Did you buy back into SGMO ?

Yeah, bought 1000 shares at $9.90 yesterday. It went lower than that.

Thanks for the reminder. I just reloaded 1000 @ $9.90.

Did you buy back into SGMO ?

Yeah, bought 1000 shares at $9.90 yesterday. It went lower than that.

ITCI had a good run, but last 5 days hasn't been kind. Glad I unloaded everything and locked in the profits. Will keep an eye on this for possible re-entry point.

View attachment 36306

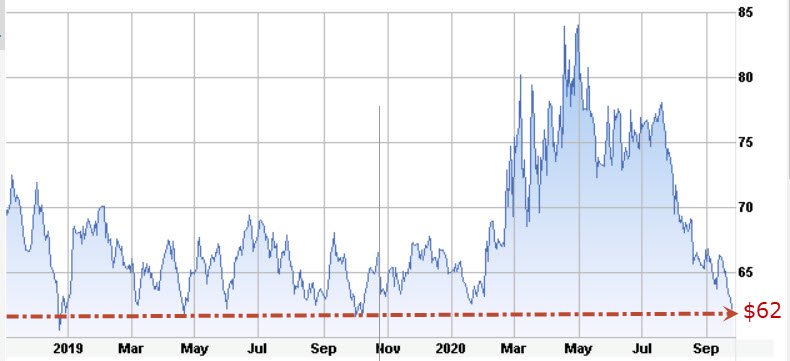

My 2000 share Gilead purchase sure is a stinker. It went below $62 today for a bit.

Console myself with a 4.4% dividend I guess. I really wasn't wanting to hold it through elections.

I’m in VNDA for 5,000 shares at $9.30 after putting off buying ITCI for way too long. Thanks for letting me lurk here!

I’m in VNDA for 5,000 shares at $9.30 after putting off buying ITCI for way too long. Thanks for letting me lurk here!

ITCI had a good run, but last 5 days hasn't been kind. Glad I unloaded everything and locked in the profits. Will keep an eye on this for possible re-entry point.

Yes, I was glad I sold at $31 to $32 although I did rebuy 1000 shares in a IRA at $28...a little upset with myself for doing that now with it trading in the low $26 area....I figured it was cheaper than the offering but I jumped in too soon. Oh well, can't win em all....maybe it will pop again.

I added some ITCI @ $24.59. It's been in a downtrend, but seems pretty cheap right now.

Guess the 5000 share purchase is starting to look pretty nice huh? That is about a $3,000 gain so far.

SGMO is back to below $10..time to start buying a little bit?

12.6% on VNDA so far. Not a bad start.

Sold half today to lock in ~17% profit. Market is pretty jittery lately.

Will hold remaining for a while and add more if price swoons down again.

Sold GILD at $64/share and it has not found a bottom yet. I don't get it.