Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

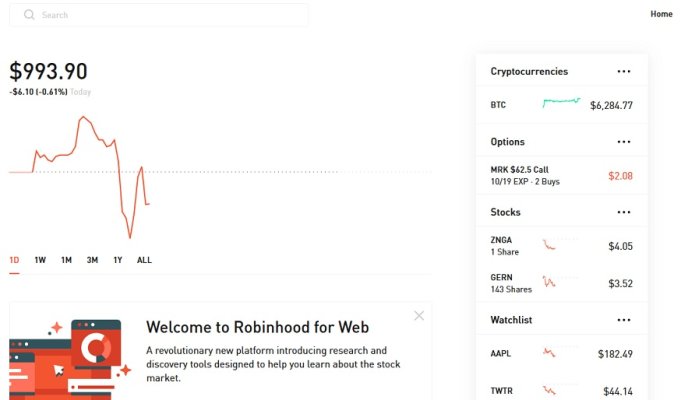

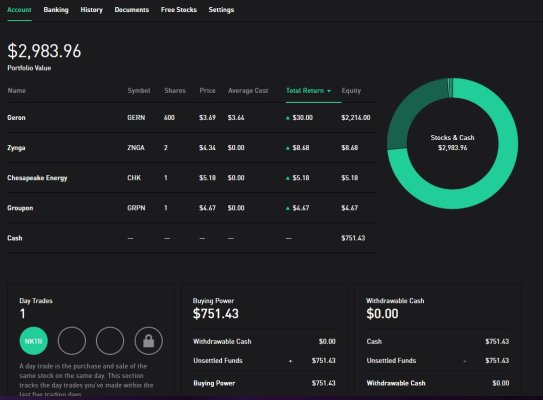

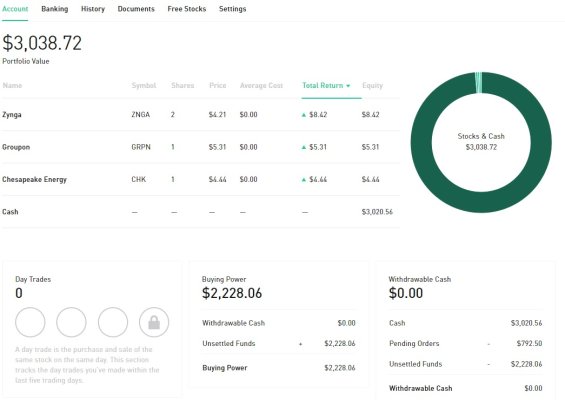

I just opened a new account with RobinHood this evening.

I am funding it with $2500 and probably will do a lot of biotech and options trading, maybe even biotech options!

It will take a couple days for me to get access to options trading (I think) because they want to make sure you know what you are doing (I do). I believe they make you place a few stock trades then apply for option level trading, which is still free.

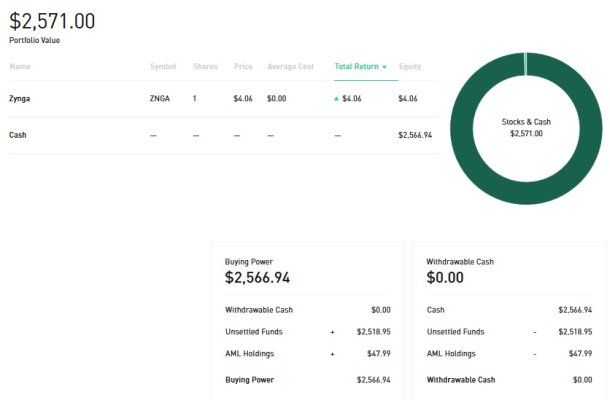

This is straight up casino gambling but I have been doing this in Etrade since 2001 and have managed to raise a $1700 IRA account to $93,000 over the 17 years. This is with paying $9.95 stock trades and $1 per contract plus $9.95 option trades AND having to wait three days for trades to settle. I think I can do a bit better and faster with the larger stake and margin account (not for margin itself but for instant settlement). This is why the rather ambitious goal of going from $2,500 to $250,000, hopefully in a decade or less, if RobinHood stays in business.

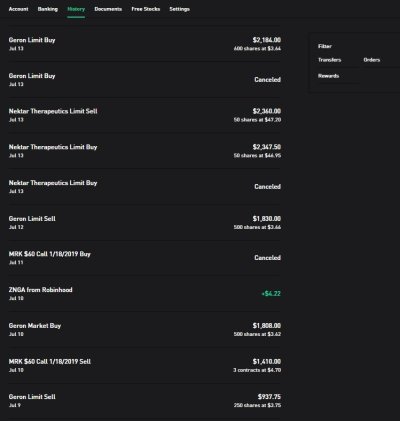

Others are welcome to join me but I figure not many are interested in the work and risk. I am still going to post my trades and a screenshot of my account balances and positions for anyone interested in tracking the success or failure.

