Thanks for the replies.You get a feel for it as you do it. There are still many variables, like the overall market. Works well in a bull market, but if you get caught holding and dividend stock, then you are still earning. Also your boosting your income by writing covered calls. I have some stocks I have been in and out 10 plus times a year. Some I keep writing calls and keep pocketing dividends. I have a goal of $500 a week and I have achieved that the last 2 years and exceeded it. This year my average is $1200 a week. I am playing with a decent amount of capital and retired, so its more of a hobby.

Don't get greedy. I will take $100 from a trade in 1 day and be happy. Better than gambling and better than getting .01% on MM.

But don't get me wrong, last March/April, I was holding and sitting on covered calls. I made money on every call but was sitting on large losses, market came back and I wrote covered calls all the way back and called out on most of them.

Cash secured puts, you need to have the cash in account. I calculate my yield on the cash. So if I secure a put with say $10K and it makes $100 in say 1 month or less, that is a 12% plus annual yield and I happy with that!

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Picking 2021

- Thread starter RVplusDog

- Start date

I don’t see much of a difference between investing in an ETF that you know nothing about except the first few top holdings, and diversifying into ~50 individuals stocks. I am a control freak when it comes to investments, if I don’t know what it is I can’t invest. The biggest difference between the two is how involved you have to be. I personally enjoy finance news and having control over my investments. But any ETF can do good or bad with somebody else doing that research for you.

My top picks have been Tesla, Square, Apple, Disney, Shopify, Bank of America (funny how well the banks shot back after the big dip, made a lot of investing on the dip), and many others. The growth can’t last but 2020 was an insanely good and abnormal year for me being up over 230%. My mentor only invests in individual stocks and has done very well for himself. I still pick ETFs like Ark when I don’t have as much knowledge on a sector. It’s the long term investments that win the most, so I won’t be selling for awhile.

My top picks have been Tesla, Square, Apple, Disney, Shopify, Bank of America (funny how well the banks shot back after the big dip, made a lot of investing on the dip), and many others. The growth can’t last but 2020 was an insanely good and abnormal year for me being up over 230%. My mentor only invests in individual stocks and has done very well for himself. I still pick ETFs like Ark when I don’t have as much knowledge on a sector. It’s the long term investments that win the most, so I won’t be selling for awhile.

What do you think of this?

You take a company like ATT

You buy the common at 28.50

You write a covered call for $15 on Jan 2022 at 13.50

So dividend yield is .52 a share or 7.3% at current price.

Odds are you won't get the final dividend on 1/8/22 bc you will probably lose the stock, but if you do get the other 3 payouts, you get 1.56 on a $15 investment which is over 10% if annualized but its less than a year, so its better.

What's the risk? Will ATT trade below $15 in a year or go bankrupt?

You take a company like ATT

You buy the common at 28.50

You write a covered call for $15 on Jan 2022 at 13.50

So dividend yield is .52 a share or 7.3% at current price.

Odds are you won't get the final dividend on 1/8/22 bc you will probably lose the stock, but if you do get the other 3 payouts, you get 1.56 on a $15 investment which is over 10% if annualized but its less than a year, so its better.

What's the risk? Will ATT trade below $15 in a year or go bankrupt?

What do you think of this?

You take a company like ATT

You buy the common at 28.50

You write a covered call for $15 on Jan 2022 at 13.50

So dividend yield is .52 a share or 7.3% at current price.

Odds are you won't get the final dividend on 1/8/22 bc you will probably lose the stock, but if you do get the other 3 payouts, you get 1.56 on a $15 investment which is over 10% if annualized but its less than a year, so its better.

What's the risk? Will ATT trade below $15 in a year or go bankrupt?

I don’t understand why you wouldn’t write the call at a higher strike price. Is it just to earn that higher premium up front? I can get static return of 5.4% on a $30 strike, earning $156 up front, still getting all the dividends, and netting $31.56 all told if the stock gets called, 11% annualized before the dividends. Just a different way to skin the cat?

Well if you write it higher you take more risk.

