd probably be at the $250k goal of you put your $$$ into TSLA [emoji857][emoji857][emoji857]Lets just say I sleep better at night holding Gilead at $63 than I would have holding Tesla at $500 post split.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Lol, I hear ya. But we must be the dummies, look at TSLA growth over past year. Heck, you'd probably be at the $250k goal of you put your $$$ into TSLA [emoji857][emoji857][emoji857]

If only I had a crystal ball. Of course I could have put my $$ into ITCI $25 call options for Sept 18 expiration when they were $0.80 each and also reached my goal.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

With your gains you should be able to easily afford that crystal ball now. [emoji41].If only I had a crystal ball. Of course I could have put my $$ into ITCI $25 call options for Sept 18 expiration when they were $0.80 each and also reached my goal.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I sold my last ITCI shares in Robinhood (200 shares) yesterday for $32.12 while waiting for the offering price. This morning seeing that it was $30 and the stock was trading at $28 pre-market, I did what I have never done before and bought pre-market, 400 shares at $28.

Not a huge purchase, but at least I have some skin in the game. The company is super well funded now with $700 million in the bank and could run to $40 next year.

I do still have the 2000 shares in the IRA but they have $20 Sept 18 calls against them and for sure will be called away.

Not a huge purchase, but at least I have some skin in the game. The company is super well funded now with $700 million in the bank and could run to $40 next year.

I do still have the 2000 shares in the IRA but they have $20 Sept 18 calls against them and for sure will be called away.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

News on Gilead may see GILD drop. They are in talks with IMMU and paying double Fridays close, which had already skyrocketed. Obviously something that GILD finds of extreme value. Maybe try to buy call on IMMU early Monday?

https://www.wsj.com/articles/gilead...nomedics-for-more-than-20-billion-11599936777

https://www.wsj.com/articles/gilead...nomedics-for-more-than-20-billion-11599936777

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

They sure are paying a lot for that...

PM showing GILD down $1.11 (1.7%) @ $64.47 so initially market didn't like that

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

PM showing GILD down $1.11 (1.7%) @ $64.47 so initially market didn't like that

That is not as bad as I feared...I though they might go down a lot more like BMY did after buying Celgene.

Oh, and today is ex-div for $0.68 so it should be down that much anyway.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

That is not as bad as I feared...I though they might go down a lot more like BMY did after buying Celgene.

Oh, and today is ex-div for $0.68 so it should be down that much anyway.

Yeah, thought could have been much more, and bounced up now. Didn't look at the XD, so even better that it's up now.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Gilead purchase looking pretty dang good now actually. A lot of fun to be paid $1360 in dividends and then on the date it should drop for ex-div, have it go up another $5,000.

ITCI also up to near $30, making the $28 repurchase pretty nice.

Hey IRS, how ya doin?

ITCI also up to near $30, making the $28 repurchase pretty nice.

Hey IRS, how ya doin?

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

ITCI also up to near $30, making the $28 repurchase pretty nice.

Hey IRS, how ya doin?

Heh - ITCI has seen some movement. Heading towards the 9/18 calls, I rolled my $19 strike to $27 strike last week, managed to squeak a few more bucks. Those were shares that I had just bought to pick up the premium with plans for it to be called @ $19. Hopefully holds above the new $27 strike, will end up almost 25% return for a month, better than originally expected. Still have another 500 shares that remains on the line. Thanks again Fermion for sharing your original post on ITCI.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I am back to all cash, made $1200 off that ITCI rebuy at $28.

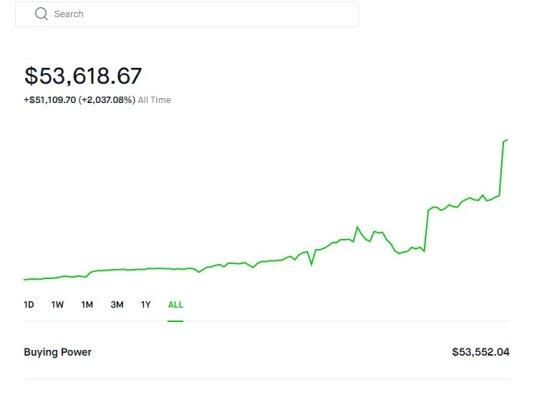

Currently have $53,500 in cash and 2030% gain since starting in June 2018.