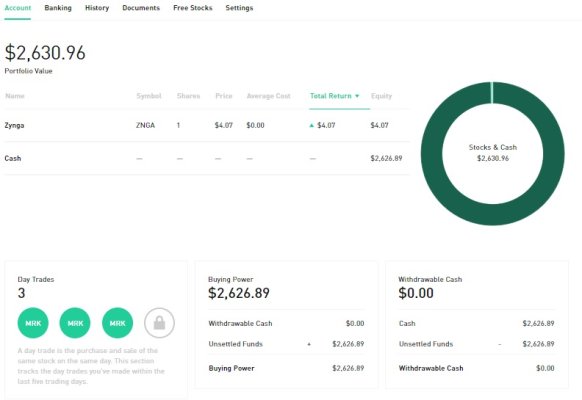

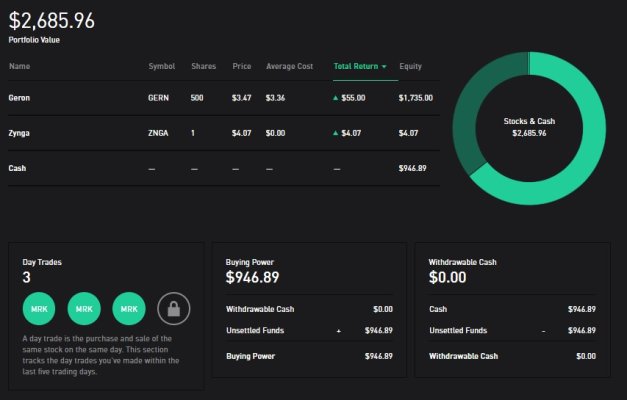

Once the funds settle, I am going to be looking at Merck Jan 2019 options and Geron stock for my first trades, if the price is right. Both stocks should move up this year on good catalysts. Geron has a decision to be made by J&J on continuing trials for MF and MDS. A positive decision on this continuation should propel the stock from $3.60 to about $7. A negative decision will likely drop it to the $1.50 to $2 range. Because of the good OS results in the trials, I think a positive decision on continuation by J&J is more likely, which makes the play a good risk/reward. A buyout could happen and would probably be for $3B to $5B, or about $15 to $25 a share.

Merck is a slow moving giant, but the options are insanely cheap for the leverage. Keytruda is doing extremely well and it is likely to help boost the stock to the $65 area by EOY from the current $61 area. The options are cheap enough that this $4 move could mean a 100% gain on Jan 2019 strikes.

I am funding it with $2500 and probably will do a lot of biotech and options trading, maybe even biotech options!

It will take a couple days for me to get access to options trading (I think) because they want to make sure you know what you are doing (I do). I believe they make you place a few stock trades then apply for option level trading, which is still free.

This is straight up casino gambling but I have been doing this in Etrade since 2001 and have managed to raise a $1700 IRA account to $93,000 over the 17 years. This is with paying $9.95 stock trades and $1 per contract plus $9.95 option trades AND having to wait three days for trades to settle. I think I can do a bit better and faster with the larger stake and margin account (not for margin itself but for instant settlement). This is why the rather ambitious goal of going from $2,500 to $250,000, hopefully in a decade or less, if RobinHood stays in business.

Others are welcome to join me but I figure not many are interested in the work and risk. I am still going to post my trades and a screenshot of my account balances and positions for anyone interested in tracking the success or failure.

Once the funds settle, I am going to be looking at Merck Jan 2019 options and Geron stock for my first trades, if the price is right. Both stocks should move up this year on good catalysts. Geron has a decision to be made by J&J on continuing trials for MF and MDS. A positive decision on this continuation should propel the stock from $3.60 to about $7. A negative decision will likely drop it to the $1.50 to $2 range. Because of the good OS results in the trials, I think a positive decision on continuation by J&J is more likely, which makes the play a good risk/reward. A buyout could happen and would probably be for $3B to $5B, or about $15 to $25 a share.

Merck is a slow moving giant, but the options are insanely cheap for the leverage. Keytruda is doing extremely well and it is likely to help boost the stock to the $65 area by EOY from the current $61 area. The options are cheap enough that this $4 move could mean a 100% gain on Jan 2019 strikes.