If att closes at say $20 you lost all your gains on the common loss. You will be holding a losing stock.

My scenario is much less risk with more gain and less capital needed. There is a good chance you will get called and pocket the dividend.

If att closes at say $20 you lost all your gains on the common loss. You will be holding a losing stock.

My scenario is much less risk with more gain and less capital needed. There is a good chance you will get called and pocket the dividend.

aja8888

Moderator Emeritus

T is a good stock to write options on since it has been trading in a range of about $25 - $34 for a good while now. I have been doing that for several months now.

GM is my latest deal as I have several hundred shares and have been writing covered calls from $55 to $60 over a two week to one month period.

GM is my latest deal as I have several hundred shares and have been writing covered calls from $55 to $60 over a two week to one month period.

MRG

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 9, 2013

- Messages

- 11,078

Help me understand what happens if T goes on a run, however unlikely, to 35 prior to the first dividend? Won't it be called if the equity is substantially higher than the call was purchased for?Well if you write it higher you take more risk.

If att closes at say $20 you lost all your gains on the common loss. You will be holding a losing stock.

My scenario is much less risk with more gain and less capital needed. There is a good chance you will get called and pocket the dividend.

I'm intrigued I don't understand how it gets settled.

ETA: It's the time value of the option making it worth more as an option until just before expiry? Interesting strategy.

Last edited:

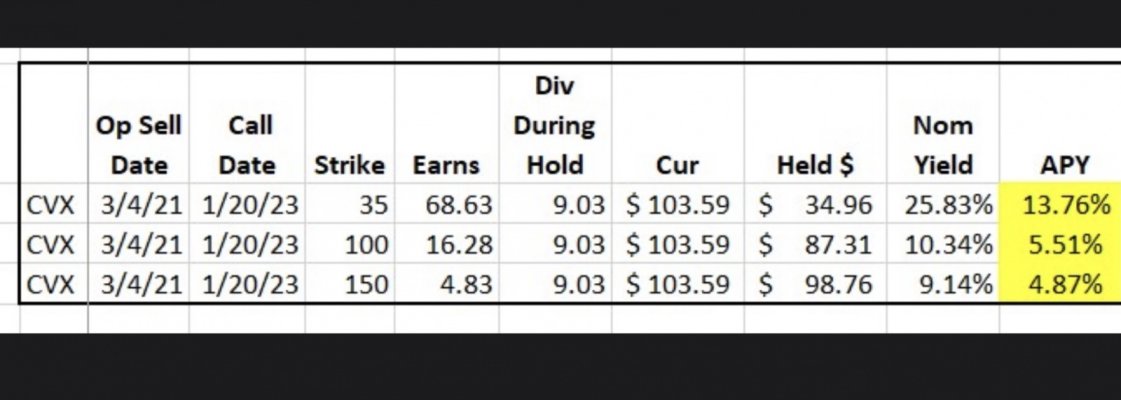

Ok, I slept on it and then created a scenario to help clarify it in my mind. I used CVX for my example, because I think of it as one of the better dividend payers, but with more stock price risk. This totally illustrates it for me:

Attachments

Help me understand what happens if T goes on a run, however unlikely, to 35 prior to the first dividend? Won't it be called if the equity is substantially higher than the call was purchased for?

I'm intrigued I don't understand how it gets settled.

ETA: It's the time value of the option making it worth more as an option until just before expiry? Interesting strategy.