When started, I needed a 60% gain per year compounded for 10 years. Here at 2 years 3 months in, I am past the 6 year point (should be at $42,000 after six years) but not quite to the seven year, $67,000 level. It starts getting insane huh?

From here, if I took about 8 years, I would need a annual return of about 22%, which sounds a lot better than 60% but not as much fun.

Time to research more biotechs!

By the way, if I hit the $250,000 goal, the money is available for any wild thing I desire (spouse approved). I am thinking a trip to Antarctica, a trip to Nome (I love Bering Sea Gold), A narrowboat journey through the UK, and a couple months in Australia/New Zealand....flying first class of course. Any other wild ideas?

Currently have $53,500 in cash and 2030% gain since starting in June 2018.

When started, I needed a 60% gain per year compounded for 10 years. Here at 2 years 3 months in, I am past the 6 year point (should be at $42,000 after six years) but not quite to the seven year, $67,000 level. It starts getting insane huh?

From here, if I took about 8 years, I would need a annual return of about 22%, which sounds a lot better than 60% but not as much fun.

Time to research more biotechs!

By the way, if I hit the $250,000 goal, the money is available for any wild thing I desire (spouse approved). I am thinking a trip to Antarctica, a trip to Nome (I love Bering Sea Gold), A narrowboat journey through the UK, and a couple months in Australia/New Zealand....flying first class of course. Any other wild ideas?

Attachments

Last edited:

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Sweet success there Fermion. Since you are all cash you've tossed in the towel on SGMO? Happy trading!

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Sweet success there Fermion. Since you are all cash you've tossed in the towel on SGMO? Happy trading!

For now. I will buy SGMO for a trade sub $10 if it gets down there again (may never). The only way I will make significant money on SGMO is if I am holding it when news pops.

I want to focus more on companies that have 1 or 2 approved drugs and are in trials for other indications. These seem to be the companies that are getting snapped up. Stemline got bought, Gilead just bought IMMU. ITCI fits this almost perfectly but some of the profit potential has been taken out of that since we can't buy it at $17 anymore.

Please inform if you come across other companies with the following criterea:

1) One or more approved drugs, with ongoing trials for more indications

2) Recent capital raises above current market cap

3) Enough cash on hand for a couple of years

There are companies out there that meet this and we just have not found them yet. I need to do a lot more digging.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Vanda flew across my radar. I remember it from years ago and took another look at it.

Has issues, but has revenue and income (gasp!) and is actually trading quite near cash on hand.

I don't think this one is a buyout or going to skyrocket, but it has somewhat limited downside here (unless scandal or lawsuit).

Went for 1000 shares at $9.75, will probably sell at $11 on a pop.

edit: Also just bought 500 shares of Ionis (IONS) at $53.43. Trading near bottom of a range, looking to make a couple thousand $ on a move back to $60. Probably not a buyout target, they have way too many licenses.

lastly, I want, but have not bought yet, EXEL. I would love to get in this at the right price.

edit: Ok, mostly just to mark it, I bought in EXEL 100 shares at $25.05. I rather expect it to drop back to the low $20s (or maybe not) but long term this looks like a good one. I would increase my holding to 500 shares at $20 to $22 a share.

Has issues, but has revenue and income (gasp!) and is actually trading quite near cash on hand.

I don't think this one is a buyout or going to skyrocket, but it has somewhat limited downside here (unless scandal or lawsuit).

Went for 1000 shares at $9.75, will probably sell at $11 on a pop.

edit: Also just bought 500 shares of Ionis (IONS) at $53.43. Trading near bottom of a range, looking to make a couple thousand $ on a move back to $60. Probably not a buyout target, they have way too many licenses.

lastly, I want, but have not bought yet, EXEL. I would love to get in this at the right price.

edit: Ok, mostly just to mark it, I bought in EXEL 100 shares at $25.05. I rather expect it to drop back to the low $20s (or maybe not) but long term this looks like a good one. I would increase my holding to 500 shares at $20 to $22 a share.

