jr6035

Recycles dryer sheets

I play with a portolio that is right now at $1,160,000

But not all of it is investable short term.

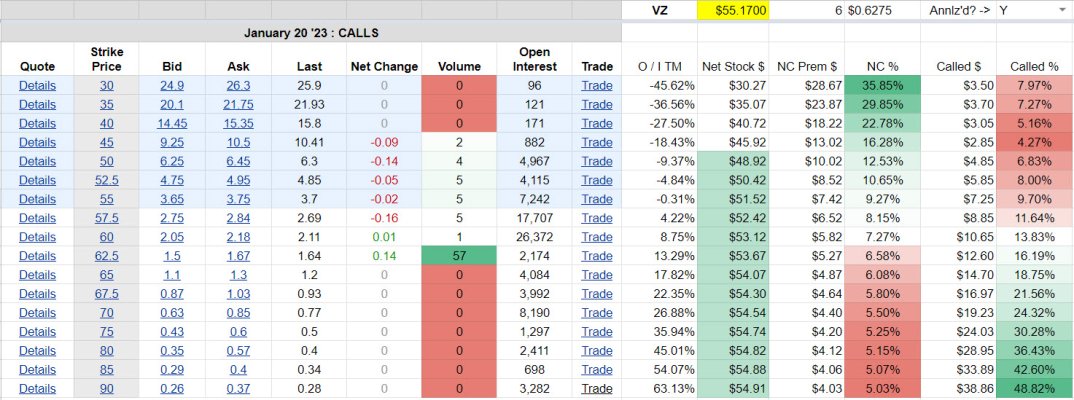

I would say only about $300K of it is short term that I buy and sell options with. The rest, I will write covered calls against long term plays with a goal of not losing my stock. That does happen sometimes but then I will hopefully have a chance to buy it back at lower price. I just got called away on my Pfizer stock and I am looking to buy it back, but I made plenty on my premium and I got the recent dividend. That is my goal to get both.

The way the leaps work. So the goal on the leap is to find a stock that you can collect a decent yield on. Works best with monthly dividends but works with any stock.

Let's use STAG as an example.

I bought 1000 shares of STAG at say $40

I sold a LEAP in December 2021 at $35, which is in the money, but sold it for $5.25, so if I get called away, I make 25 cents a share or $250.

If I don't get called away, I pocket a dividend of 12 cents or $120 a month.

$120 a month on a ($40,000 - $5,250) = $34,750 is 4% yield.

So I get the dividend and as long as stock never goes below $35, I am gauranteed to make money.

That one is close, I have done others even further out of the money, but they usually will get called, but again, I make money regardless, since I always make sure my net cost is below strike.

Realty Income is another one I played.

Symbol O

Pays monthly, nice dividend, I have covered call at $50 with a net of 49.75

You are not making big money here, but who wouldn't want a pretty safe 4-5%

But O is at $70 today. But i'm still learning.