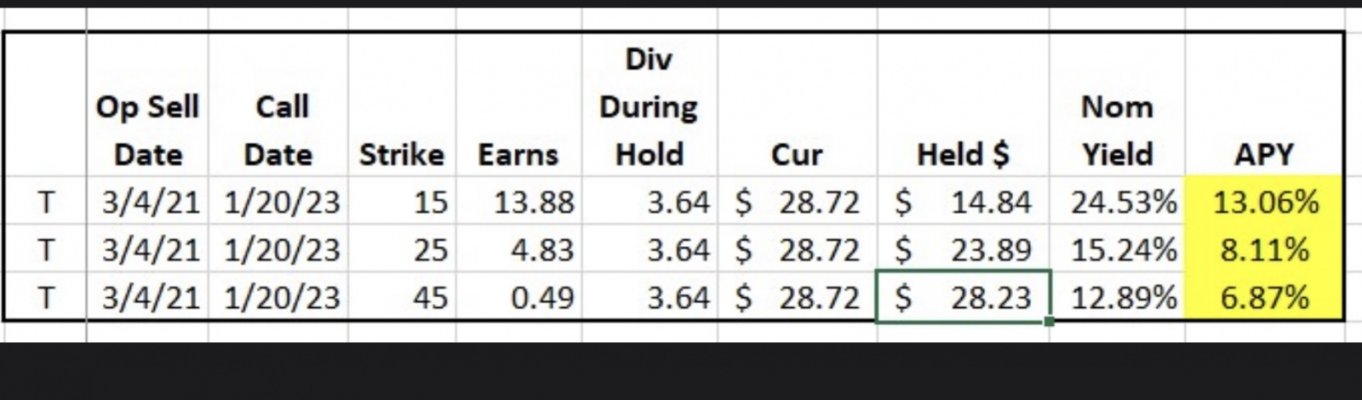

If you look at my T chart, you can see their cost for the stock would have been $14.84 (cur 28.72- option premium $13.88), so if it gets called before any dividends they only earn $.16 per share, $16 which would mainly have gotten eaten up by transaction costs.

My broker doesn't charge a fee, so commision is non issue.

So RV, your charts show my theory works?

If you do this with a low risk stock (one that will move with market and is no way going to zero), you pretty much will have a positive yield which beats any CD on market today!

I have already done this with 2 stocks. Delta (which is a risk, but I feel it has to be higher than it is when I did it). I already cashed that one out for a nice profit on common and took a small loss on the LEAP.

I just ABBV - which I feel is a low risk stock.

I was doing it with CVX, but shorter term and higher and just lost my CVX.

ATT is a good one to play with.

So RV, your charts show my theory works?

If you do this with a low risk stock (one that will move with market and is no way going to zero), you pretty much will have a positive yield which beats any CD on market today!

I have already done this with 2 stocks. Delta (which is a risk, but I feel it has to be higher than it is when I did it). I already cashed that one out for a nice profit on common and took a small loss on the LEAP.

I just ABBV - which I feel is a low risk stock.

I was doing it with CVX, but shorter term and higher and just lost my CVX.

ATT is a good one to play with.

TSLA!!

I did not buy a Tesla because the stock is way more profitable than the car. Yes, eventually I'll drive a Tesla just like most of the world and some company's EV. That is a conversation for another thread.

My father, who is wealthy but falls under the Poor Dad of Rich Dad Poor Dad, asked me on the phone if I saw the TSLA stock recently (dropping big time... along with nearly the entire S&P500). The reality is that it loses more and gains more than the S&P500.

Some of the top top top advisors/investors, such as Warren Buffet, say just invest in the index funds and this post is not to speak against that at all. This post is to say, IMO, TSLA is a freaking amazing stock and will far exceed the S&P500 over time. The 700+% gain last year MIGHT not even be its largest gaining years. Tesla still has to release the new Cybertruck, FSD, and a lot more 18-wheelers.

This is a long post and DW wants to go for a walk. Hope you appreciate it!

*I am not a financial advisor

I did not buy a Tesla because the stock is way more profitable than the car. Yes, eventually I'll drive a Tesla just like most of the world and some company's EV. That is a conversation for another thread.

My father, who is wealthy but falls under the Poor Dad of Rich Dad Poor Dad, asked me on the phone if I saw the TSLA stock recently (dropping big time... along with nearly the entire S&P500). The reality is that it loses more and gains more than the S&P500.

Some of the top top top advisors/investors, such as Warren Buffet, say just invest in the index funds and this post is not to speak against that at all. This post is to say, IMO, TSLA is a freaking amazing stock and will far exceed the S&P500 over time. The 700+% gain last year MIGHT not even be its largest gaining years. Tesla still has to release the new Cybertruck, FSD, and a lot more 18-wheelers.

