+1 I think I would lose any profits and increase anxiety by having to pay a tax preparer to figure out the convoluted mess I made with all the buying and selling. As it is now my tax prep is simple enough to let the AARP volunteers do them with their software programs. I used to do them myself for decades but I check their work and they come up with the same results. Life is too short.

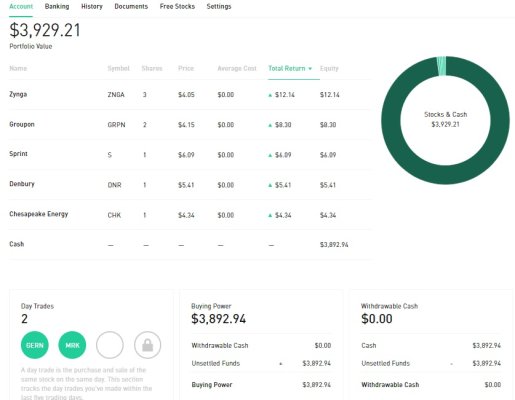

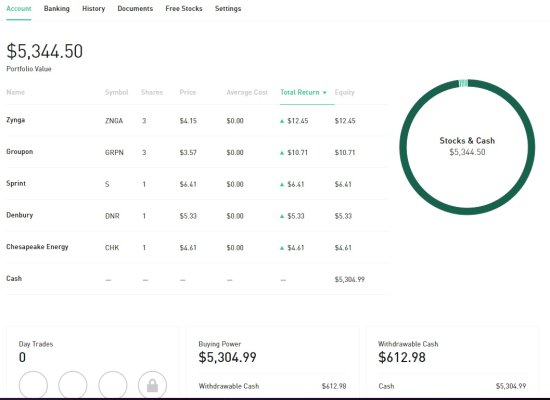

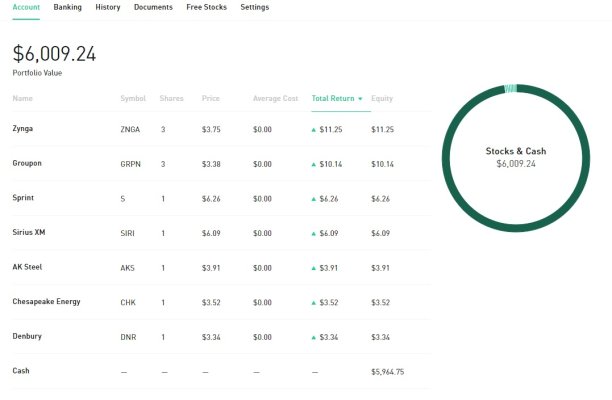

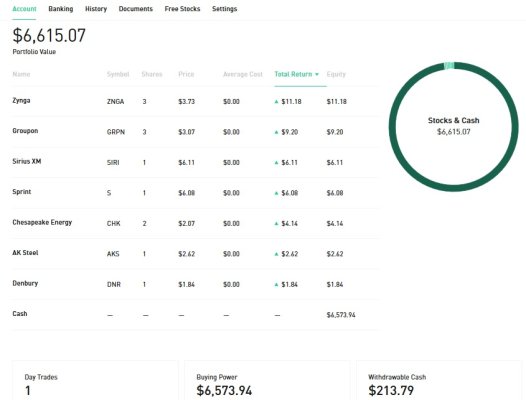

I can appreciate what Fermion is doing. It's just very rare that you see someone bold enough to go on record and put it out there for everyone to see.

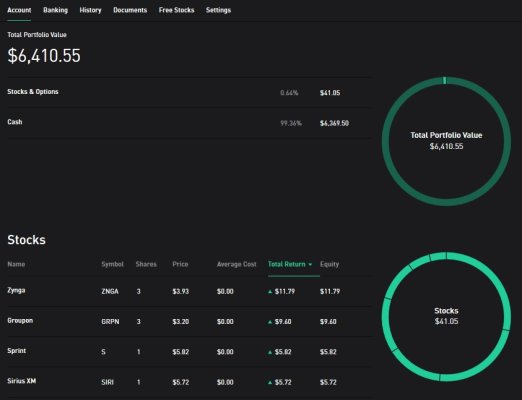

I do similar with my brokerage account at Merrill Edge, because I get 100 commission free trades each month. I have become very sour on the stock market in general, and have come to the conclusion that if I can consistently make a few hundred dollars a month on a $10k account, simply churning in and out of a few stocks which I am very familiar with, then why the heck not? The remainder of the account is in CDs, Treasuries, and municipal bonds.

As far as the tax preparation headache - most all well-known brokerages provide interfaces with the major tax preparation software packages (I'm a Turboxtax man myself). You just click a button to import and that's it. Going a step further, lots of folks make a big deal out of K-1 forms with limited partnerships and they had me all worried last year...and it turns out for no reason. Company provided individual Turbotax files to download from their website, and again, single click to import and take care of everything. Electronic filing eliminates the burden of having to print it all out and mail in 50 or more pages worth of individual short-term transactions.

Back in the day, during graduate studies, it wasn't unusual to go through exercises that come to the conclusion that in general, even if you have an arbitrage type system that could beat the market, you'd not be successful because transaction costs would eat away the profits. Well, what if your transaction costs are taken to zero? At the very least, it reduces your risk significantly when it comes to short-term trading or trading with micro-transactions. If you bought $1000 of some stock in the morning and could sell it for $25 profit in the afternoon, why wouldn't you? That's 2.5% profit in one day...the same as what you would earn if you locked up that money for an entire year in a CD. If it's me, these days I'm selling and banking that profit. As far as higher tax rates for short-term trading - I now look at it as a badge of honor for a profitable trade.

Anyhow, again, I can very well appreciate what Fermion is attempting here. Whether utilizing Robinhood or other platform that offers commission free trading, it offers significant opportunity that could/should be taken advantage of. If I do utilize the entire 100 commission free trades in a month with Merrill, that's effectively $695 in service which I have received...$695 I have effectively taken out of the system, $695 which I would have had to made on any other trades just to walk away at breakeven. JP Morgan just made a very big announcement about offering commission free trading -100 commission free trades per year for all customers and unlimited for those with higher balances (

https://money.cnn.com/2018/08/21/investing/jpmorgan-chase-free-trades/index.html ). I think that commission free trades may well become more the norm as the financial houses look to increase their assets under management - money that they are able to use for other purposes with interest rates on the rise.

In any case, I've rambled enough.