haha

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

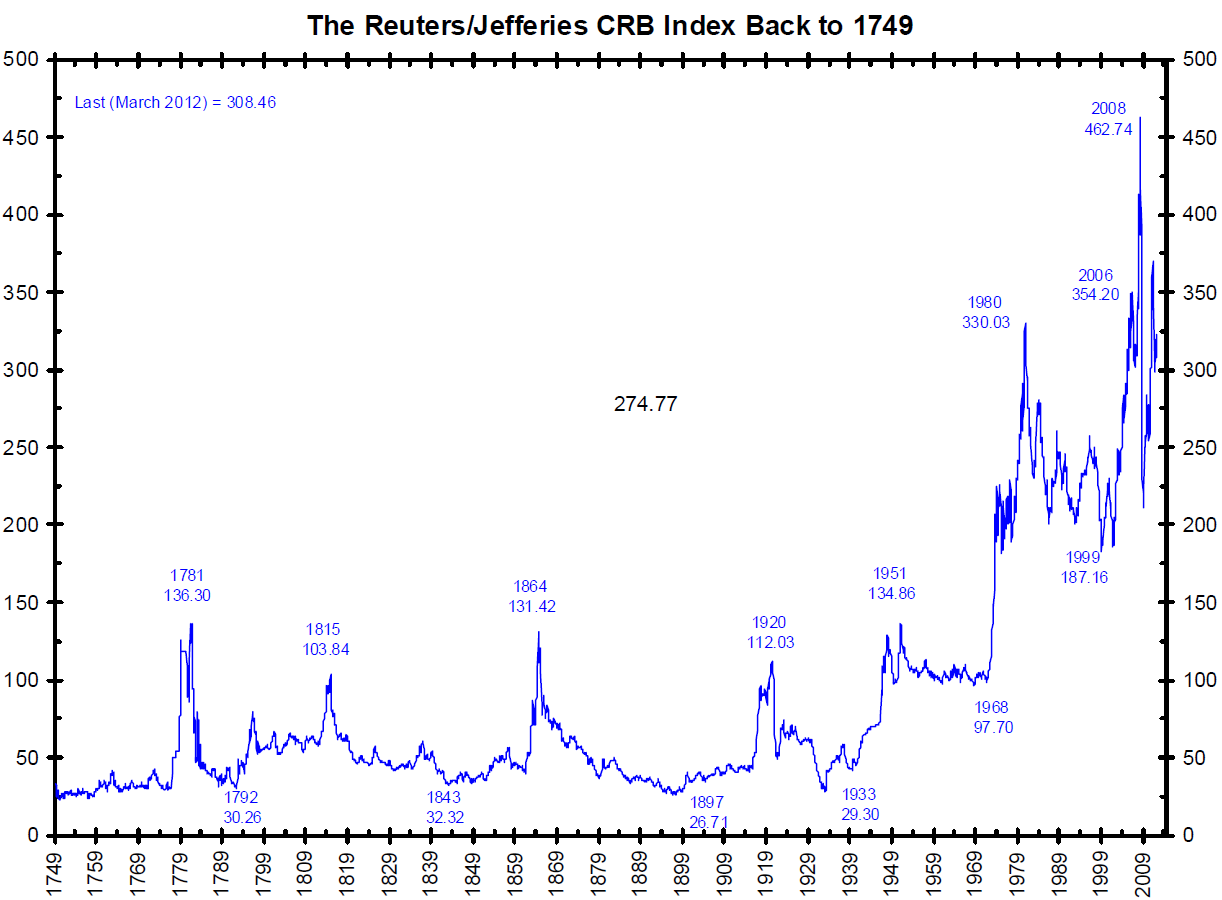

I know a few. Always be a bottom fisher. Prefer commodity companies. Oil and gas have worked really well lately, but mining gold, copper, uranium or just about anything in the ground can give pretty good pain. If it weren't for the exquisitely superior pain being inflicted by oil and gas in almost any guise, I'd say that mining stocks are actually very good pain givers. I used to think that agricultural commodities like fertilizer, and other stuff farmers inject with those fabulous tractors might give respite from the pummeling other stuff from the ground has been delivering. After all the world population is growing and people like to eat, right? But no, NPK also has been giving me a good kicking.

Worse is that none of these things seems to be bored by kicking, stomping and punching me, they aren't even looking tired of the game!

Ha

Worse is that none of these things seems to be bored by kicking, stomping and punching me, they aren't even looking tired of the game!

Ha