Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

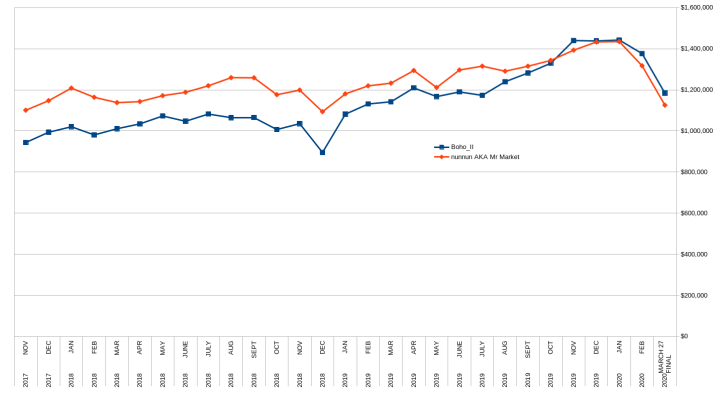

Results as of two hours after the last trading day of the contest. I'll check rankings for the next three days to see if there's been any updates.

comsecga, spudd, kite_rider, and cfahey27 win the non-exclusive license to use the phrase "I Beat Boho" on tee shirts, mugs, etc., for their own personal use.

Cash values below are included in the total account value next to the players' names. The list below is compiled from individual pages of the players.

1. comsecga $3,722,114.02

Cash $283,480.02

Annual Return 56.18 %

2. Spudd $2,434,926.11

Cash $1,351,426.11

Annual Return 34.61 %

3. kite_rider $1,385,621.66

Cash $458,446.66

Annual Return 14.06 %

4. cfahey27 $1,348,168.17

Cash $18,957.67

Annual Return 12.72 %

5. Boho $1,183,932.26

Cash $4,581.28

Annual Return 5.80 %

6. lbymfreddie $1,134,877.82

Cash $3,155.12

Annual Return 4.34 %

7. easysurfer $1,007,976.34

Cash $204,161.56

Annual Return 0.27 %

8. Jenkins Leroy $1,000,000.00

Cash $1,000,000.00

Annual Return 0.00 %

9. exnavynuke $1,000,000.00

Cash $1,000,000.00

Annual Return 0.00 %

10. jmil07 $1,000,000.00

Cash $1,000,000.00

Annual Return 0.00 %

11. guestperson $987,675.01

Cash $933,660.01

Annual Return -1.35 %

12. nvestysly $984,767.63

Cash $976.41

Annual Return -0.60 %

13. covert1 $931,879.74

Cash $129.74

Annual Return -2.42 %

14. RiskyBusinessC2 $850,378.22

Cash $297,808.22

Annual Return -5.58 %

15. DieWurst $837,553.58

Cash - $579,799.58

Annual Return -5.75 %

16. natetheb $654,456.76

Cash $38,814.72

Annual Return -26.04 %

17. ransil $604,169.09

Cash $797,651.29

Annual Return -66.32 %

18. lawrencewendall $424,501.59

Cash - $189,453.50

Annual Return -24.90 %

comsecga, spudd, kite_rider, and cfahey27 win the non-exclusive license to use the phrase "I Beat Boho" on tee shirts, mugs, etc., for their own personal use.

Cash values below are included in the total account value next to the players' names. The list below is compiled from individual pages of the players.

1. comsecga $3,722,114.02

Cash $283,480.02

Annual Return 56.18 %

2. Spudd $2,434,926.11

Cash $1,351,426.11

Annual Return 34.61 %

3. kite_rider $1,385,621.66

Cash $458,446.66

Annual Return 14.06 %

4. cfahey27 $1,348,168.17

Cash $18,957.67

Annual Return 12.72 %

5. Boho $1,183,932.26

Cash $4,581.28

Annual Return 5.80 %

6. lbymfreddie $1,134,877.82

Cash $3,155.12

Annual Return 4.34 %

7. easysurfer $1,007,976.34

Cash $204,161.56

Annual Return 0.27 %

8. Jenkins Leroy $1,000,000.00

Cash $1,000,000.00

Annual Return 0.00 %

9. exnavynuke $1,000,000.00

Cash $1,000,000.00

Annual Return 0.00 %

10. jmil07 $1,000,000.00

Cash $1,000,000.00

Annual Return 0.00 %

11. guestperson $987,675.01

Cash $933,660.01

Annual Return -1.35 %

12. nvestysly $984,767.63

Cash $976.41

Annual Return -0.60 %

13. covert1 $931,879.74

Cash $129.74

Annual Return -2.42 %

14. RiskyBusinessC2 $850,378.22

Cash $297,808.22

Annual Return -5.58 %

15. DieWurst $837,553.58

Cash - $579,799.58

Annual Return -5.75 %

16. natetheb $654,456.76

Cash $38,814.72

Annual Return -26.04 %

17. ransil $604,169.09

Cash $797,651.29

Annual Return -66.32 %

18. lawrencewendall $424,501.59

Cash - $189,453.50

Annual Return -24.90 %

Last edited: