|

TIPS Strategy for Current Income

05-26-2018, 10:29 AM

05-26-2018, 10:29 AM

|

#1

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

TIPS Strategy for Current Income

OK, there may be something radically wrong with this thinking. So all you bond gurus can let me know:

(This is all in an IRA, so tax considerations do not apply.)

Just to have something concrete, I am looking at theoretically buying CUSIP 912810FH6. This is a 30 year 3.875% coupon TIPS with an index ratio of about 1.5. So, on $10,000 face value it is now paying about $580/year in interest.

Pricing right now gives me a YTM of about 0.875%, so the bond is priced at almost a 100% premium to face value.

If I am looking for current cash and buy this bond, my semiannual "interest" payments are some interest and, effectively, some return of principal. At maturity I'll receive only about half of what I paid. (Ignoring inflation adjustments for the moment.)

But ... getting less at maturity may be OK. After all, we will be ten years older and have less lifetime to be vulnerable to high inflation, which is our main reason for buying TIPS in the first place.

This is not a bet-the-farm strategy. Whatever we do with a TIPS scenario like this it will be less than 15% of our total portfolio and less than 50% of our fixed income bucket.

Stated more generally, the idea is to buy a high-coupon TIPS to generate current cash, accepting the fact that the TIPS is a wasting asset if YTM at purchase is substantially below the coupon. I guess one could do this with any bond, but we are interested in the inflation protection.

Thoughts?

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

05-26-2018, 11:22 AM

05-26-2018, 11:22 AM

|

#2

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,373

|

Putting the inflation adjustments aside, how is this any different from any other deep premium bond with a 5.8% coupon and a 0.875% effective yield?

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

05-26-2018, 11:39 AM

05-26-2018, 11:39 AM

|

#3

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by pb4uski

Putting the inflation adjustments aside, how is this any different from any other deep premium bond with a 5.8% coupon and a 0.875% effective yield?

|

Well, quoting myself  :

Quote: Quote:

Originally Posted by OldShooter

... I guess one could do this with any bond, but we are interested in the inflation protection.

|

|

|

|

05-26-2018, 12:08 PM

05-26-2018, 12:08 PM

|

#4

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Nov 2010

Location: Sarasota, FL & Vermont

Posts: 36,373

|

I guess a nuance of a difference is that I would characterize the amortization of premium as an adjustment of each coupon received to reduce the interest than as a return of principal.... IOW, it is what is needed to reduce the interest from the 5.8% coupon to the 0.875% effective yield.

I'm not keen on long-term bonds and paying a 100% premium would be uncomfortable for me but I concede that I can't explain why.

__________________

If something cannot endure laughter.... it cannot endure.

Patience is the art of concealing your impatience.

Slow and steady wins the race.

Retired Jan 2012 at age 56

|

|

|

05-26-2018, 01:04 PM

05-26-2018, 01:04 PM

|

#5

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by pb4uski

... I'm not keen on long-term bonds ...

|

Me neither, but TIPS are a different and IMO underappreciated animal. The big issue with long bonds is inflation and what that might do to the bond's value. TIPS take that risk completely out of the equation.

I'm not even sure why TIPS have a yield curve. I guess it must be to account for the risk that real interest rates might rise over the long term. I'm not hampered by a lot of data or studying on this however. Just idle curiosity.

|

|

|

05-26-2018, 02:13 PM

05-26-2018, 02:13 PM

|

#6

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Feb 2013

Posts: 9,358

|

We usually just buy our TIPS at auction and dollar cost average the purchases by buying a batch each auction period or whenever we have spare cash to reinvest. I don't know if that is the smartest way to do it but it is pretty easy and there are no transaction fees buying at auction.

__________________

Even clouds seem bright and breezy, 'Cause the livin' is free and easy, See the rat race in a new way, Like you're wakin' up to a new day (Dr. Tarr and Professor Fether lyrics, Alan Parsons Project, based on an EA Poe story)

|

|

|

05-27-2018, 02:18 PM

05-27-2018, 02:18 PM

|

#7

|

|

Full time employment: Posting here.

Join Date: Jun 2016

Posts: 889

|

Not a fan of TIPS at the current premium over inflation.

|

|

|

05-27-2018, 02:53 PM

05-27-2018, 02:53 PM

|

#8

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by BeachOrCity

Not a fan of TIPS at the current premium over inflation.

|

Neither am I, at current inflation. Current inflation looked pretty benign in the late '60s, early '70s too before it hit 14% in around 1980. That kind of inflation can totally ruin a retirement plan. I consider the slight premium I pay for TIPS as an insurance premium, just like my home fire insurance.