Last edited:

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Vanda is probably one of the higher potential reward stocks in this recent purchase spree.

As mentioned, I had invested in them way back in (2014?) when they got approval for 24 hour sleep pattern disorder but had not been in the stock since then.

Interesting to me is their phase III drug Tradipitant (where do they come up with drug names?). It is being used to treat gastroparesis, which is really widespread. Sounds super great except they got into a spat with the FDA over animal testing (the FDA wanted a longer testing period for toxicity in a number of different animals). They actually sued the FDA. You know what usually happens when you sue the government? Yeah...you lose.

But anyway, it seems a number of patients that were taking Tradipitant for the max 3 month trial period allowed without the longer toxicity tests have appealed to the FDA to be allowed to continue taking it, calling it life changing. To me, if a drug is being clamored for by patients, and it isn't morphine based, that is a potential seller.

So they have revenues from two drugs of about 250 million a year, they eek out a small profit from this despite the other drug trials, they have over 300 million in cash, and they have a 500 million dollar market cap.

Yeah. Interesting for sure.

As mentioned, I had invested in them way back in (2014?) when they got approval for 24 hour sleep pattern disorder but had not been in the stock since then.

Interesting to me is their phase III drug Tradipitant (where do they come up with drug names?). It is being used to treat gastroparesis, which is really widespread. Sounds super great except they got into a spat with the FDA over animal testing (the FDA wanted a longer testing period for toxicity in a number of different animals). They actually sued the FDA. You know what usually happens when you sue the government? Yeah...you lose.

But anyway, it seems a number of patients that were taking Tradipitant for the max 3 month trial period allowed without the longer toxicity tests have appealed to the FDA to be allowed to continue taking it, calling it life changing. To me, if a drug is being clamored for by patients, and it isn't morphine based, that is a potential seller.

So they have revenues from two drugs of about 250 million a year, they eek out a small profit from this despite the other drug trials, they have over 300 million in cash, and they have a 500 million dollar market cap.

Yeah. Interesting for sure.

bobandsherry

Thinks s/he gets paid by the post

- Joined

- Nov 24, 2015

- Messages

- 2,692

Fermion - I had never really looked at bio's previous to you mentioning your most recent plays so I don't know the players and background. Appreciate you sharing your information. Not sure if Vanda is worth a roll of the dice so time to do some DD. Got to find the IMMU unicorns then you'll be much closer to your goal

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Fermion - I had never really looked at bio's previous to you mentioning your most recent plays so I don't know the players and background. Appreciate you sharing your information. Not sure if Vanda is worth a roll of the dice so time to do some DD. Got to find the IMMU unicorns then you'll be much closer to your goal

Yes, that is one of my goals, to identify the Stemlines and IMMUs out there. It isn't easy!

ITCI is definitely one, but I think it will be closer to bipolar disorder indication approval before they are bought out ($50 to $100 buyout).

If Vanda does get approved in 2022 for gastroparesis they would have peak sales of that of maybe $1 billion a year....with a 500mil market cap LOL. A lot of ifs there. They bought the drug from Pfizer in 2013? or something around there IIRC.

I have mixed feelings about Ionis. I think it will only be good for a trade. They *only* dropped to about $40 during the COVID market crisis, so $53 is pretty close to a bottom, and $60 seems within reach easily on volume/news. They have partnered or licensed waaaay too much to be an attractive buyout candidate so I might not stay in this one very long. I can't afford to tie up $25,000 in Robinhood.

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

What are your thoughts on rlftf? It can’t be traded on Robin Hood, but stage 3 trial results due in the next month for a Covid therapy.

Doesn't seem to be a valid stock symbol.

Similar threads

- Replies

- 4

- Views

- 615

- Replies

- 19

- Views

- 511