This is a long post and DW wants to go for a walk. Hope you appreciate it!

*I am not a financial advisor

Dash man

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

TSLA!!

The 700+% gain last year MIGHT not even be its largest gaining years. Tesla still has to release the new Cybertruck, FSD, and a lot more 18-wheelers.

Unless another disruptive stock comes along! Perhaps a hydrogen fuel cell car or truck company?

I put money into Tesla and enjoyed the ride, but fortunately bailed before the latest dip.

Unless another disruptive stock comes along! Perhaps a hydrogen fuel cell car or truck company?

I put money into Tesla and enjoyed the ride, but fortunately bailed before the latest dip.

If looking for other EV companies either already public or probably going public:

-EVgo probably has an April IPO (GM is going to build their charging stations with EVgo)

-Lucid (Luxury EVs; from former Tesla employee)

-Sila Nanotechnology (EV batteries and also former Tesla employee)

Lucid and Sila are part of the "Tesla Mafia"

Extension of the "PayPal Mafia"

Last edited:

copyright1997reloaded

Thinks s/he gets paid by the post

TSLA!!

I did not buy a Tesla because the stock is way more profitable than the car. Yes, eventually I'll drive a Tesla just like most of the world and some company's EV. That is a conversation for another thread.

My father, who is wealthy but falls under the Poor Dad of Rich Dad Poor Dad, asked me on the phone if I saw the TSLA stock recently (dropping big time... along with nearly the entire S&P500). The reality is that it loses more and gains more than the S&P500.

Some of the top top top advisors/investors, such as Warren Buffet, say just invest in the index funds and this post is not to speak against that at all. This post is to say, IMO, TSLA is a freaking amazing stock and will far exceed the S&P500 over time. The 700+% gain last year MIGHT not even be its largest gaining years. Tesla still has to release the new Cybertruck, FSD, and a lot more 18-wheelers.

This is a long post and DW wants to go for a walk. Hope you appreciate it!

*I am not a financial advisor

TSLA since SP 500 addition:http://tos.mx/ISmsZRq

Bryan Barnfellow

Thinks s/he gets paid by the post

TSLA!!

I did not buy a Tesla because the stock is way more profitable than the car. Yes, eventually I'll drive a Tesla just like most of the world and some company's EV. That is a conversation for another thread.

My father, who is wealthy but falls under the Poor Dad of Rich Dad Poor Dad, asked me on the phone if I saw the TSLA stock recently (dropping big time... along with nearly the entire S&P500). The reality is that it loses more and gains more than the S&P500.

Some of the top top top advisors/investors, such as Warren Buffet, say just invest in the index funds and this post is not to speak against that at all. This post is to say, IMO, TSLA is a freaking amazing stock and will far exceed the S&P500 over time. The 700+% gain last year MIGHT not even be its largest gaining years. Tesla still has to release the new Cybertruck, FSD, and a lot more 18-wheelers.

This is a long post and DW wants to go for a walk. Hope you appreciate it!

*I am not a financial advisor

Why does this read like one of the pumping posts on r/wallstreetbets? I think it belongs there more appropriately, along with GME, AMC, etc.

Why does this read like one of the pumping posts on r/wallstreetbets? I think it belongs there more appropriately, along with GME, AMC, etc.

Understand that we might have different thoughts about this topic...

GME = Brick and mortar video games sales; that is the past (outdated and I'm not a gamer at all)

AMC = Brick and mortar movie watching; it's not gone but with streaming (Netflix, Disney+ and many more) as well as, due to our current times, people do not want to be in an enclosed space with strangers (movie theaters)

Tesla = EV leader (by far) and EVs are just getting started (2-5% of cars). Unless you think cars are on the way out due to WFH or believe ICE cars will maintain their appeal for years to come. President Biden is talking about increasing/extending the federal discounts for buying EVs which will further help their sales.

