Luvtoride

Thinks s/he gets paid by the post

Another interesting investment alternative article in the Wall Street Journal. I hope the link below works.

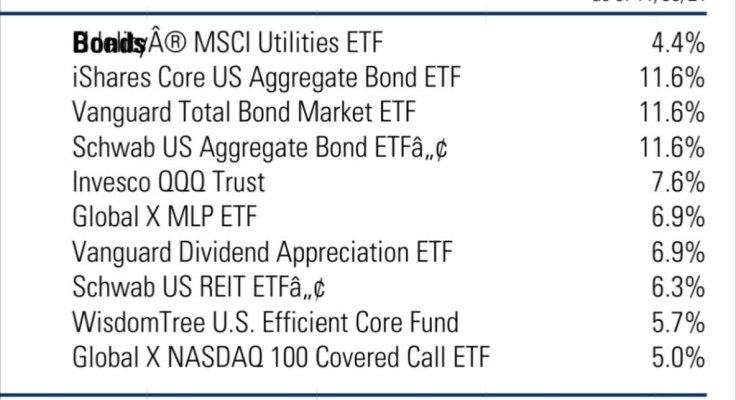

If not, to summarize, this is an ETF that pays out a 7% Yield by investing in Bond and stock ETF's. Part of the payout is from actual income (interest and dividends) from the underlying ETF investments, while most of the return comes from harvesting increases in the ETFs value during the hot stock market run.

True, this could result in the value of the ETF going down if stock returns falter, but over the past 18 months, the value has increased while the 7% return has been maintained.

Not a risk free way to get yield, but one that seems to be working well in the current markets, with moderate risk.

https://www.wsj.com/articles/whats-...gy-shares-nasdaq-7handl-index-etf-11639757973

Consider the Strategy Shares Nasdaq 7HANDL Index

Here's a link to the fund from Morningstar...

https://www.morningstar.com/search?query=Strategy Shares Nasdaq 7 Handl™ ETF

If not, to summarize, this is an ETF that pays out a 7% Yield by investing in Bond and stock ETF's. Part of the payout is from actual income (interest and dividends) from the underlying ETF investments, while most of the return comes from harvesting increases in the ETFs value during the hot stock market run.

True, this could result in the value of the ETF going down if stock returns falter, but over the past 18 months, the value has increased while the 7% return has been maintained.

Not a risk free way to get yield, but one that seems to be working well in the current markets, with moderate risk.

https://www.wsj.com/articles/whats-...gy-shares-nasdaq-7handl-index-etf-11639757973

Consider the Strategy Shares Nasdaq 7HANDL Index

Here's a link to the fund from Morningstar...

https://www.morningstar.com/search?query=Strategy Shares Nasdaq 7 Handl™ ETF

Last edited: