Retireby45ish

Recycles dryer sheets

- Joined

- Dec 8, 2018

- Messages

- 209

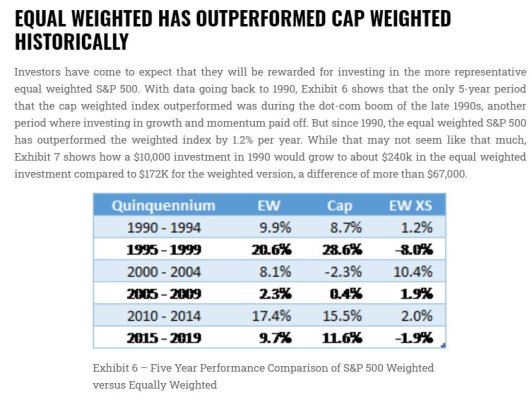

Just read this article and thought it was interesting. Clearly a handful of stocks pulling the index up (or down) the last few months.

My question is, what to do about being so overweight these companies? I actually also own aapl, goog... have for years. they are about 12% of portfolio plus what I own thru index portion. So quite a bit...most of this is because they have done so well for me. But because of all the gains I don’t want to sell them out now either or else my tax hit would be significant as I’m still in a high bracket. Hmmm...

https://www.marketwatch.com/story/the-hidden-risk-hiding-in-your-sp-500-index-fund-2020-07-17

My question is, what to do about being so overweight these companies? I actually also own aapl, goog... have for years. they are about 12% of portfolio plus what I own thru index portion. So quite a bit...most of this is because they have done so well for me. But because of all the gains I don’t want to sell them out now either or else my tax hit would be significant as I’m still in a high bracket. Hmmm...

https://www.marketwatch.com/story/the-hidden-risk-hiding-in-your-sp-500-index-fund-2020-07-17