If the US dollar takes a 20% hit as it loses its status as the world's reserve currency, we might see 25% inflation on imports and on commodities like oil, corn/maize, and other foods. The fed will be powerless over this. Everybody hates us for our currency's status and our consequent ability to use our banking system as a political weapon. Our national debt is over 100% of GDP vs. an OECD average of 73%, which has led to lower US bond ratings. So ... I wish I had confidence that current inflation would project smoothly into the future but I do not.

|

|

|

05-27-2018, 03:15 PM

05-27-2018, 03:15 PM

|

#9

|

|

Moderator Emeritus

Join Date: Apr 2011

Location: Conroe, Texas

Posts: 18,731

|

No criticism intended here, but I have read this thread a few times and it looks like you have reasons (and good ones) as to why you have a small portion of your portfolio in TIPs, but it's not clear to me what you are looking for from us in the way of responses?

Am I missing something?

Thanks.

__________________

*********Go Yankees!*********

|

|

|

05-27-2018, 04:29 PM

05-27-2018, 04:29 PM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by aja8888

... Am I missing something?  ... |

Well, actually that's my line. I am not much of a bond guy and when this high-coupon-low-YTM scenario occurred to me it was a totally new thing. I wanted to run it by the group to see if I was missing something. Maybe this idea is common and well documented elsewhere, but at the time I came up with it, it seemed kind of radical to me.

And, ... actually ... now that I have thought about it for a while I still think it works. But I've also figured out that it cuts my inflation protection because the index ratio is less than the buy price. Roughly 1.5/2, or only 75% of my buy price is inflation protected. Maybe that is a big enough negative to keep me from using the idea. I'm still thinking and still interested in comments. ... Thanks in advance.

|

|

|

05-27-2018, 04:41 PM

05-27-2018, 04:41 PM

|

#11

|

|

Moderator Emeritus

Join Date: Apr 2011

Location: Conroe, Texas

Posts: 18,731

|

Quote: Quote:

Originally Posted by OldShooter

Well, actually that's my line. I am not much of a bond guy and when this high-coupon-low-YTM scenario occurred to me it was a totally new thing. I wanted to run it by the group to see if I was missing something. Maybe this idea is common and well documented elsewhere, but at the time I came up with it, it seemed kind of radical to me.

And, ... actually ... now that I have thought about it for a while I still think it works. But I've also figured out that it cuts my inflation protection because the index ratio is less than the buy price. Roughly 1.5/2, or only 75% of my buy price is inflation protected. Maybe that is a big enough negative to keep me from using the idea. I'm still thinking and still interested in comments. ... Thanks in advance.

|

Understand!

__________________

*********Go Yankees!*********

|

|

|

05-28-2018, 07:37 AM

05-28-2018, 07:37 AM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,892

|

Quote: Quote:

Originally Posted by OldShooter

... But I've also figured out that it cuts my inflation protection because the index ratio is less than the buy price. Roughly 1.5/2, or only 75% of my buy price is inflation protected....

|

If you are paying a 100% premium, aren't you only getting half the inflation protection?

And if you are only going in at 15% of portfolio, it doesn't really seem to be doing much overall. Personally, I just wouldn't bother.

-ERD50

|

|

|

05-28-2018, 08:05 AM

05-28-2018, 08:05 AM

|

#13

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,186

|

Quote: Quote:

Originally Posted by ERD50

Personally, I just wouldn't bother.

-ERD50

|

+1

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

05-28-2018, 08:17 AM

05-28-2018, 08:17 AM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Couldn't you just buy a 10 year TIPS at 0.84% ? As I understand it, you are buying a 30 year one with 10 years to go. Or did I get that wrong?

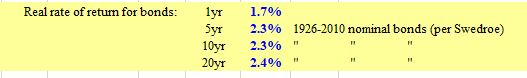

FWIW, I currently am just using short term bonds. Here is a table of real interest rate history. As you can see we are far off normal real rates for TIPS:

|

|

|

05-28-2018, 09:21 AM

05-28-2018, 09:21 AM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by ERD50

If you are paying a 100% premium, aren't you only getting half the inflation protection?

|

I don't think so. To the Treasury the bond currently has a face value of 150% of the original issue face value, due to the inflation adjustments. So if I am paying 200% then, roughly speaking, I am 3/4 covered. It may be more complicated than that because of the large annual payments that I view as being partially a return of principal, but I am too lazy to calculate that out in detail.