TESLA = EVs what:

Xerox = Copying

Google = Internet searches

Q-tip = Cotton swab (had to look that up, haha)

Ok, I had asked if anyone participated in their broker’s “fully paid lending” programs a while back. Just got my first report from ETrade. They are paying me about $1.30 /day for my GBTC, which they say is daily average rate of 1.75%. ASLE has a daily average rate % listed of 10.81, and my stock with the next highest % rate is IPOE at 9.51%. Small positions in each of those, so it’s just pennies per day. I’m not sure how their math works, but it seemed like a “why not” program for me. Total of all the stocks they currently list in my accounts is still under $2/day.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ok, I had asked if anyone participated in their broker’s “fully paid lending” programs a while back. Just got my first report from ETrade. They are paying me about $1.30 /day for my GBTC, which they say is daily average rate of 1.75%. ASLE has a daily average rate % listed of 10.81, and my stock with the next highest % rate is IPOE at 9.51%. Small positions in each of those, so it’s just pennies per day. I’m not sure how their math works, but it seemed like a “why not” program for me. Total of all the stocks they currently list in my accounts is still under $2/day.

That is interesting.

How much do you have of GBTC stock to earn $1.30/day ?

That is interesting.

How much do you have of GBTC stock to earn $1.30/day ?

TLDR: 500-ish.

I swing trade it, generally keeping a core of 500 shares with a very high limit sell on them. I trade blocks of 500 shares with a max in mind of 1500 shares at any one time. But usually I’m taking profits between $2-10 per share, then lining up the next lots with limit buys. If BTC went back down into the 30s I’d consider pushing my GBTC up to 2000 shares, but it think that’s about all I can handle. I also lightly swing trade MSTR (5-10 shares at a time) and have single options out for MARA, RIOT, CAN, & EBON.

I have done much better so far with crypto than I have with my forays into pharma. Just bought some IDRA via sold puts. Oh well ~ at least the MRK 75 June option seems to be looking healthier. ¯\_(ツ)_/¯

Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Tesla = EV leader (by far) and EVs are just getting started (2-5% of cars). Unless you think cars are on the way out due to WFH or believe ICE cars will maintain their appeal for years to come. President Biden is talking about increasing/extending the federal discounts for buying EVs which will further help their sales.

TESLA = EVs what:

Xerox = Copying

Google = Internet searches

Q-tip = Cotton swab (had to look that up, haha)

You forgot

Kodak = camera/picture

Nokia = phone

Not every current leader survives...

You forgot

Kodak = camera/picture

Nokia = phone

Not every current leader survives...

Neither Kodak or Nokia were run by the 1st or 2nd wealthiest man in the world. This does not technically "say" anything about Tesla and Elon Musk's companies but lesson learned for how well it did for Jeff Bezos and Amazon stock says there is a good chance TSLA will continue it's successful track record.

It's my opinion but think Tesla is starting a new... evolution/revolution/whatever the word is for the change from ICE to EV. It will take some time but I'm happy to enjoy the "ride." (Pun intended)

Liking the MRK reports... found this on Bloomberg, dated 3/25: “ Merck’s Little Brown Pill Could Transform the Fight Against Covid. The antiviral drug molnupiravir, still in clinical trials, would give doctors an important new treatment and a weapon against coronaviruses and future pandemics”

Every single one of the calls I sold - except for KR - are still out of the money, so that’s good . Now I just need to roll some of my puts that seemed like a good idea at the time I sold them :-/. I did sell some with the intention of actually purchasing the stock this week, and a couple of those still look profitable.

. Now I just need to roll some of my puts that seemed like a good idea at the time I sold them :-/. I did sell some with the intention of actually purchasing the stock this week, and a couple of those still look profitable.

DR1959, I used your idea on a couple of T calls, sold them at $15 strike for 1/23 date - that looks like a nice, stable income generator.

Every single one of the calls I sold - except for KR - are still out of the money, so that’s good

DR1959, I used your idea on a couple of T calls, sold them at $15 strike for 1/23 date - that looks like a nice, stable income generator.

Similar threads

- Replies

- 44

- Views

- 5K

- Replies

- 5

- Views

- 728