2Black

Dryer sheet wannabe

- Joined

- Nov 15, 2017

- Messages

- 21

Hi,

I was wondering if anybody can give me some feedback on the following strategy

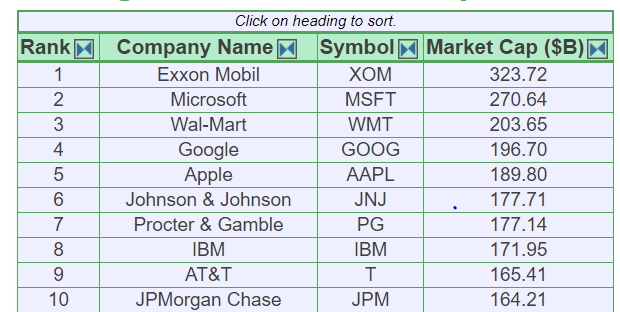

Once a year (eg early January) buy top 10 of biggest companies (market cap). and swap/redistribute once a year when needed.

So currently that would be, MSFT, AAPL, AMZN,GOOG, etc…

https://finviz.com/screener.ashx?v=121&f=cap_mega&ft=4&o=-marketcap

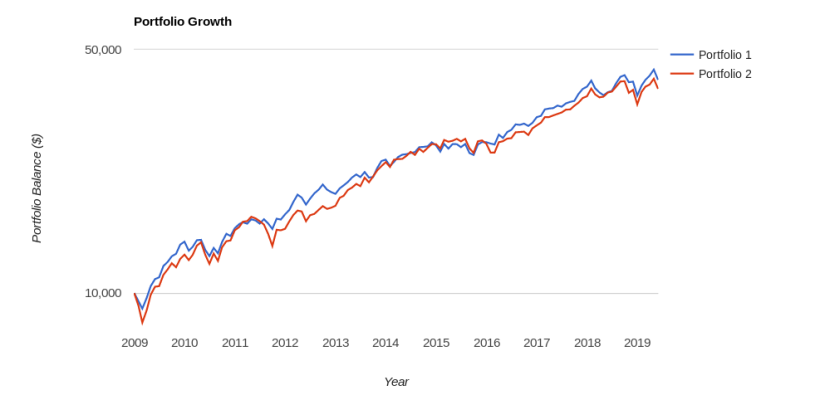

sure they did great last 10+ years but how did they do around 2008 or 2002? Did they bounce back, got broke or got hit more than eg. The sp500?

I quickly searched for historic data but couldn’t find any to run a back test.

If you simply compare the dow30 with the sp500 the result is dramatic, so if you assume the dow30 contains the biggest players of the sp500 you surely would not use that strategy but that is perhaps a bit too simple.

https://finance.yahoo.com/chart/^DJ...oYXJ0TmFtZSI6ImNoYXJ0In19fSwicmFuZ2UiOm51bGx9

anyway, I’m interested if anybody has such a portfolio (starting pre 2008) and likes to share his/hers experience

or if somebody knows where to find historic data (top 10 market cap. stocks/year)

Or would it be simpler to buy an ETF?

Thanks!

I was wondering if anybody can give me some feedback on the following strategy

Once a year (eg early January) buy top 10 of biggest companies (market cap). and swap/redistribute once a year when needed.

So currently that would be, MSFT, AAPL, AMZN,GOOG, etc…

https://finviz.com/screener.ashx?v=121&f=cap_mega&ft=4&o=-marketcap

sure they did great last 10+ years but how did they do around 2008 or 2002? Did they bounce back, got broke or got hit more than eg. The sp500?

I quickly searched for historic data but couldn’t find any to run a back test.

If you simply compare the dow30 with the sp500 the result is dramatic, so if you assume the dow30 contains the biggest players of the sp500 you surely would not use that strategy but that is perhaps a bit too simple.

https://finance.yahoo.com/chart/^DJ...oYXJ0TmFtZSI6ImNoYXJ0In19fSwicmFuZ2UiOm51bGx9

anyway, I’m interested if anybody has such a portfolio (starting pre 2008) and likes to share his/hers experience

or if somebody knows where to find historic data (top 10 market cap. stocks/year)

Or would it be simpler to buy an ETF?

Thanks!