RetiredAt49

Recycles dryer sheets

- Joined

- Oct 30, 2021

- Messages

- 468

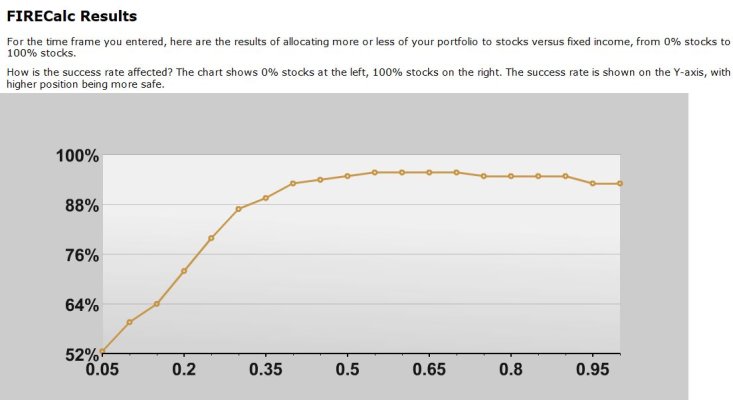

A retiree would be smart to go mostly fixed income, especially now that CD rates are improving. An easy math sample: $1M at 4%= $40,000. That generated income would really help in my humble opinion.

I’ll stick with my 100% equities allocation at an average return rate (based on historical data going back more than a century) of just over 10%