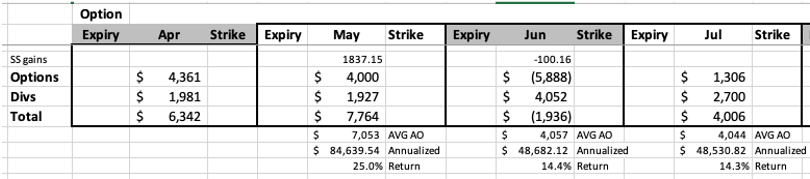

Inspired by this thread, I have dipped toes in to Covered Calls with 5 stocks that I intend to hold. Just started this (in April) as a way to supplement income once retired in next year to year and a half. I'd like to outline my thoughts on this strategy/plan and see how it aligns with those that have been at this a lot longer and that are much more experienced with Options. I am now looking at cash covered Puts to accomplish my stated strategy below of reallocating position across more sectors. So far:

~$500k in positions allocated to this "income strategy"

Avg DIVS - $1,766/mo

Avg Options - $5,162/mo

Total Avg "Income" - $6,928/mo

I am going to decrease holdings in these 5 stocks to allow same overall position value with 5 additional stocks to add some sector diversity.

I am trying to "ignore" for the most part the position swings in overall value (other than what I would do with any stock as far as decision making on hold, sell, buy) and only looking at the "income" side. I am also looking at beta of 1 or less average for the 10 positions once I have re-allocated.

Open to thoughts/suggestions.

~$500k in positions allocated to this "income strategy"

Avg DIVS - $1,766/mo

Avg Options - $5,162/mo

Total Avg "Income" - $6,928/mo

I am going to decrease holdings in these 5 stocks to allow same overall position value with 5 additional stocks to add some sector diversity.

I am trying to "ignore" for the most part the position swings in overall value (other than what I would do with any stock as far as decision making on hold, sell, buy) and only looking at the "income" side. I am also looking at beta of 1 or less average for the 10 positions once I have re-allocated.

Open to thoughts/suggestions.