Retired 12 years.

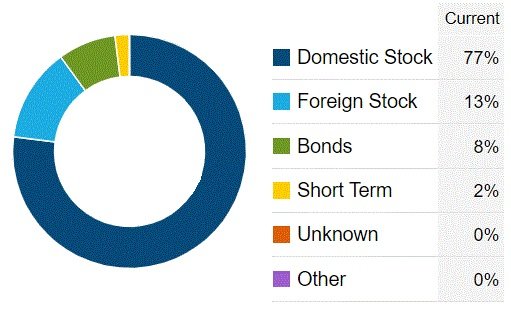

80% equity (all index funds), with about 2/3rds Total U.S. Stock and 1/3rd Total International Stock.

20% cash and short term dollar denominated securities, mostly T-bills, T-notes, non-callable CDs + a few I-Bonds.

80% equity (all index funds), with about 2/3rds Total U.S. Stock and 1/3rd Total International Stock.

20% cash and short term dollar denominated securities, mostly T-bills, T-notes, non-callable CDs + a few I-Bonds.