Quote: Quote:

Originally Posted by ERD50

And if you are only going in at 15% of portfolio, it doesn't really seem to be doing much overall. Personally, I just wouldn't bother.

|

Well, I don't know what it will be if I pull the trigger. I put the 15% in there just to avoid people who would rightfully point out that doing this with a large % of assets would not be wise. We are about 75/25 right now, so even 15% would be 60% of the fixed income tranche.

Quote: Quote:

Originally Posted by Lsbcal

Couldn't you just buy a 10 year TIPS at 0.84% ? As I understand it, you are buying a 30 year one with 10 years to go. Or did I get that wrong? ...

|

The whole point is that the scenario creates substantially larger "interest" payments, almost 6%. Just buying a low coupon bond may get a similar YTM but nowhere near the annual cash flow.

|

|

|

05-28-2018, 09:50 AM

05-28-2018, 09:50 AM

|

#16

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by OldShooter

...

The whole point is that the scenario creates substantially larger "interest" payments, almost 6%. Just buying a low coupon bond may get a similar YTM but nowhere near the annual cash flow.

|

I probably don't understand the logic here. Is this just a return of principle rather then true income?

Another thought, since these are very old TIPS are you not taking some risk if there is a depression (deflation)? I seem to recall this is an issue with older originally high rate TIPS.

|

|

|

05-28-2018, 10:09 AM

05-28-2018, 10:09 AM

|

#17

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by Lsbcal

I probably don't understand the logic here. Is this just a return of principle rather then true income?

|

Well, to the Treasury and to the IRS (in a taxable account) it is just an interest payment. But to someone using this strategy, the difference between YTM and the big "interest" payment has to come from somewhere. And it comes from the fact that at maturity the principal payment the owner receives will be less than he originally paid for the TIPS. So that's why I think of it as a return of principal.

(I would say "probably less" because the end payment might have enough inflation adjustment that in nominal dollars it approaches or even exceeds the purchase price, but in constant dollars the owner is clearly getting less.)

Quote: Quote:

Originally Posted by Lsbcal

Another thought, since these are very old TIPS are you not taking some risk if there is a depression (deflation)? I seem to recall this is an issue with older originally high rate TIPS.

|

I'm not sure about that except maybe the risk is reinvestment risk. If the interest dollars cannot be invested at the high coupon rate, then the owner loses. & actually, when we bought our current TIPS around 2006 we deliberately bought the longest bonds and lowest coupon we could find. At that time, it was 2%/2026.

You guys are doing a good job of making me think this thing through.

|

|

|

05-28-2018, 10:19 AM

05-28-2018, 10:19 AM

|

#18

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,892

|

Quote: Quote:

Originally Posted by OldShooter

Well, to the Treasury and to the IRS (in a taxable account) it is just an interest payment. But to someone using this strategy, the difference between YTM and the big "interest" payment has to come from somewhere. And it comes from the fact that at maturity the principal payment the owner receives will be less than he originally paid for the TIPS. So that's why I think of it as a return of principal. ...

|

Well, I haven't thought this all the way through, but if you are buying at a premium to get the higher effective rate, and (as you say), that premium dwindles away as you approach maturity, so it is pretty much a return of principal - why not just buy the other TIPS at/near par, and keep the principal (which you an then use when/as you see fit)?

Seems like you are giving up flexibility, what's the advantage? I'm pretty sure the bond market prices these to be neutral, so you are just moving $ from one pile to another. Not sure I get it.

-ERD50

|

|

|

05-28-2018, 10:32 AM

05-28-2018, 10:32 AM

|

#19

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

Quote: Quote:

Originally Posted by ERD50

Well, I haven't thought this all the way through, but if you are buying at a premium to get the higher effective rate, and (as you say), that premium dwindles away as you approach maturity, so it is pretty much a return of principal - why not just buy the other TIPS at/near par, and keep the principal (which you an then use when/as you see fit)?

Seems like you are giving up flexibility, what's the advantage? I'm pretty sure the bond market prices these to be neutral, so you are just moving $ from one pile to another. Not sure I get it.

-ERD50

|

Well, you may be right. I posted the scenario to generate discussion of something that seemed unusual to me, not because I necessarily thought it was the path to truth and light.

Still thinking ...

|

|

|

05-28-2018, 03:48 PM

05-28-2018, 03:48 PM

|

#20

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

What I was referring to in "Another thought" above was the fact that TIPS accumulate an inflation factor. Then if we have deflation, I think there is some risk to loosing some of this. But I have forgotten the reasoning so only a partial "thought".

Perhaps someone here can fill us in on this one.

As ERD50 points out, the bond market prices in such bonds to be somewhat neutral. You need a really sharp pencil to get ahead of these guys.

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|